Korea Short-term Energy Outlook

Research • Publications

-

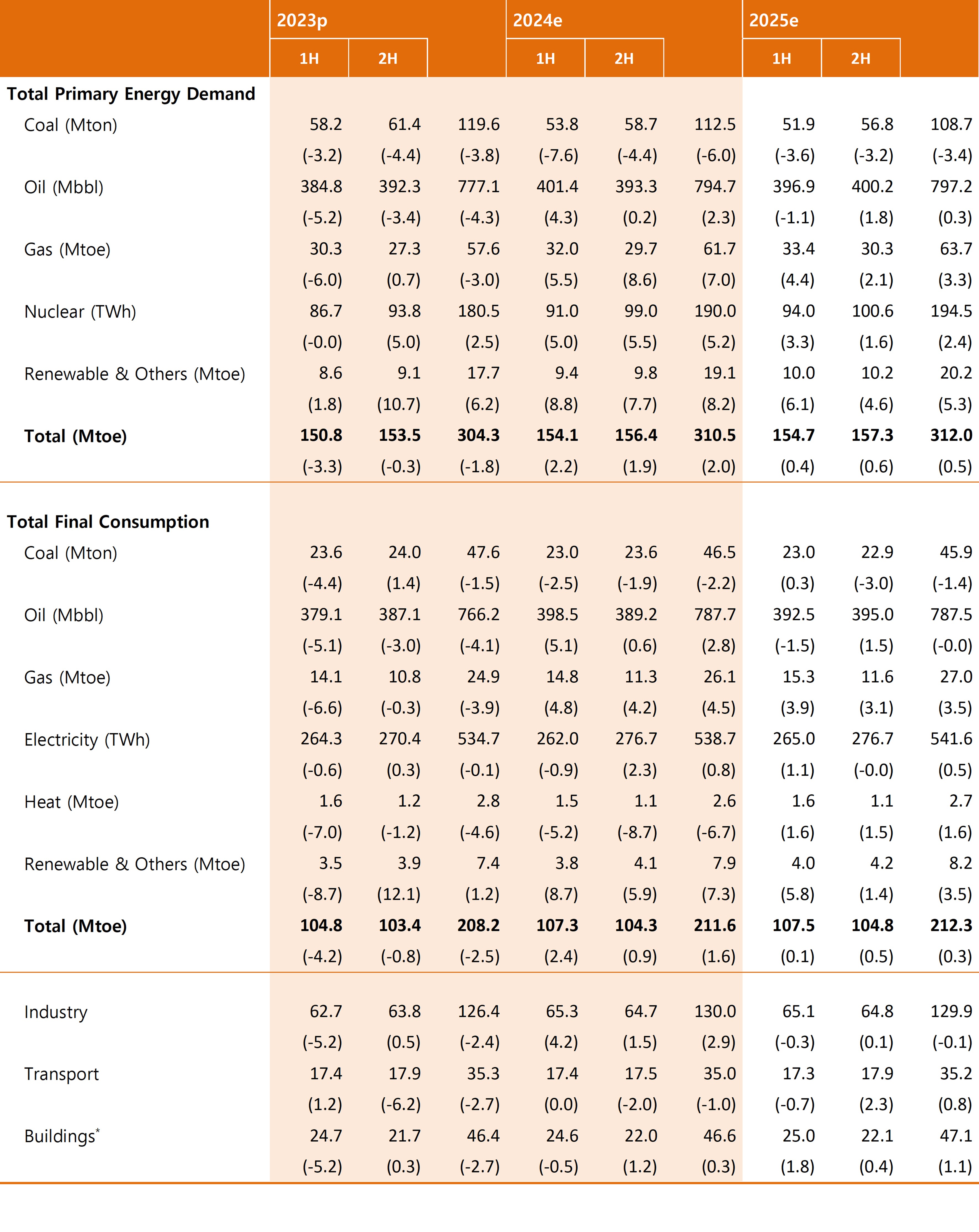

2025 Korea Energy Outlook (2024, Second Half)

- Date2025/02/10

- Author Department of Energy Supply Statistics Research

- Number of downloads 23

-

Download multiple files Download the entire file

Energy Consumption Trends

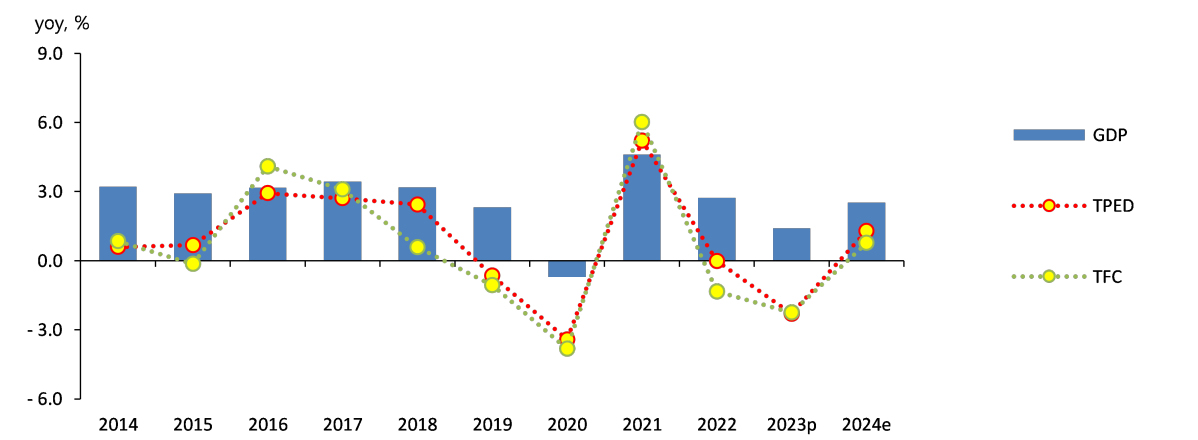

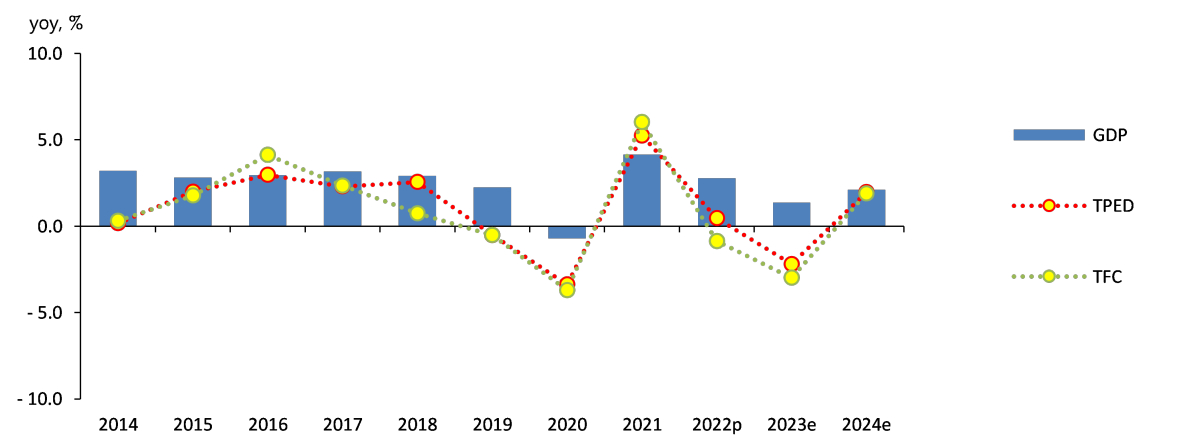

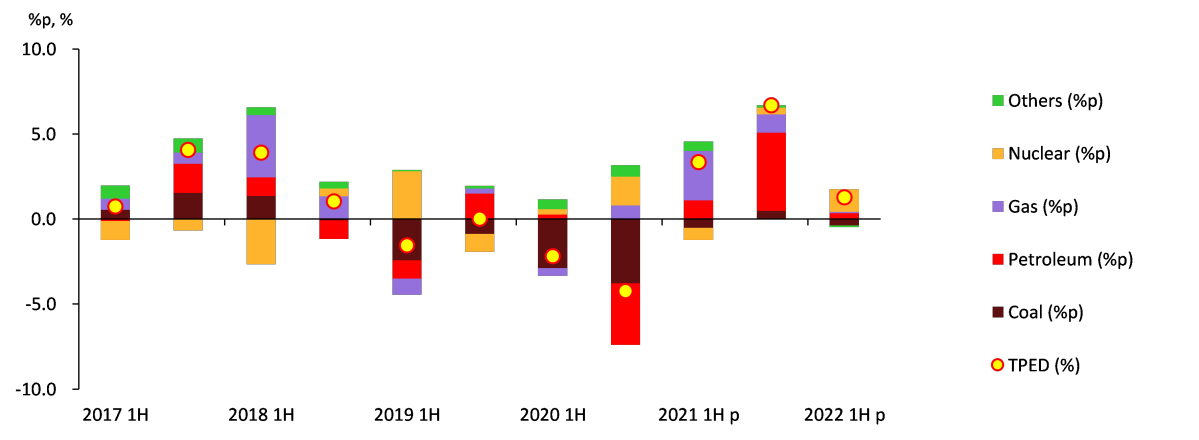

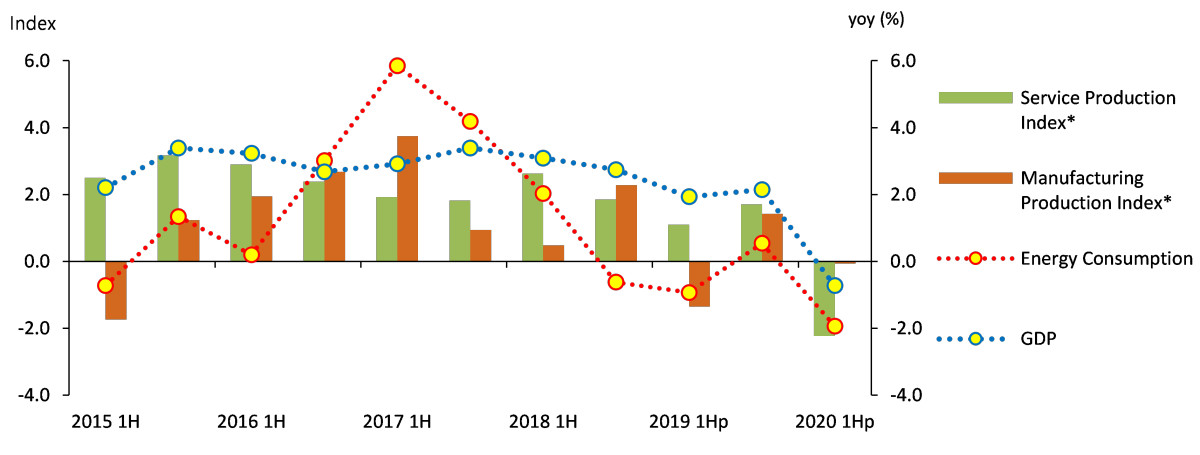

In the first half of 2024, Total Primary Energy Demand (TPED) rebounded by 2.2% year-on-year, but the recovery was weak.

The recovery of energy consumption was limited due to sluggish production in major energy-intensive industries, energy price hikes, and the temperature effect.

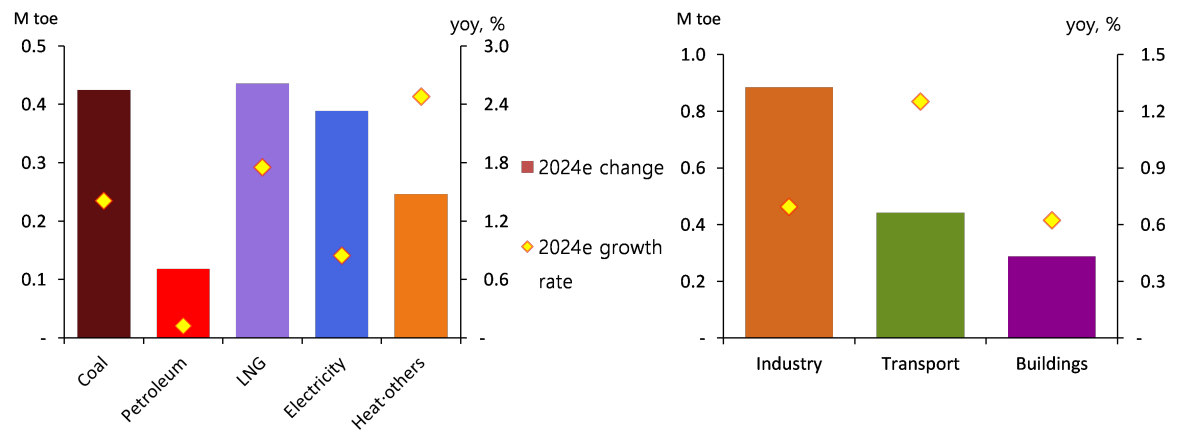

Looking at each energy source, consumption of most energy sources except coal increased year-on-year due to base effects.

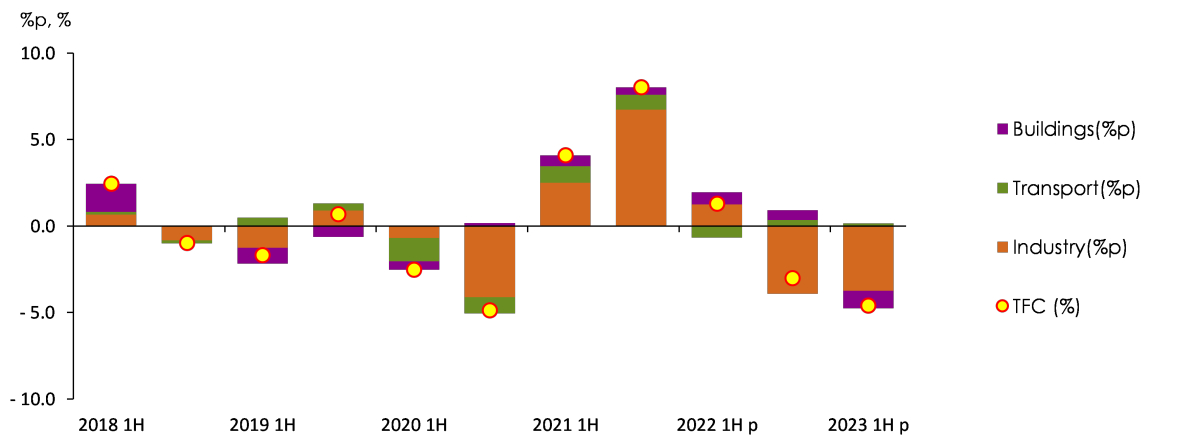

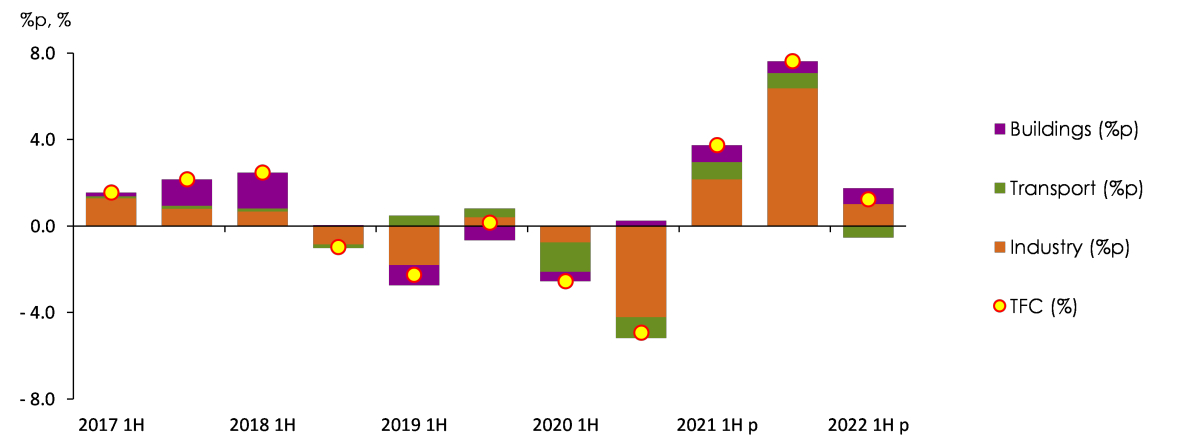

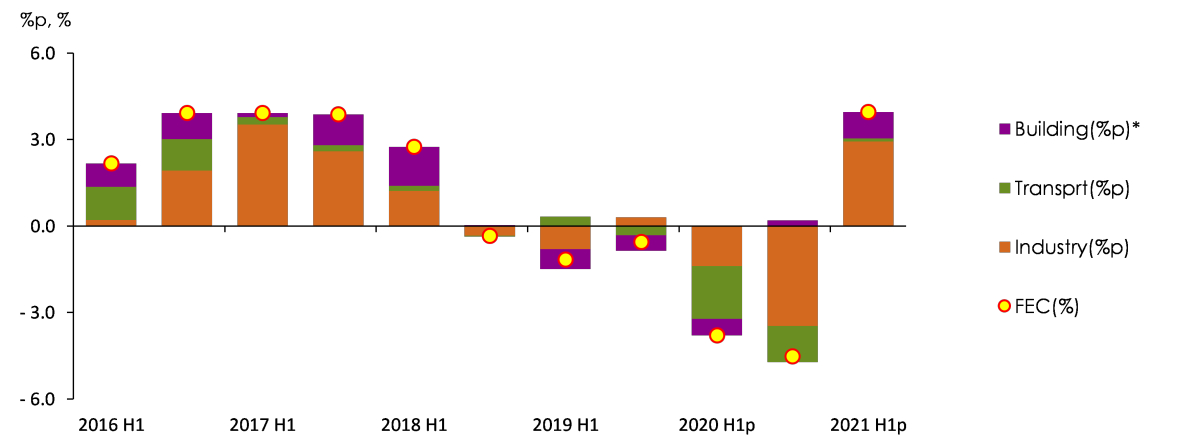

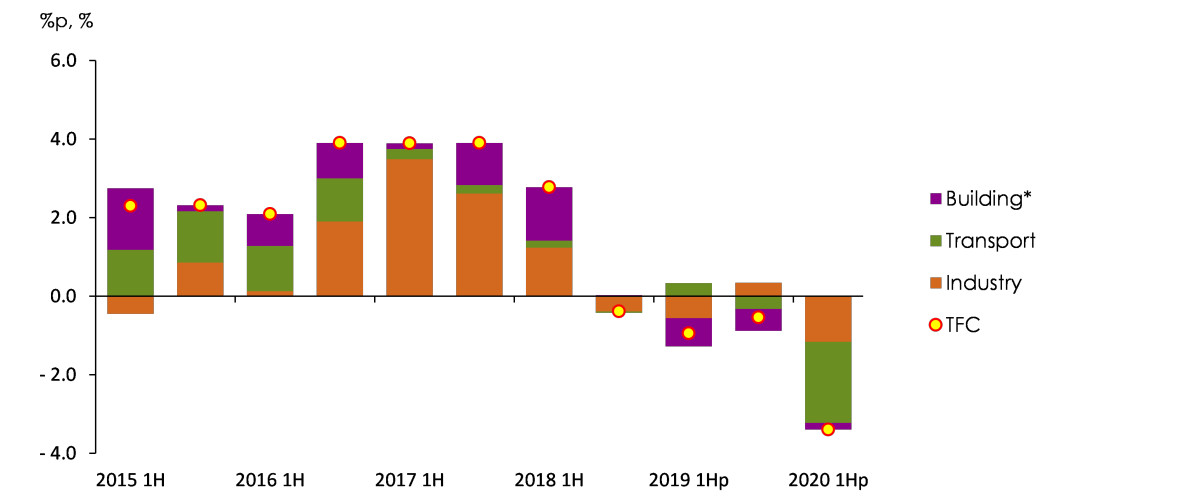

Total final consumption (TFC) increased by 2.4% year-on-year, with a decrease in buildings, a flat trend in transportation, and an increase in the industrial sector.

Consumption in the industrial sector increased by 4.2% year-on-year, with an increase in consumption of petrochemicals and machinery amid a general slowdown in manufacturing activity, and consumption in steel remaining at the previous year's level.

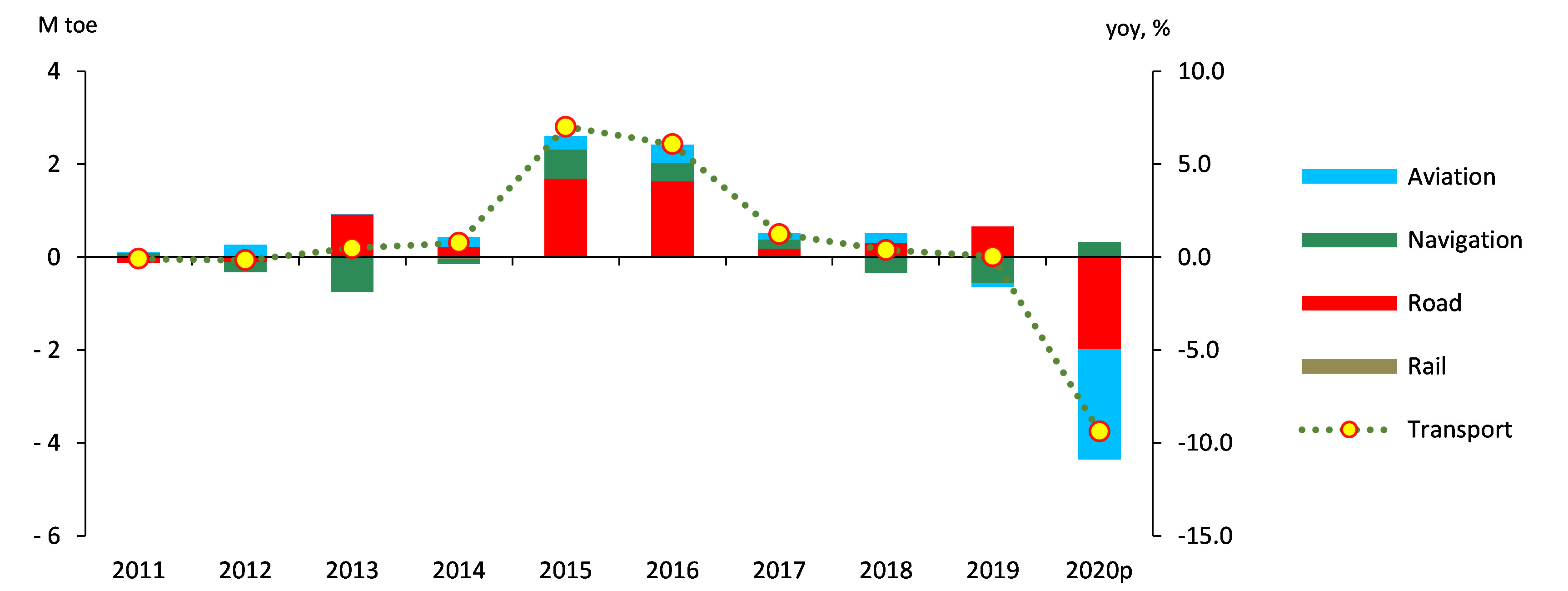

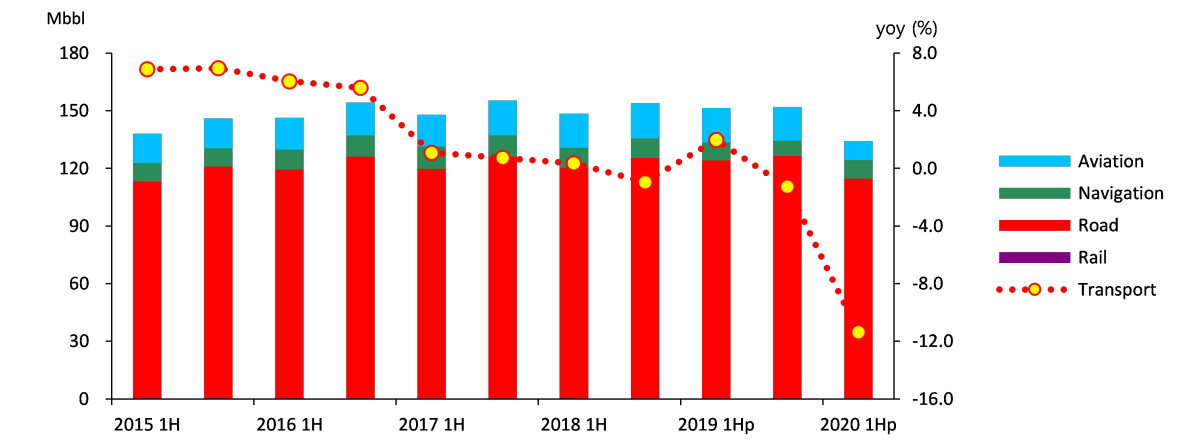

Energy consumption in the transportation sector increased in the road sector, but decreased in all other sectors, including domestic navigation, domestic aviation, and rail, and remained at the same level as the previous year (0.0%).

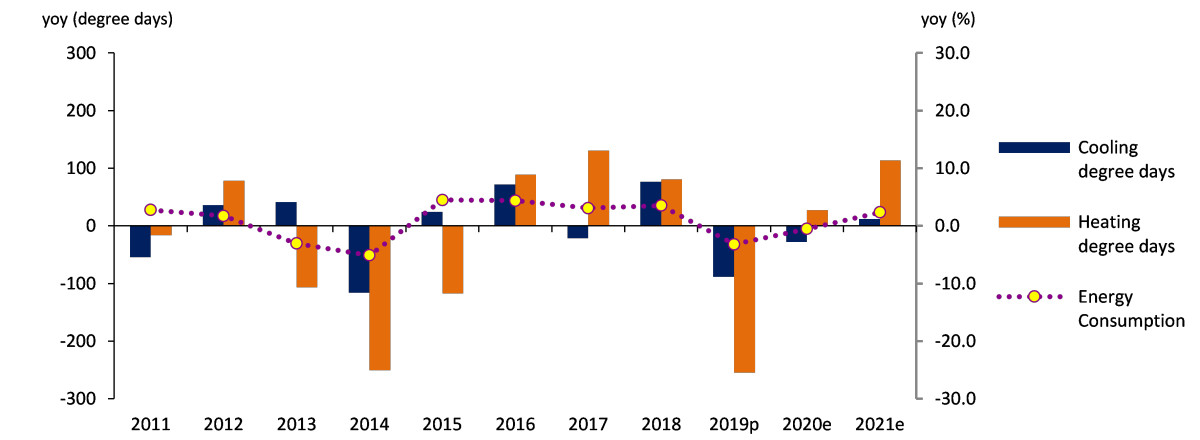

In the building sector, energy consumption decreased slightly (0.5%) year-on-year due to a decrease in heating degree days and an increase in energy prices for civilian use.

Energy Consumption Trends and Demand Outlook

Energy Demand Outlook

Total Primary Energy Demand is expected to increase by 2.0% in 2024 and 0.5% in 2025, reaching 312.0 million toe.

TPED is expected to increase in 2024, mainly in the industrial sector, but the growth rate is expected to slow down in 2025 due to the delayed economic recovery, mainly in energy-intensive industries.

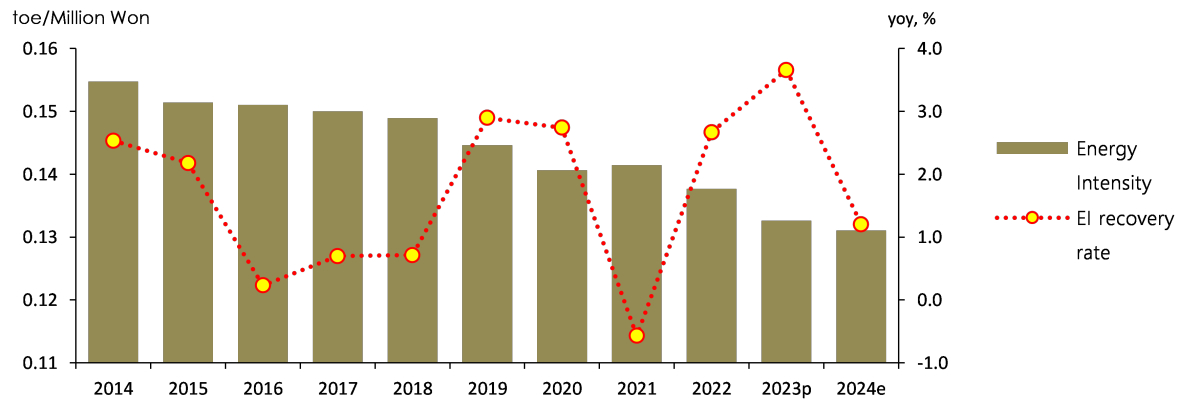

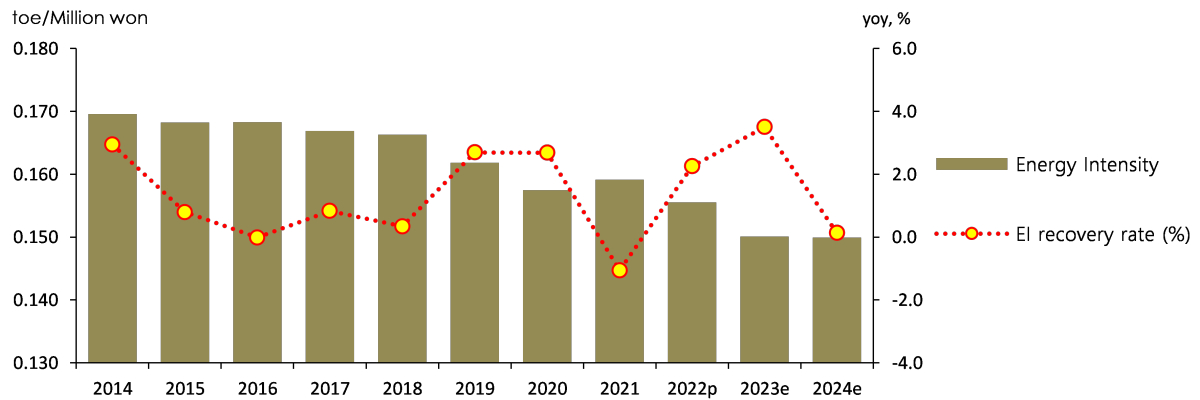

The energy intensity (toe/KRW 100 million) is expected to remain at the previous year's level in 2024 as energy demand rebounds due to base effects, but the improvement in energy intensity is expected to accelerate again in 2025 as energy demand stagnates due to a delay in the recovery of production in energy-intensive industries.

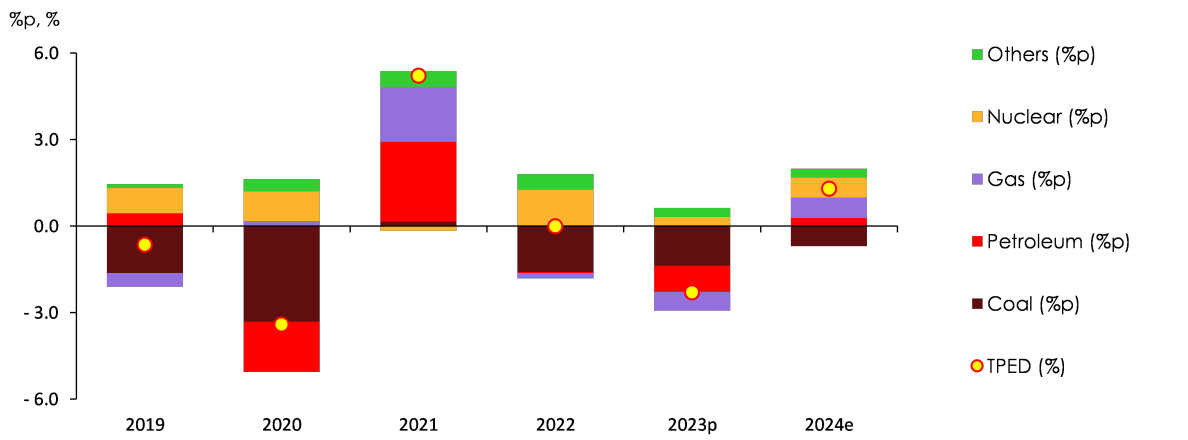

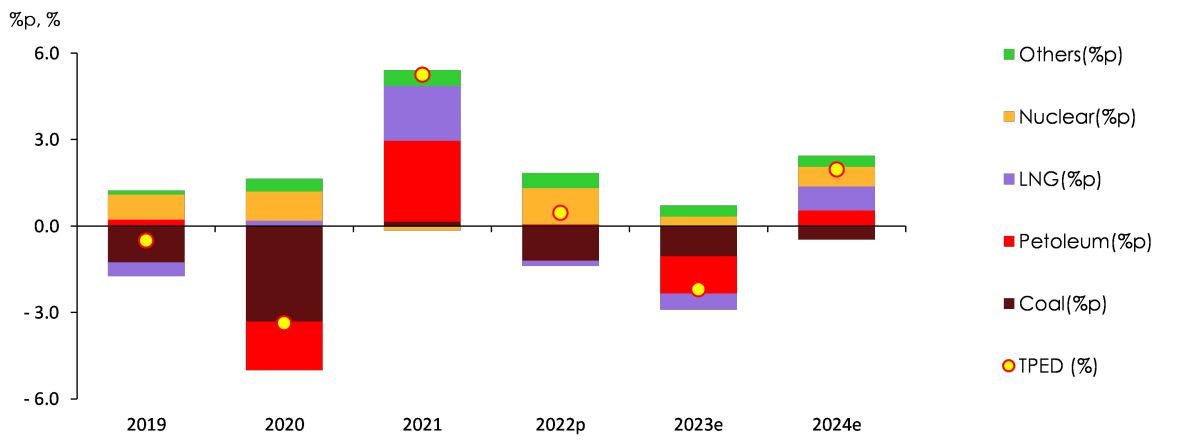

The downward trend in coal demand is expected to ease in 2025, while the growth of other energy sources is expected to slow down.

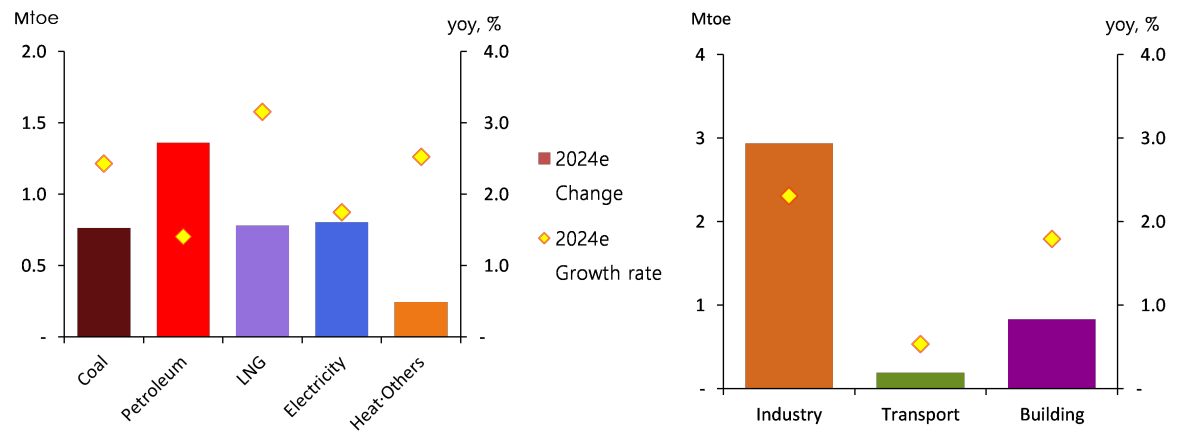

Oil demand is expected to increase by 2.3% in 2024 due to the base effect, mainly for industrial feedstock, but in 2025, it is expected to increase only slightly (0.3%) due to the delay in the recovery of the petrochemical industry.

Coal demand will decline in both the power generation and industrial sectors during the forecast period, falling by 6.0% in 2024 and easing in 2025, but continuing to decline by 3.4%.

Nuclear power generation is expected to increase by 5.3% and 2.4% in 2024 and 2025, respectively, due to the impact of new nuclear power plants entering the market.

Natural gas demand is expected to increase by 6.2% in 2024 and 4.4% in 2025, as the growth in demand for gas manufacturing is expected to expand, but the growth in demand for power generation is expected to slow down.

Electricity demand in the final consumption sector is expected to slow down from 0.8% growth in 2024 to 0.5% growth in 2025 due to the delayed recovery of electricity-intensive industries.

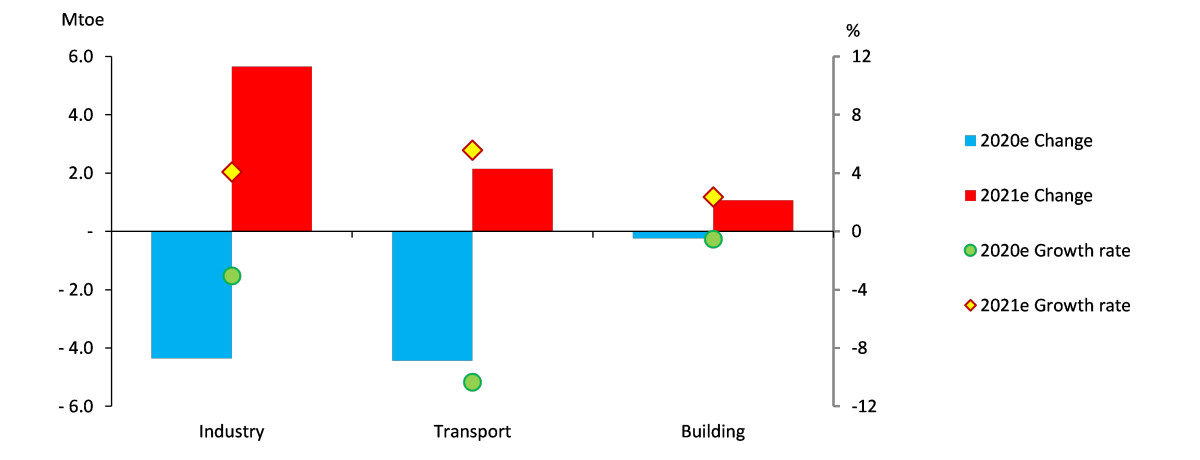

The growth rate of total final consumption is expected to slow down from 1.6% in 2024 to 0.3% in 2025.

The energy demand in the industrial sector is expected to increase by 2.9% in 2024 due to the base effect despite the recession in the manufacturing industry, but in 2025, it is expected to slightly fall short of the previous year's level (-0.1%) due to the continued sluggishness in the steel and petrochemical industries.

In the transportation sector, energy demand is expected to decrease by 1.0% in 2024 due to sluggish demand for freight transport due to the economic slowdown, but is expected to turn to a slight increase (0.8%) in 2025 as the economy recovers somewhat in the second half of the year.

Energy demand in the building sector is expected to increase by 0.3% year-on-year in 2024, mainly for cooling, and by 1.1% in 2025, mainly for heating.

Key Features and Implications

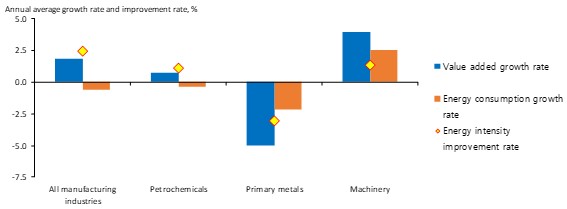

Decoupling of economic growth and energy consumption in the industrial sector

While the added value of the manufacturing industry has increased, energy consumption has decreased, resulting in a decoupling of economic growth and energy consumption.

In the last five years (2018-2023), the Korean economy has grown at an annual average rate of 2.1%. Despite the relatively sluggish manufacturing industry compared to the past, the manufacturing industry, along with the service industry, plays a major role in economic growth.

Value added, energy consumption growth rate, and energy intensity improvement rate for the period 2018-2023

Contrary to the increase in added value, energy consumption in the manufacturing industry as a whole has decreased over the past five years, which is the main reason for the slowdown in the growth of energy consumption in the country as a whole compared to economic growth.

The outlook for the domestic manufacturing industry over the next five years is expected to follow the trend of the past five years, with growth centered on machinery, especially semiconductors, rather than petrochemicals or primary metals. This means that the manufacturing industry's energy intensity will continue to improve and the decoupling of economic growth and industrial energy consumption will continue.

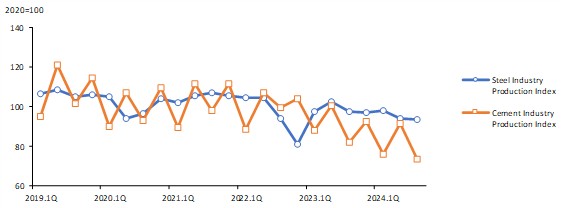

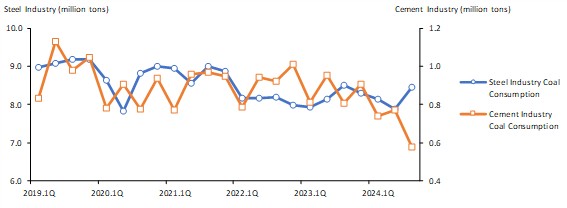

Coal demand in the steel and cement industries will continue to be sluggish.

Due to the downturn in the business environment, coal consumption in the steel and cement industries, which are coal-intensive industries, has shrunk significantly.

Coal consumption in the steel industry peaked in the second quarter of 2018 and has been on a downward trend until the third quarter of 2024 due to sluggish production activity.

The coal consumption of the cement industry, which is highly dependent on domestic demand, has been declining rapidly since 2019 due to the sluggish domestic construction market and a decline in production activities.

Production Index Trends by Industry

Coal Consumption Trends by Industry

Steel industry coal consumption will remain at the same level as in 2025, but cement industry consumption is expected to continue to decline in 2025.

In 2025, steel production will shrink due to a decrease in production in the major demand industries, such as automobiles and shipbuilding, compared to 2024, but it is expected to remain at the same level as in 2024 due to increased exports to emerging countries (India, ASEAN, etc.) and Europe. (Korea Institute for Industrial Economics & Trade 2024.11.25.)

Construction investment in 2025 is expected to continue the sluggish trend of 2024 due to the cumulative sluggishness of construction-related leading indicators (construction start-up area) and the government's reduction in the SOC budget (-3.6% year-on-year) despite positive factors such as interest rate cuts and a recovery in the real estate market. (Korea Institute for Industrial Economics & Trade 2024.11.25.)

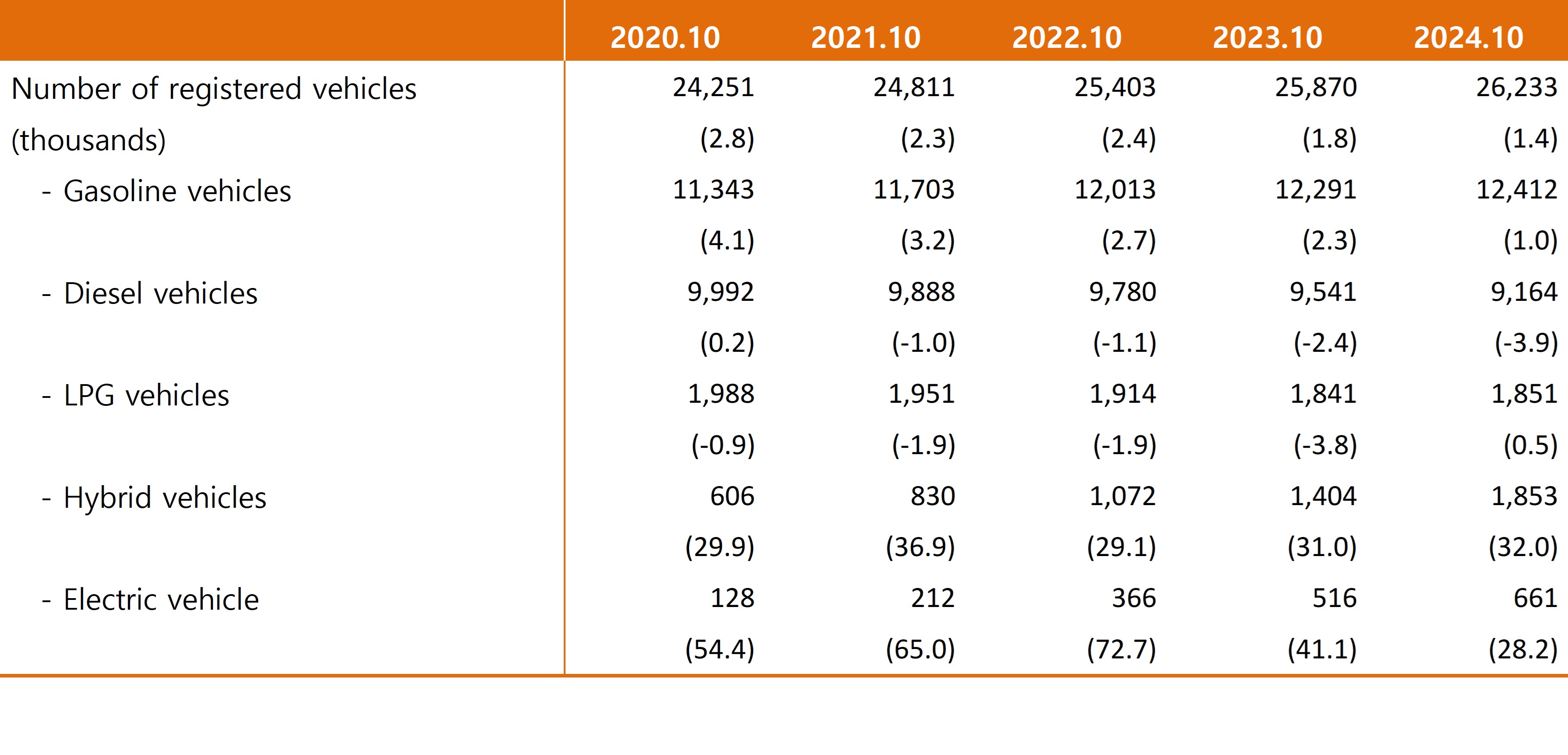

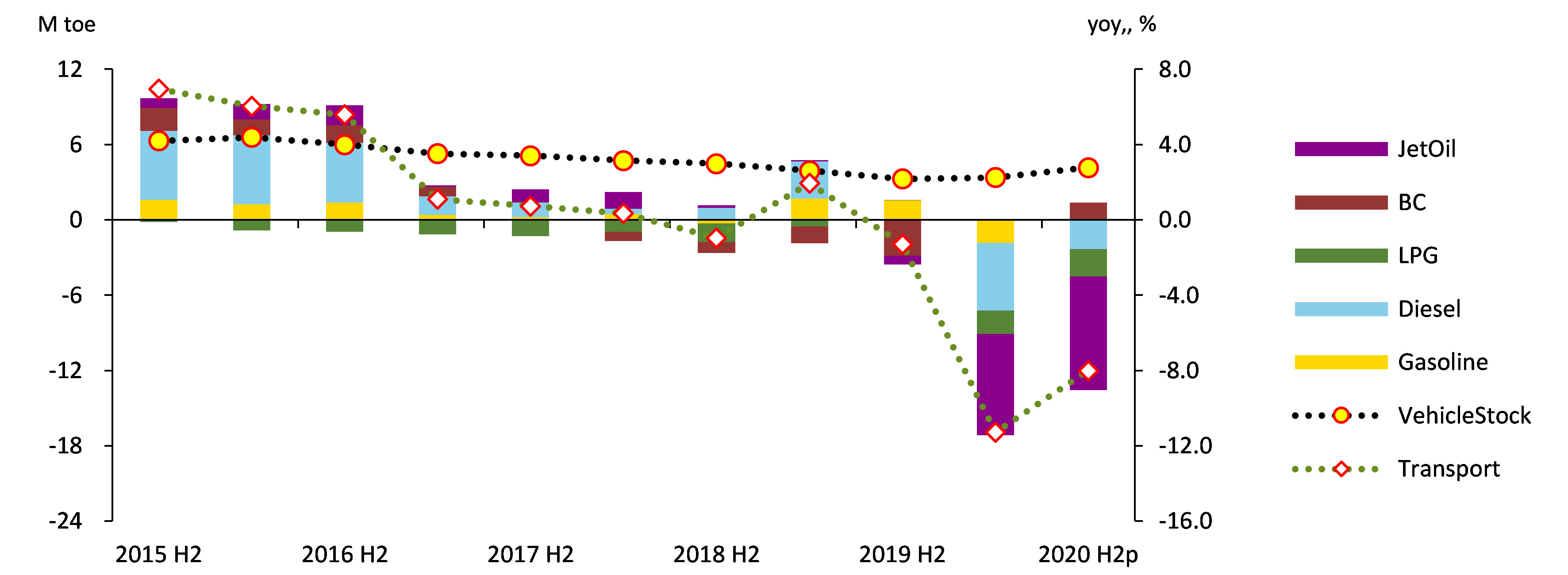

Changes in transportation policy and the number of registered cars

The government's policy on LPG vehicles has changed, and the decline in the number of LPG vehicles will be significantly eased by 2024.

The number of LPG vehicles registered and the consumption of LPG in the transportation sector have been declining continuously, but in 2024, the discontinuation of existing diesel trucks and the launch of new LPG 1-ton trucks will significantly ease the decline in the number of LPG vehicles registered.

There is a movement to increase the number of LPG vehicle registrations and increase LPG demand as a substitute for diesel vehicles, but in the long term, the number of LPG vehicles is expected to decrease as the government strengthens its support system for the purchase of eco-friendly vehicles.

The rate of increase in the number of registered electric vehicles, which has been growing rapidly recently, is slowing down, and the number of diesel vehicles is continuing to decrease.

The number of new sales and registrations of electric vehicles is still increasing, but the rate of increase is slowing down.

The number of diesel-powered vehicles registered has continued to decline as diesel vehicle reduction policies have been implemented.

Number of vehicles registered by fuel type in Korea (as of October)

Attachments

Attachments-

N_2024H2.png

Download

N_2024H2.png

Download

-

EnergyOutlook_2024H2.pdf

Download

View Details

EnergyOutlook_2024H2.pdf

Download

View Details

-

2024 Energy Demand Outlook (2024, First Half)

- Date2024/07/19

- Author Department of Energy Outlook Research

- Number of downloads 71

-

Download multiple files Download the entire file

Energy Consumption Trend

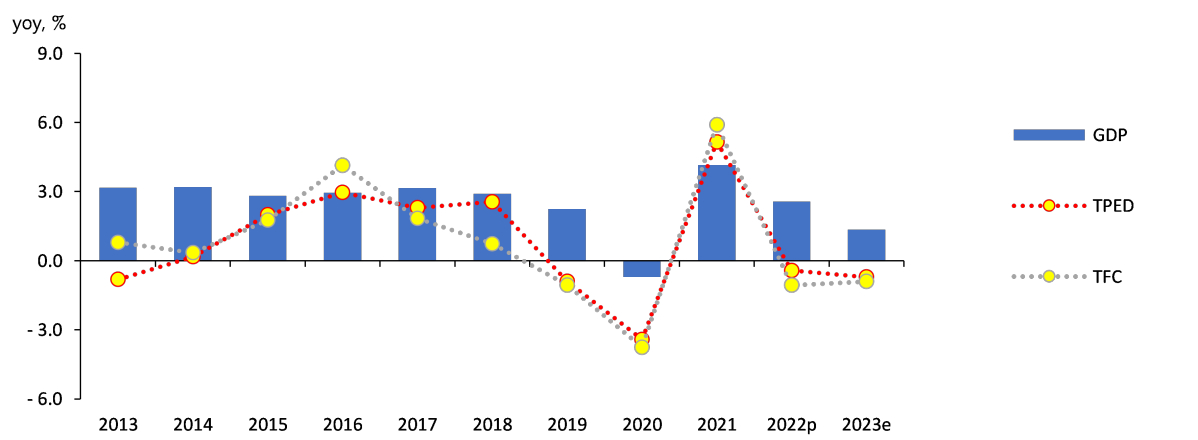

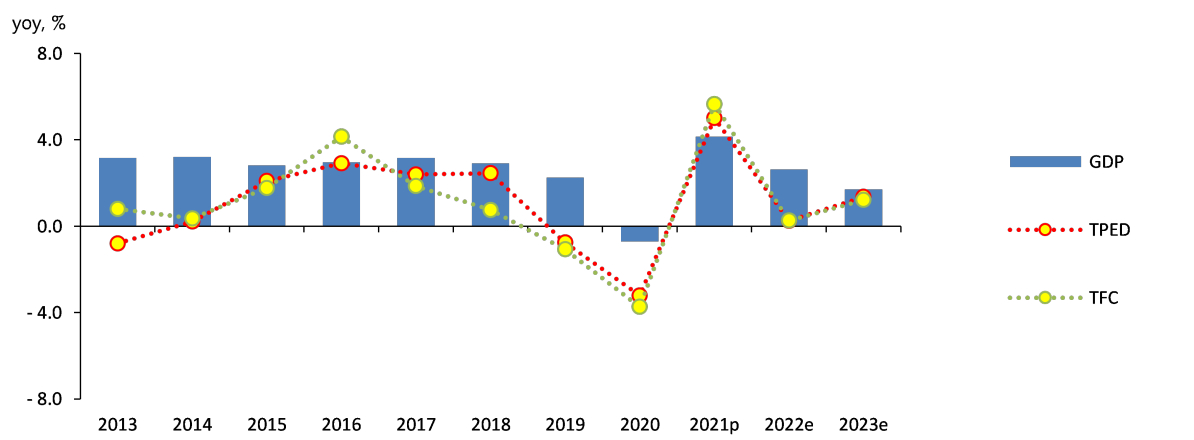

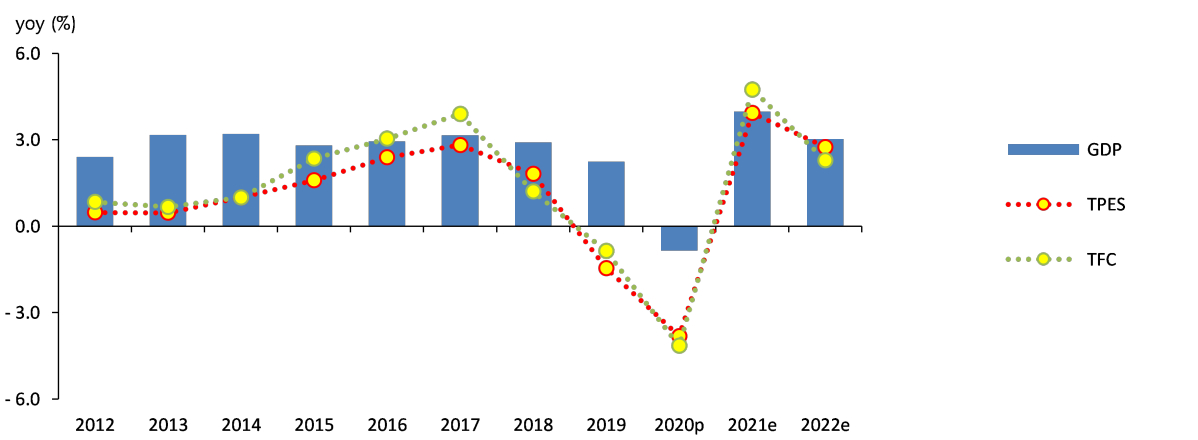

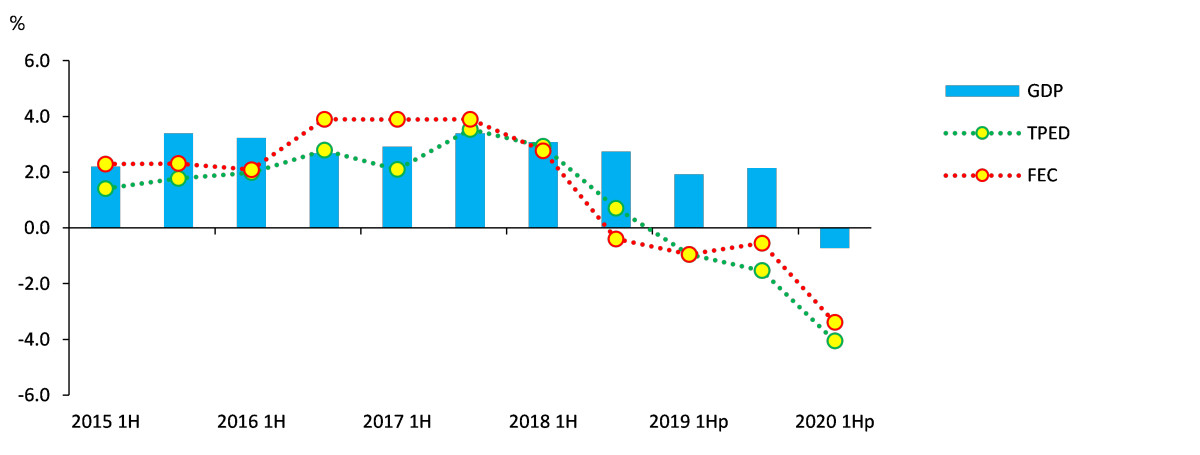

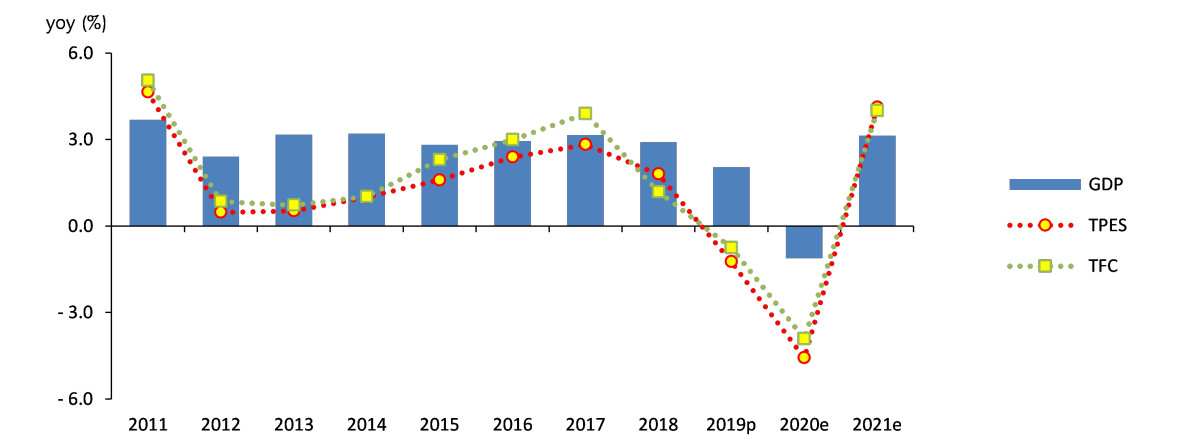

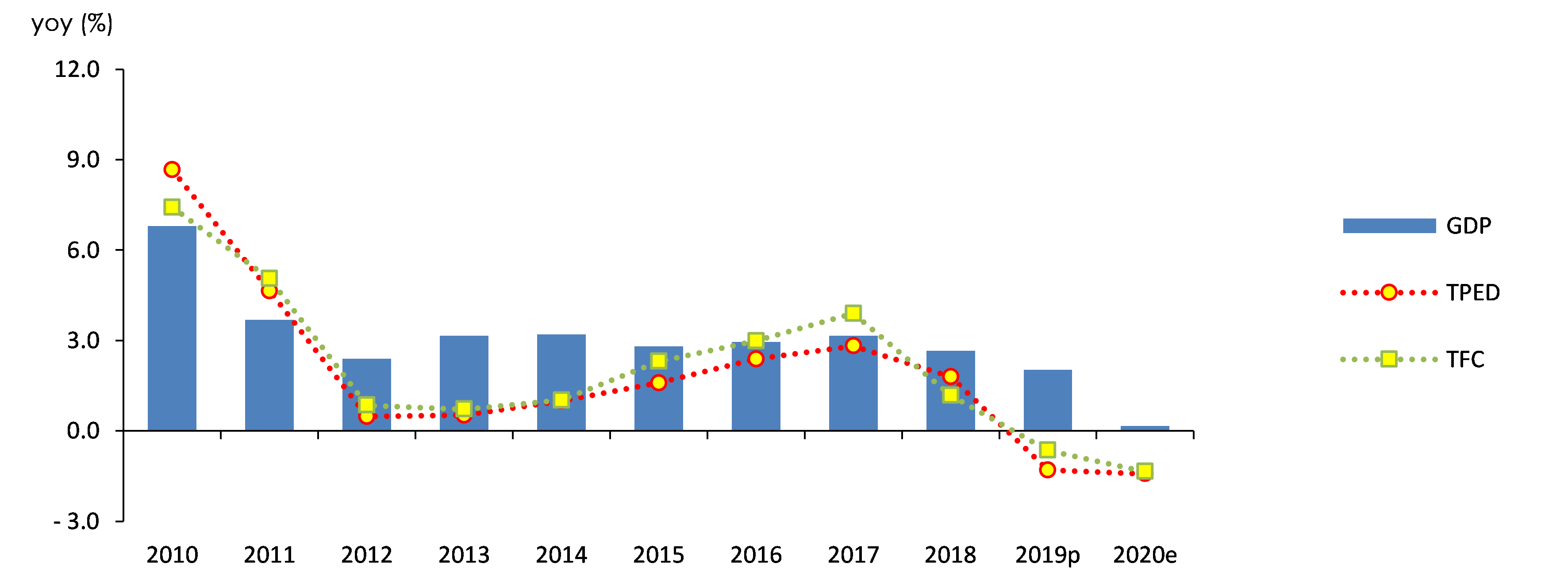

Total primary energy demand (TPED) in 2023 decreased by 2.3% y-o-y to 297.5 million toe due to a decline in manufacturing production activity.

Despite the decline in manufacturing production, the economy grew by 1.4% y/y due to an increase in service sector production and lower international energy prices, but energy consumption declined mainly in the energy-intensive industrial sector.

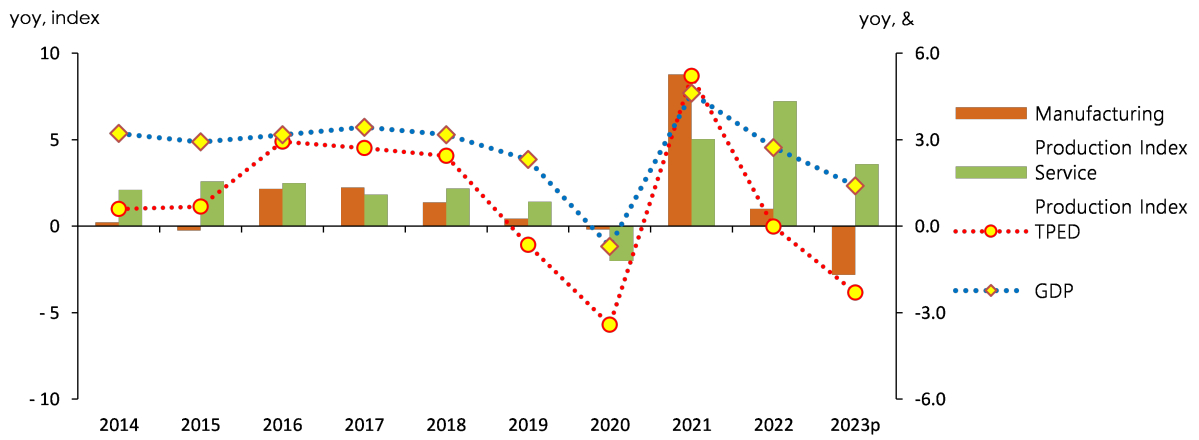

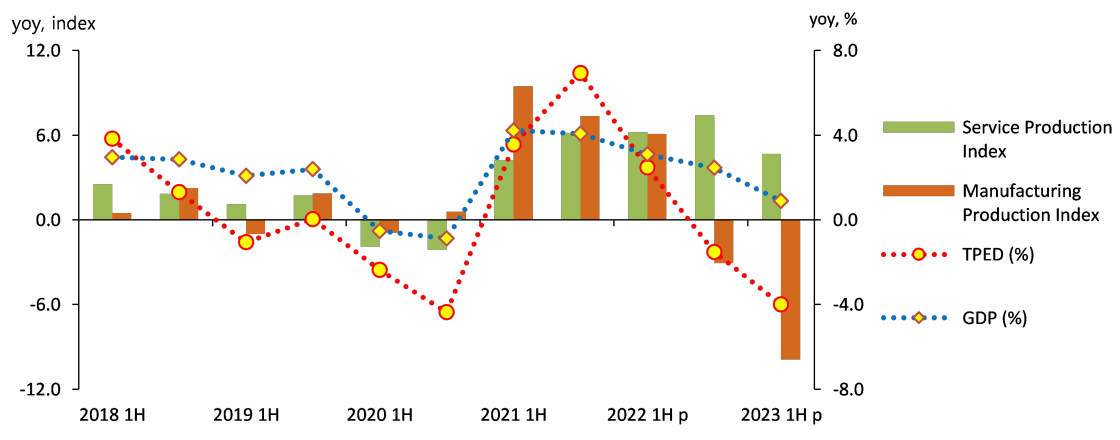

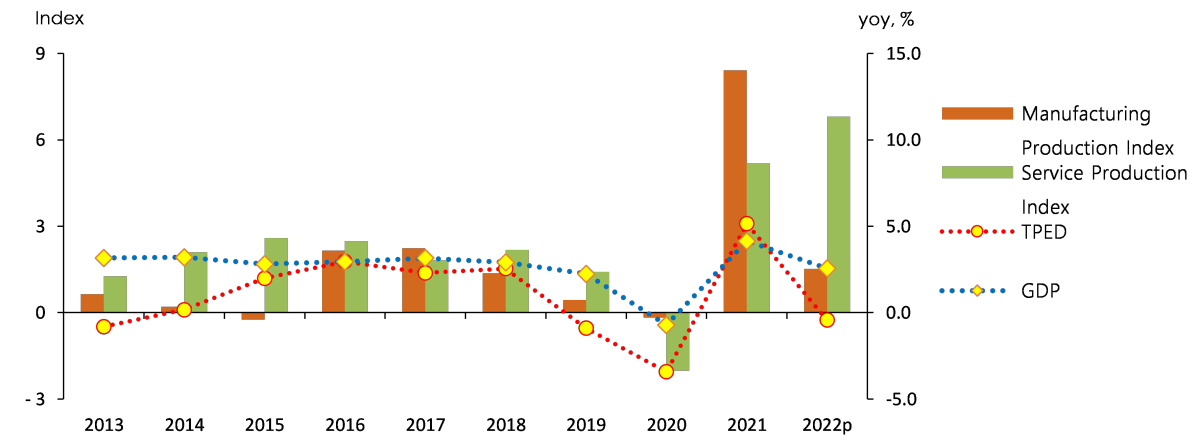

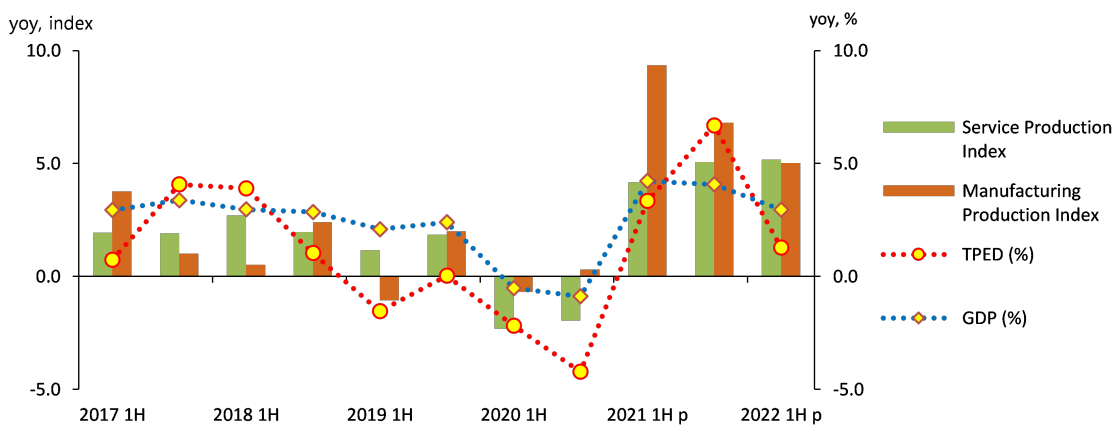

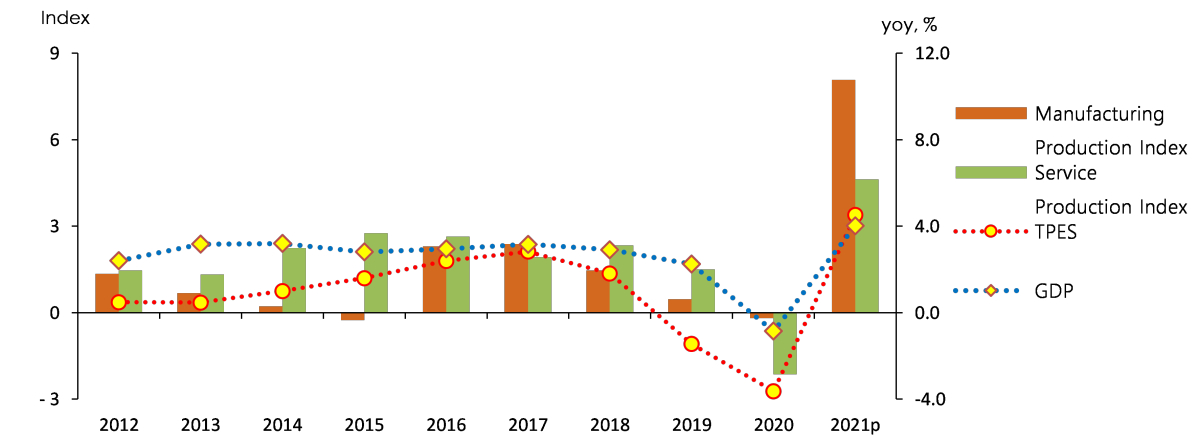

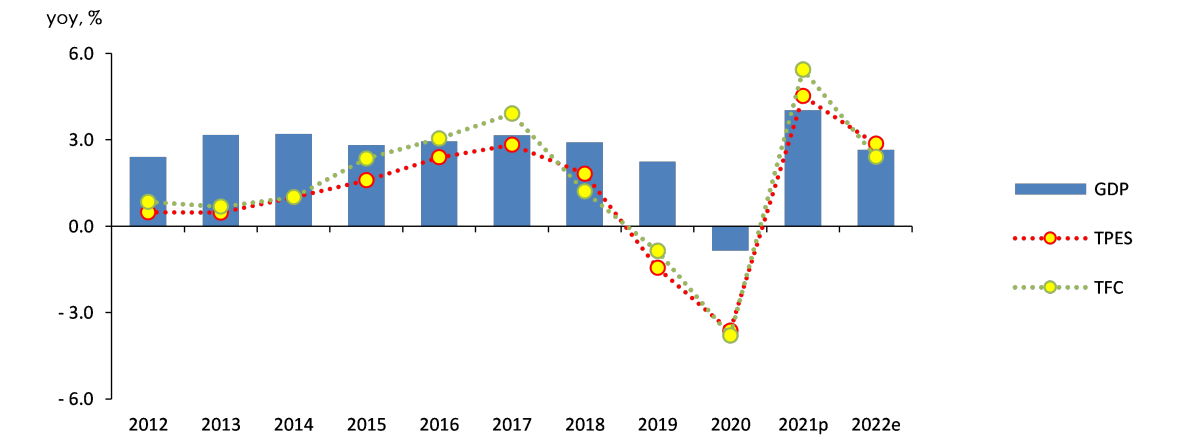

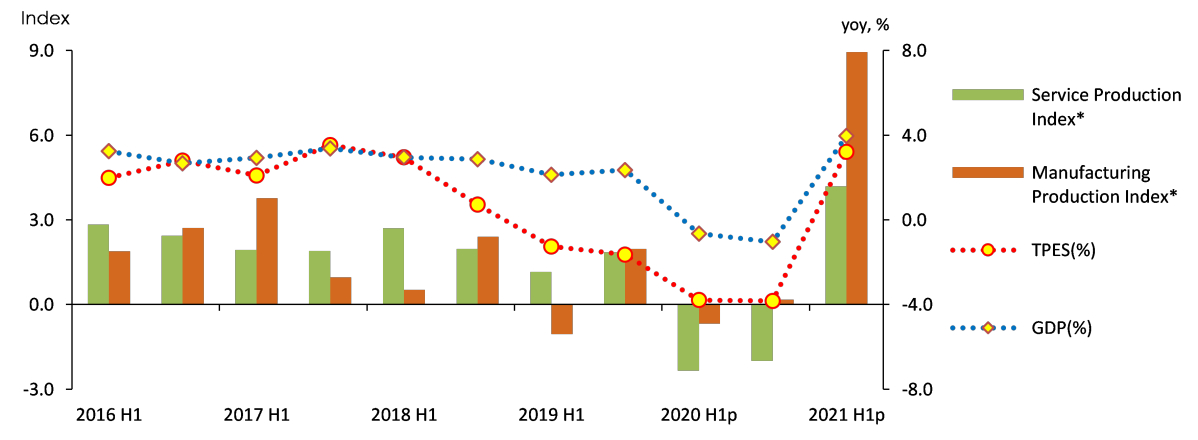

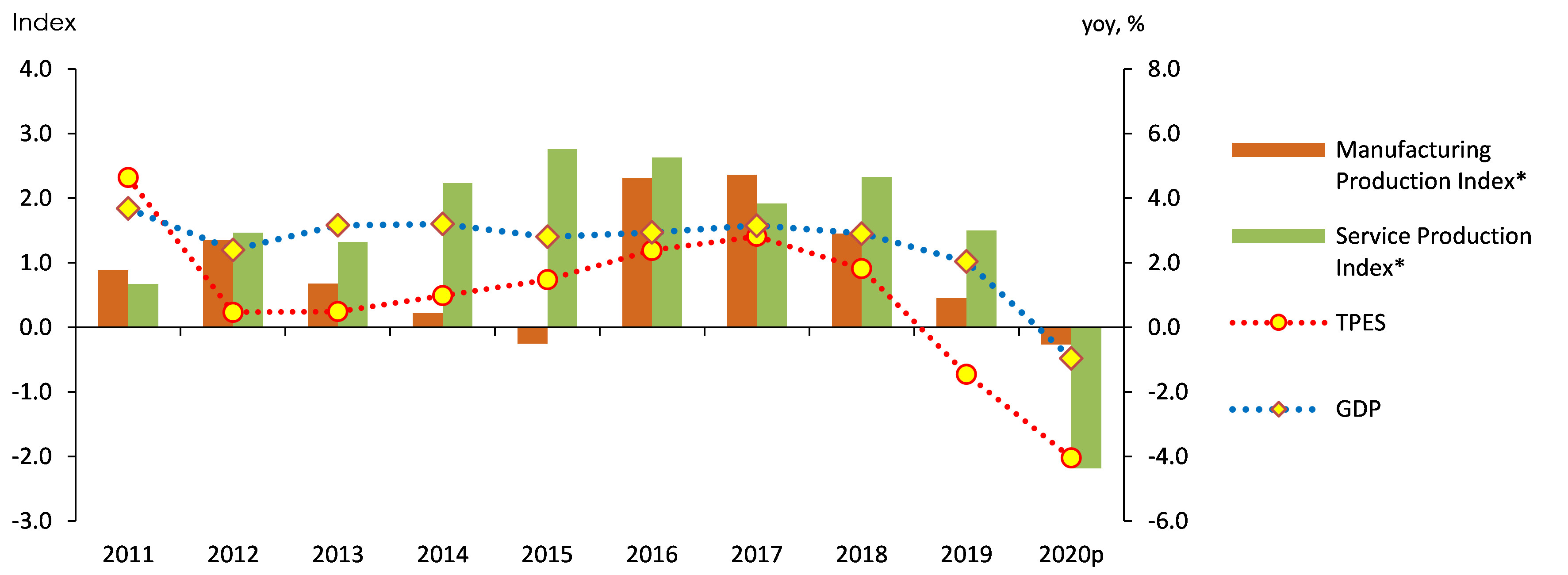

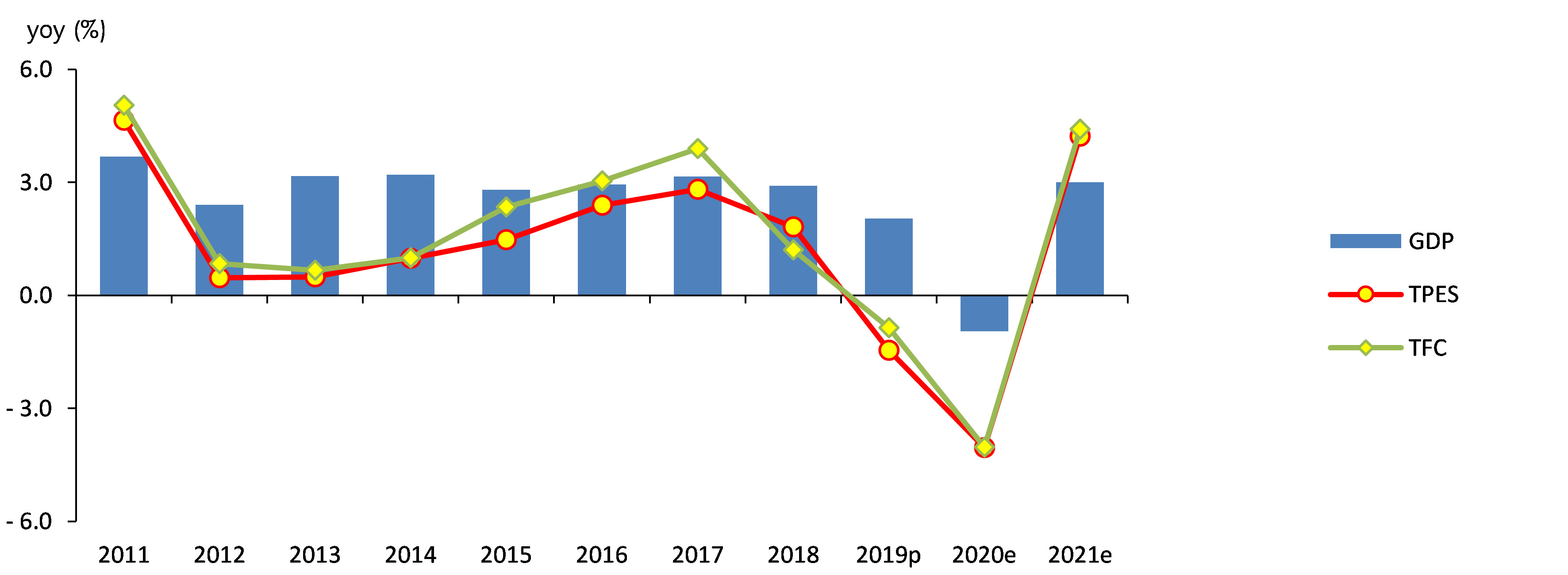

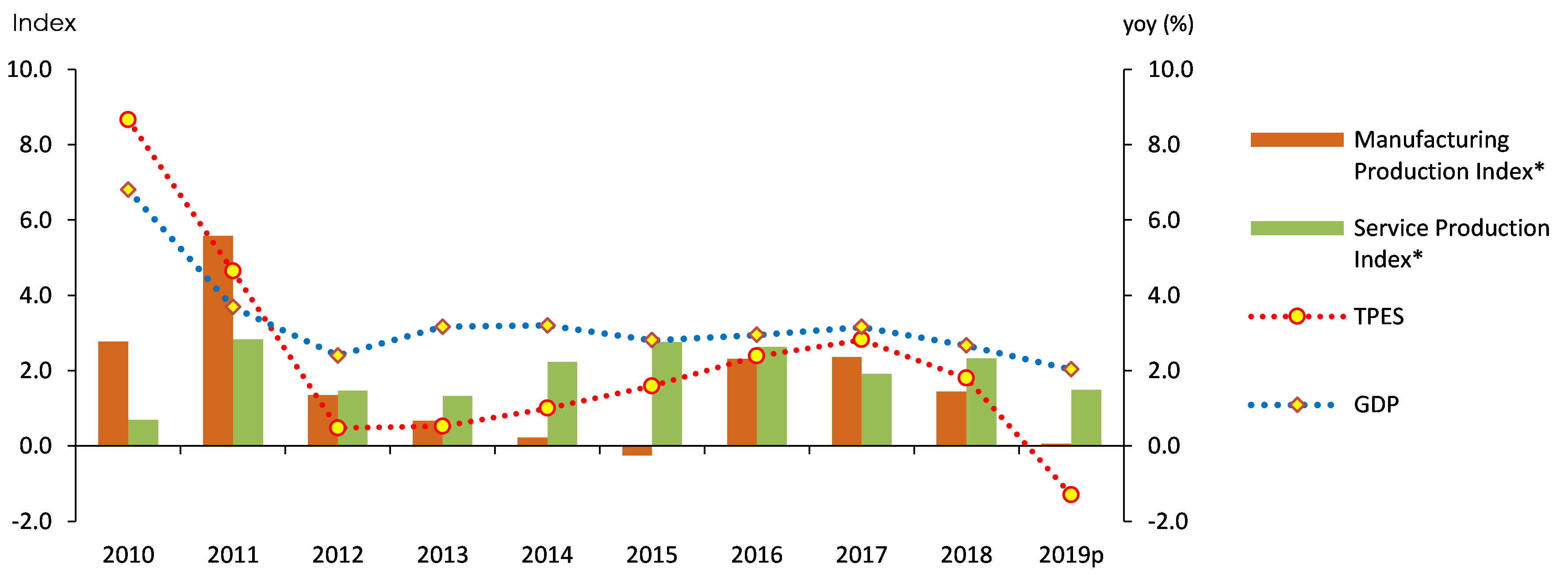

The growth rates of GDP and TPED, production index

Note: Production indexes show year-on-year differences.

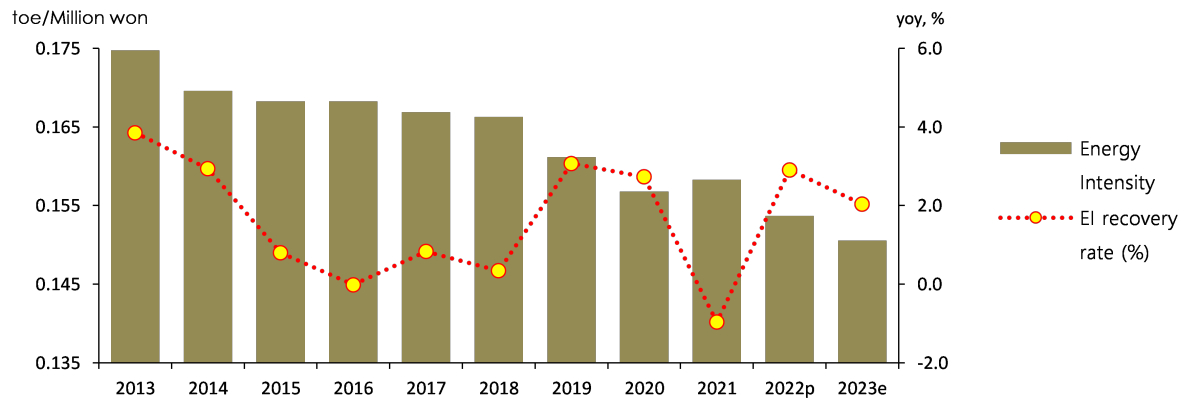

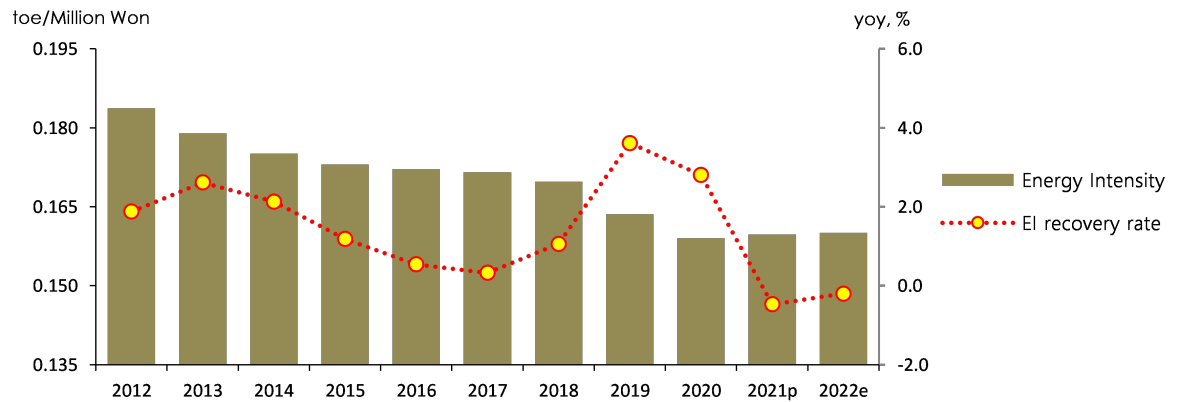

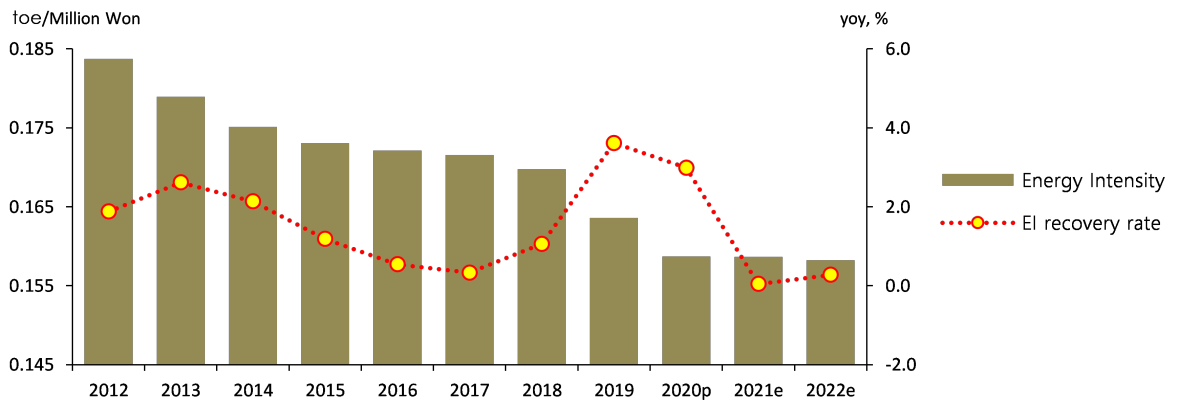

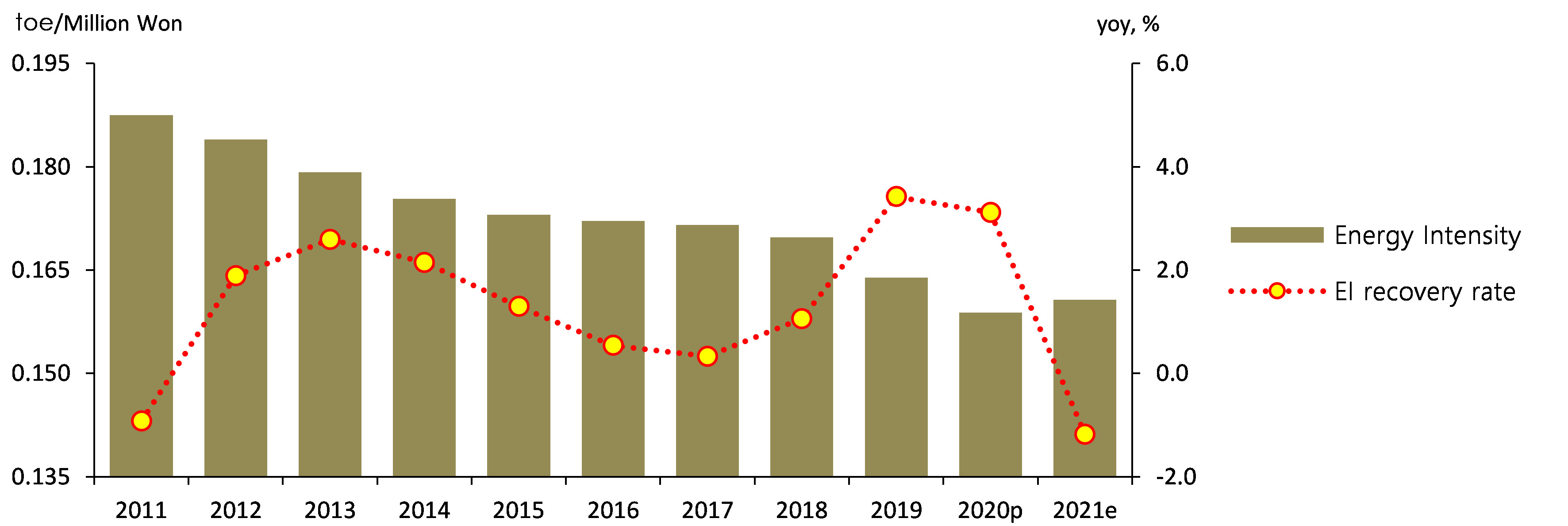

Energy intensity (TOE/million KRW) improved (decreased) by 3.7% year-on-year as economic growth fell by 1.3 percentage points year-on-year, but total energy consumption fell more (2.3 percentage points).

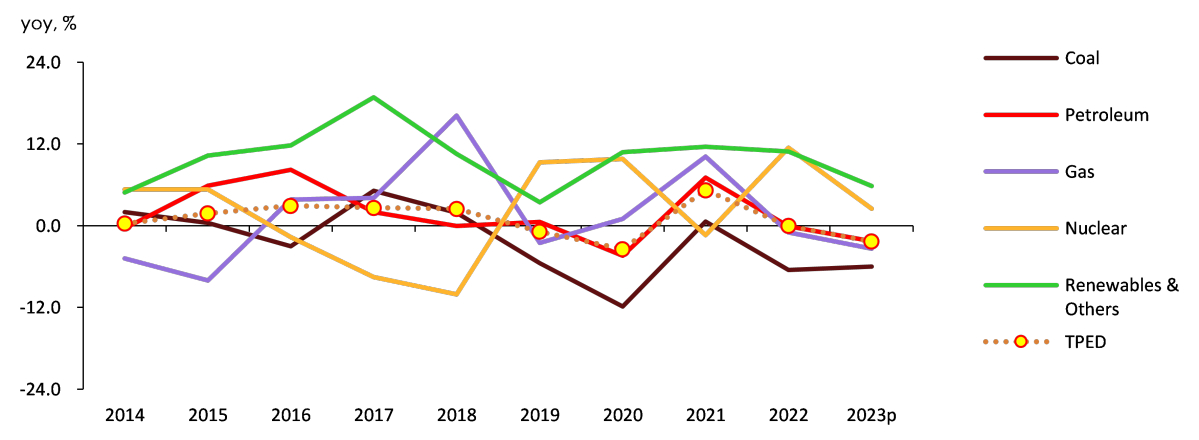

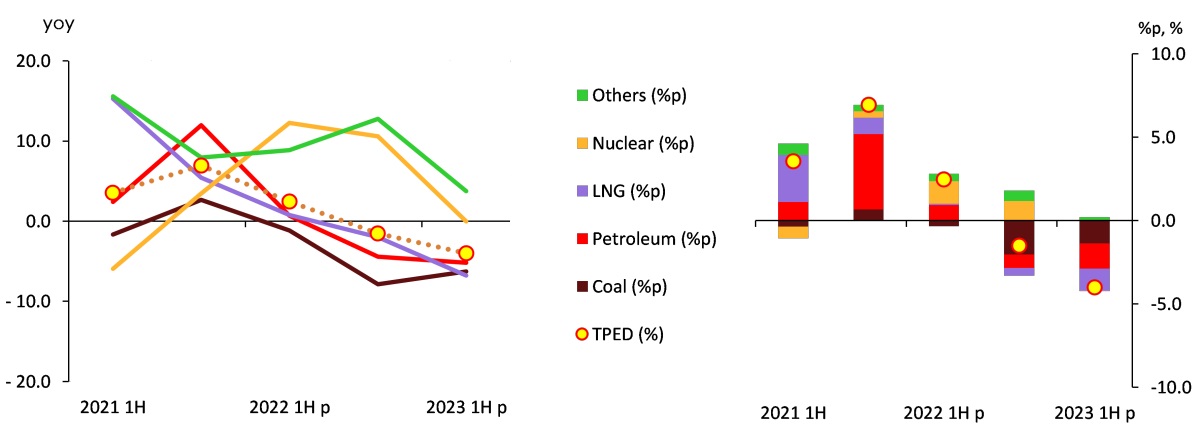

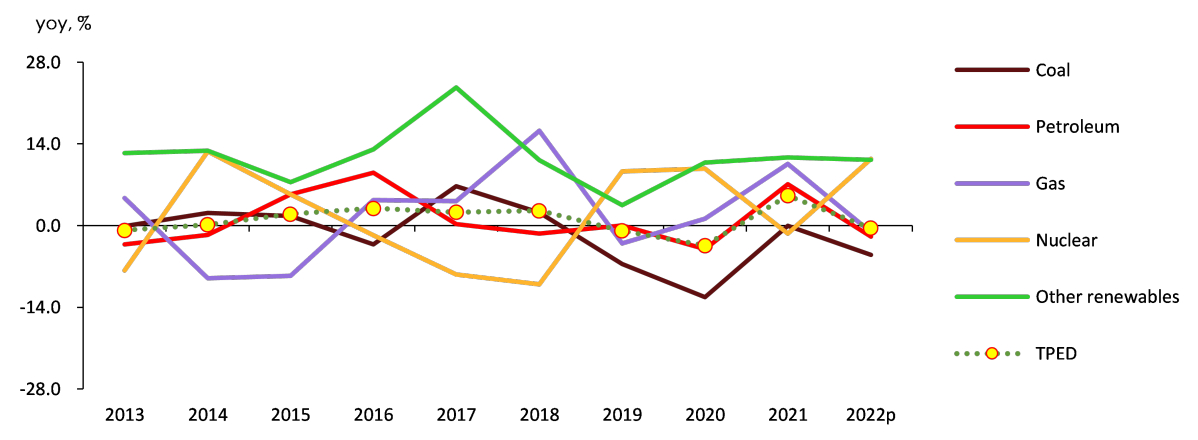

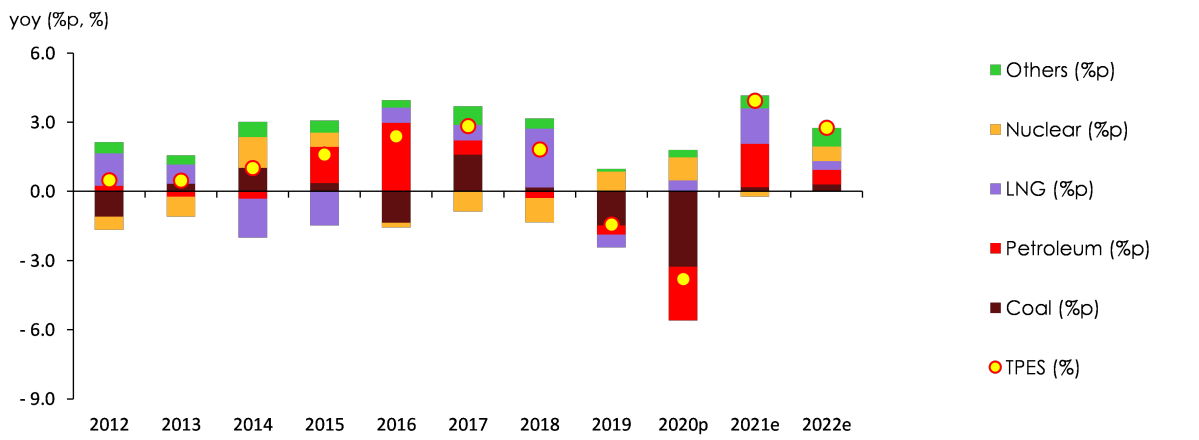

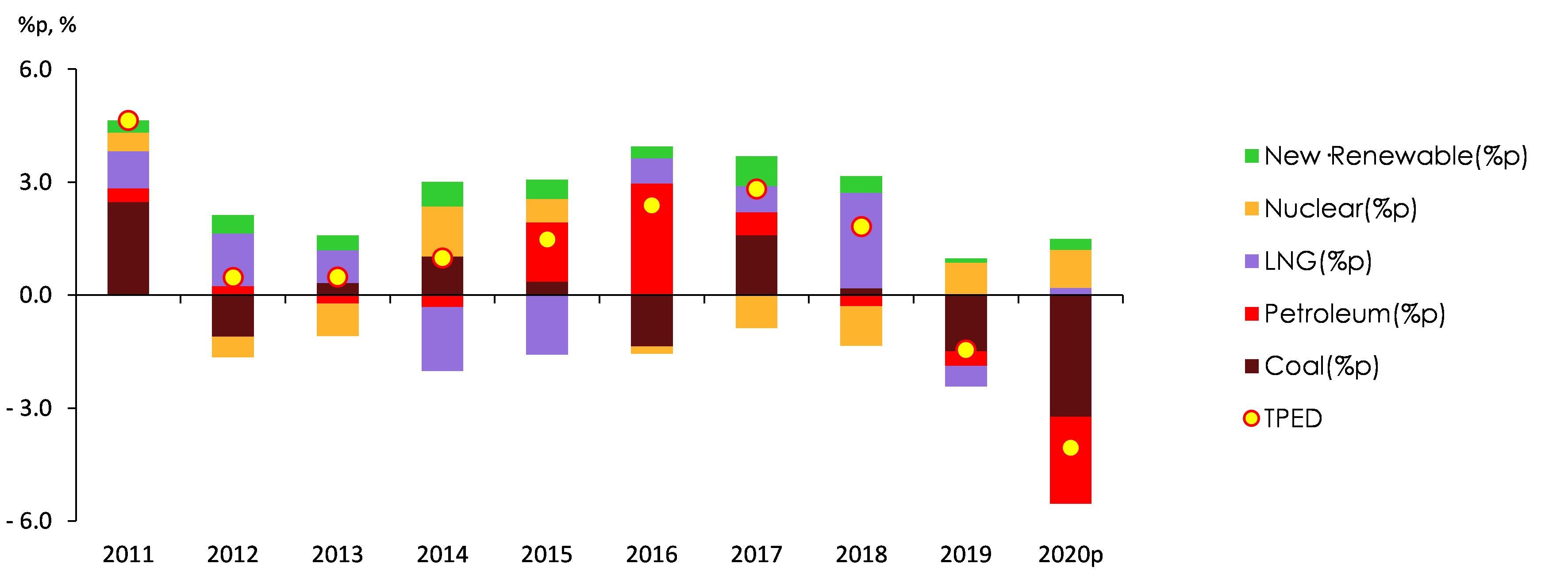

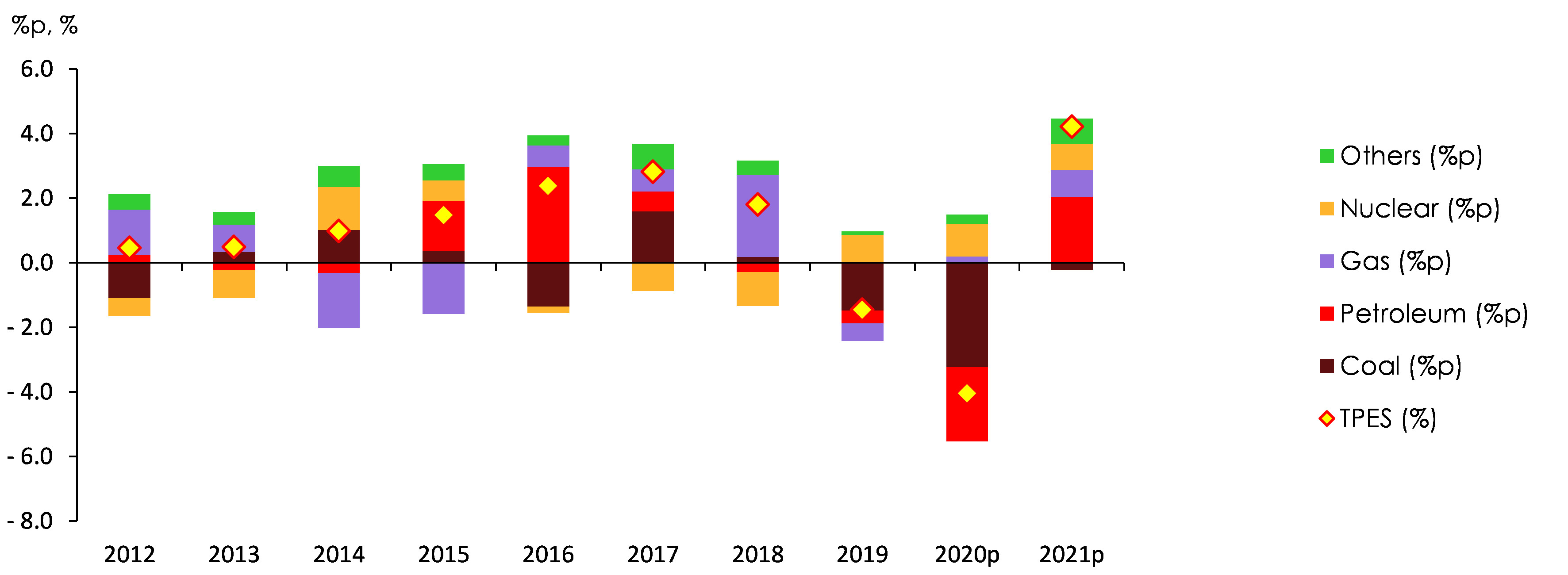

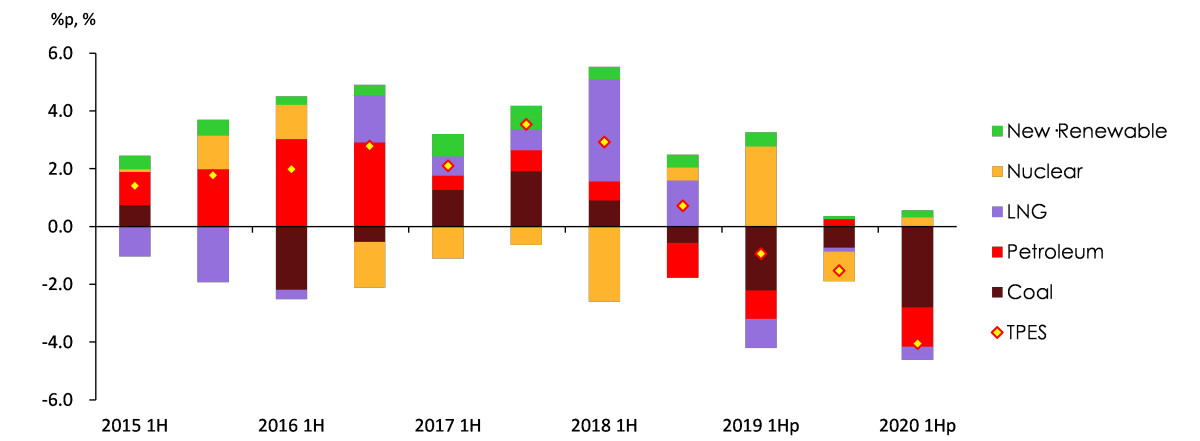

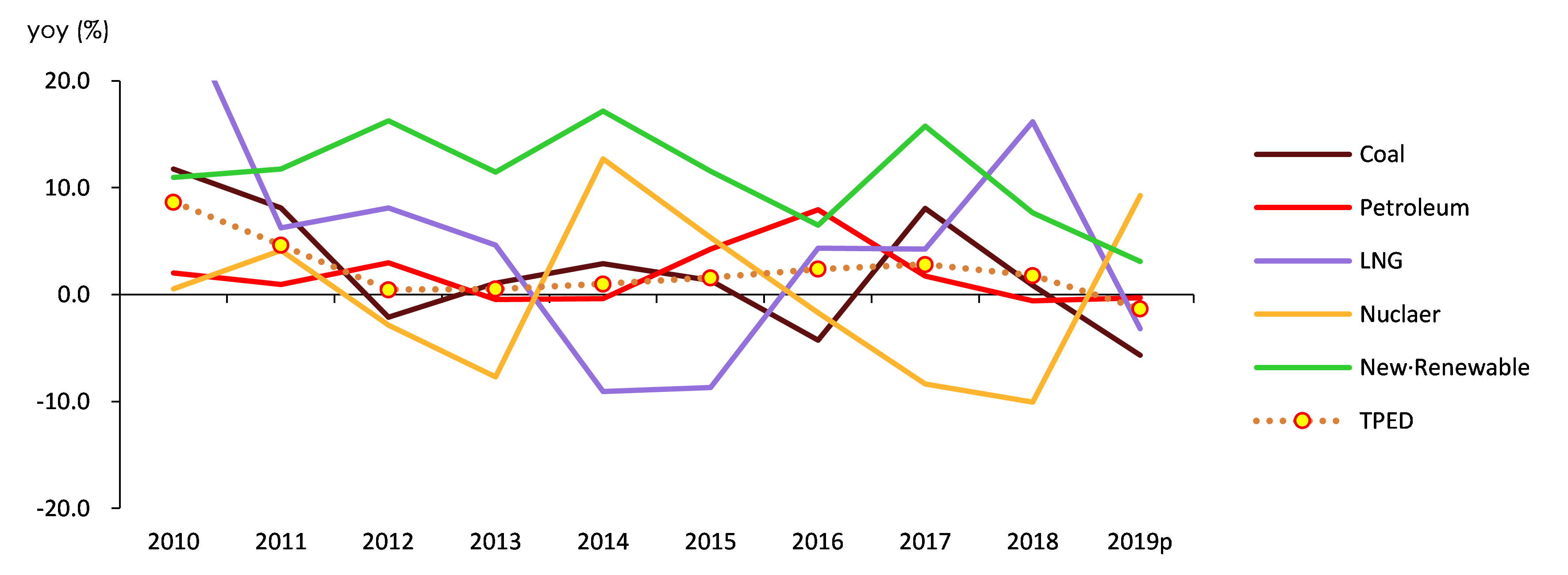

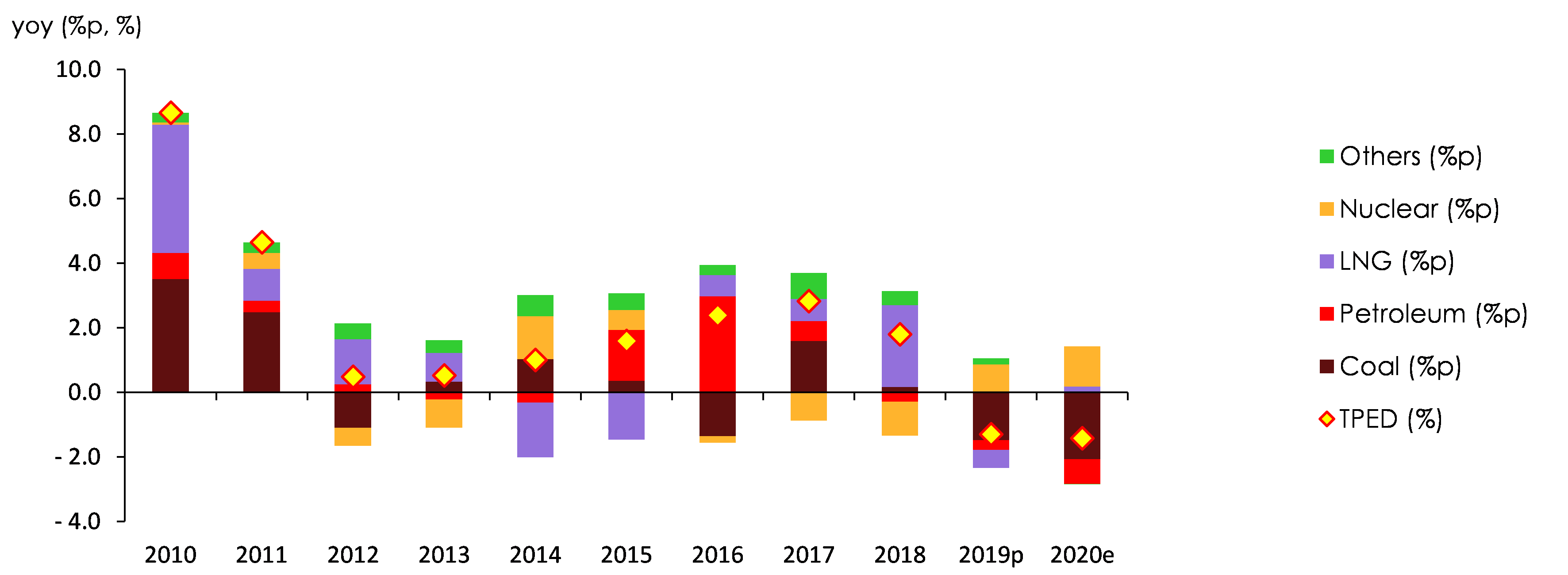

In TPED, nuclear and renewable consumption increased, while coal, oil and gas consumption decreased year-on-year.

Coal consumption decreased by 6.3% y/y, as the decline widened in the power generation sector due to grid constraints and increased nuclear and renewable generation, and continued to decline in the industrial sector due to stagnant consumption in the steel industry and contraction in petrochemicals and cement due to the slowdown in the economy.

Oil consumption decreased by 4.3% y-o-y, with the decline in industrial use widening to raw materials due to the slowdown in petrochemicals, and in transportation due to the decline in the quantity of goods transported as a result of the reduction in production activities, despite the increase in passenger travel demand.

Gas (natural + city) consumption decreased by 3.3% YoY, with a faster decline in power generation due to lower electricity consumption, and a decline in both industrial and building use due to the slowdown in the economy, temperature and price effects.

Nuclear power increased by 2.5% YoY due to reduced preventive maintenance and the entry of Shin-Hanul Unit 1 (2022.12), while renewables increased by 5.8% YoY, led by solar, bio and fuel cell power generation.

TPED share was oil (39.8%), coal (22.0%), gas (19.3%), nuclear (12.9%), and renewable/other (6.0%), while the share of non-fossil energy continued to rise, reaching 18.9%.

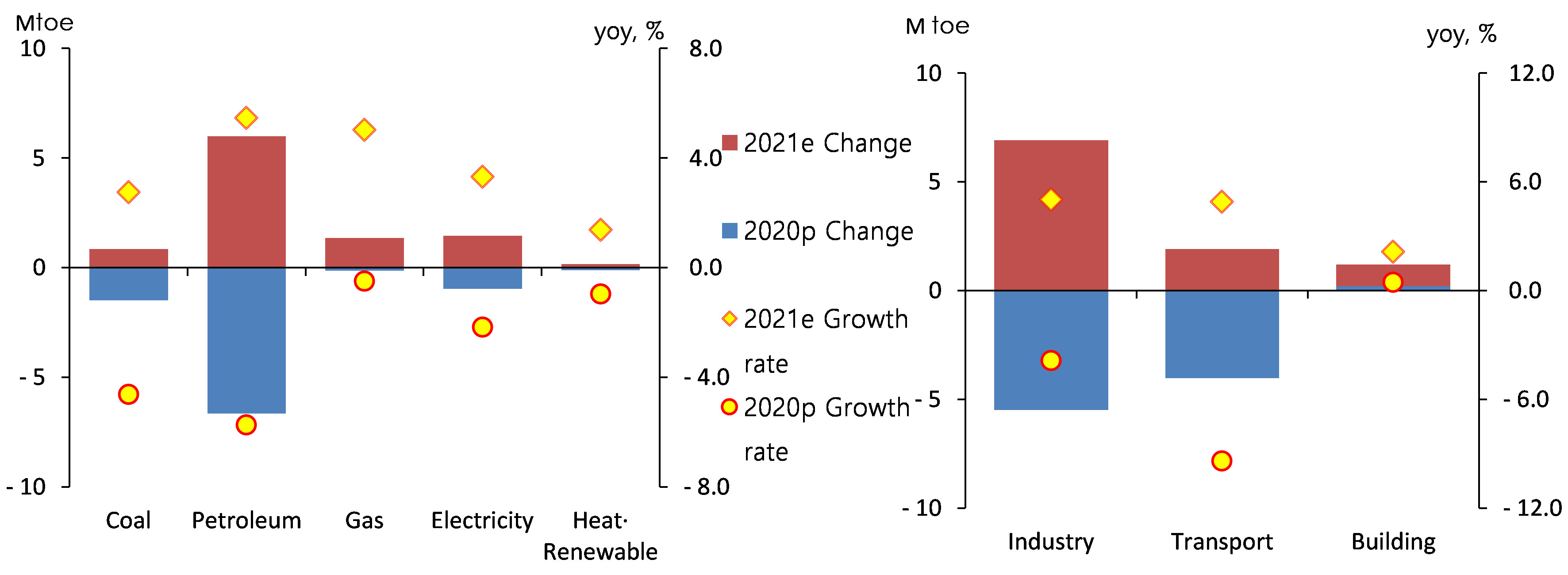

The growth rates of energy use by major energy source

Meanwhile, electricity consumption, a secondary energy, shifted to decline in industrial use due to the slowdown in the economy, while building use declined 0.1% year-on-year due to slower growth in service sector production, fewer heating and cooling degree days, and higher electricity prices.

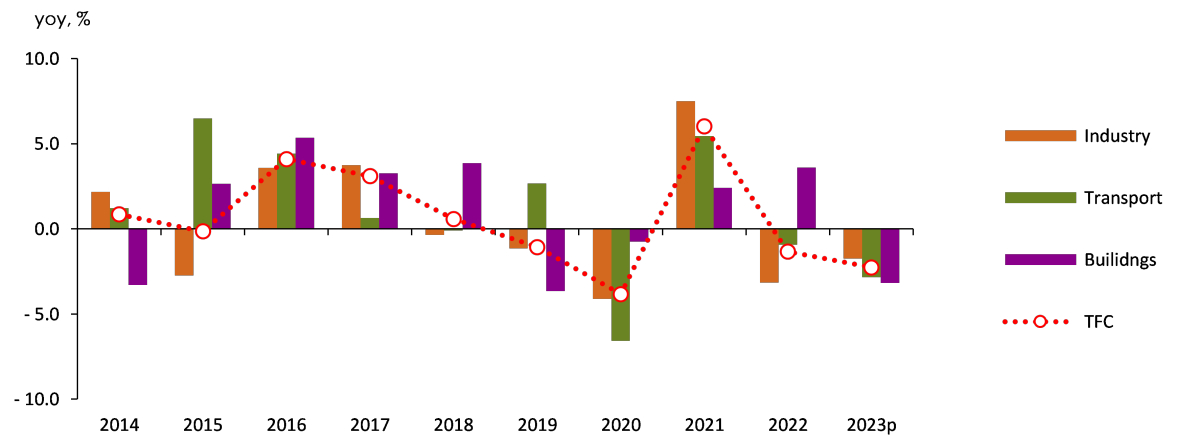

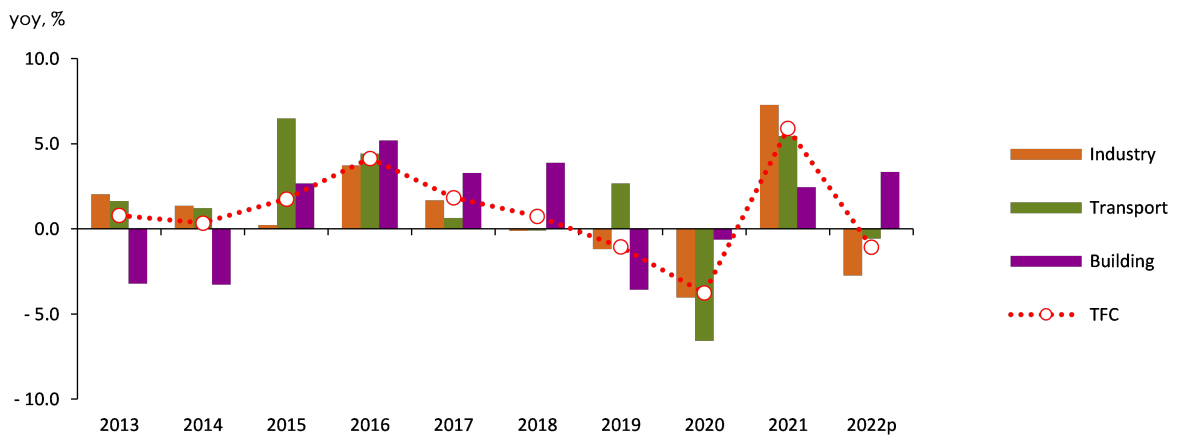

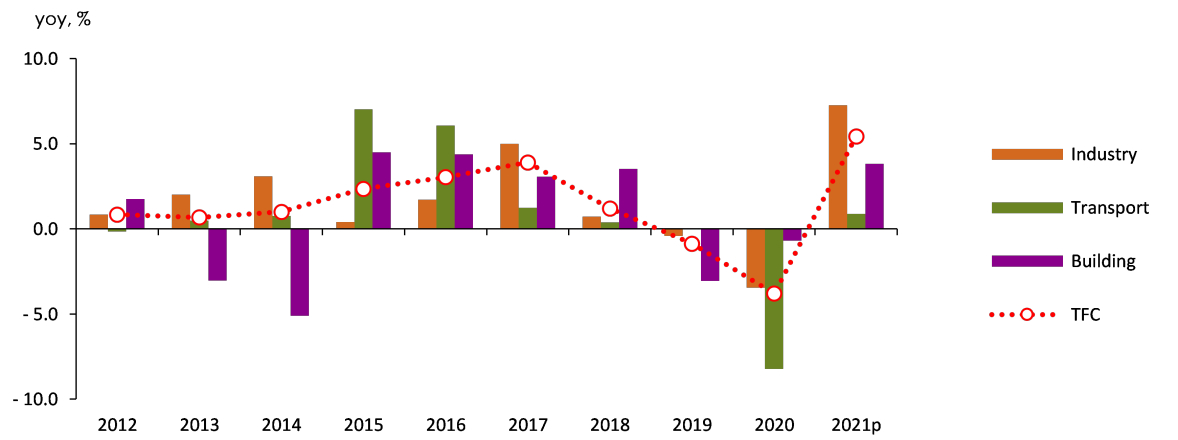

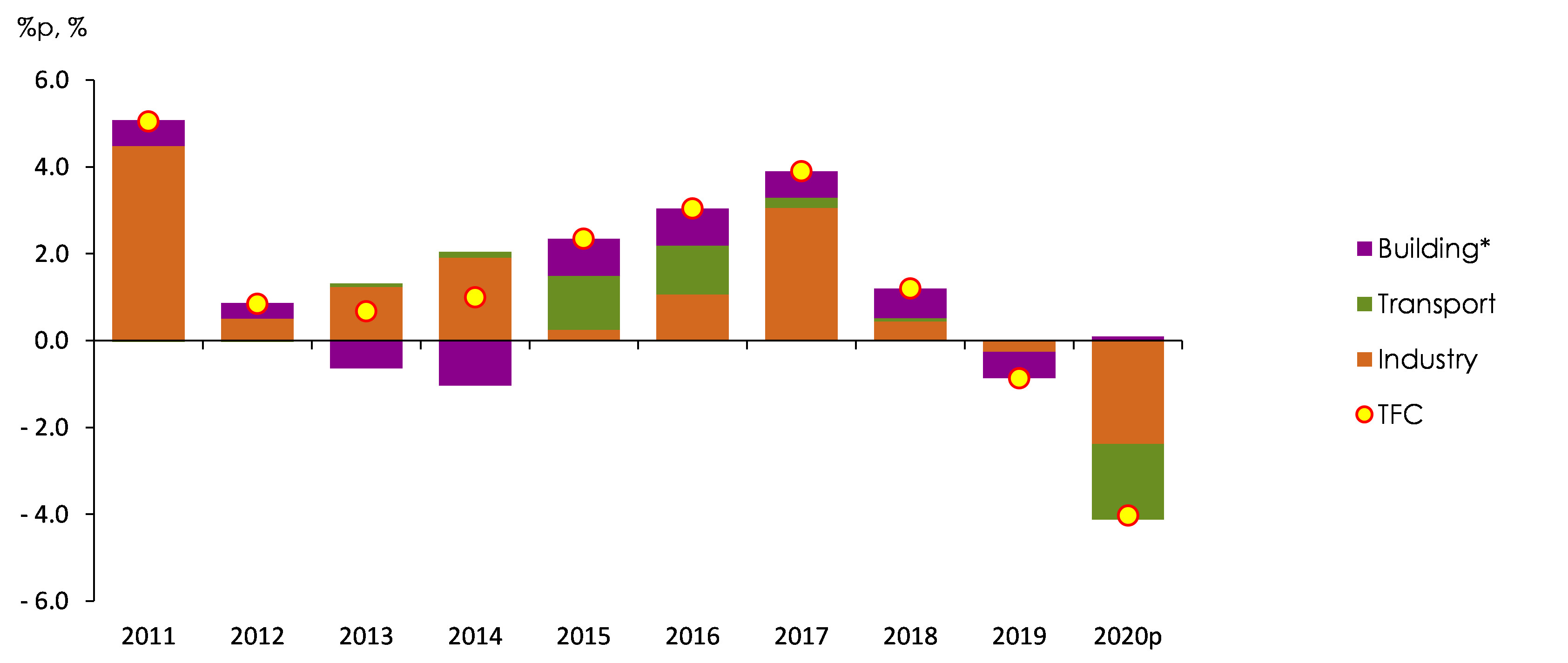

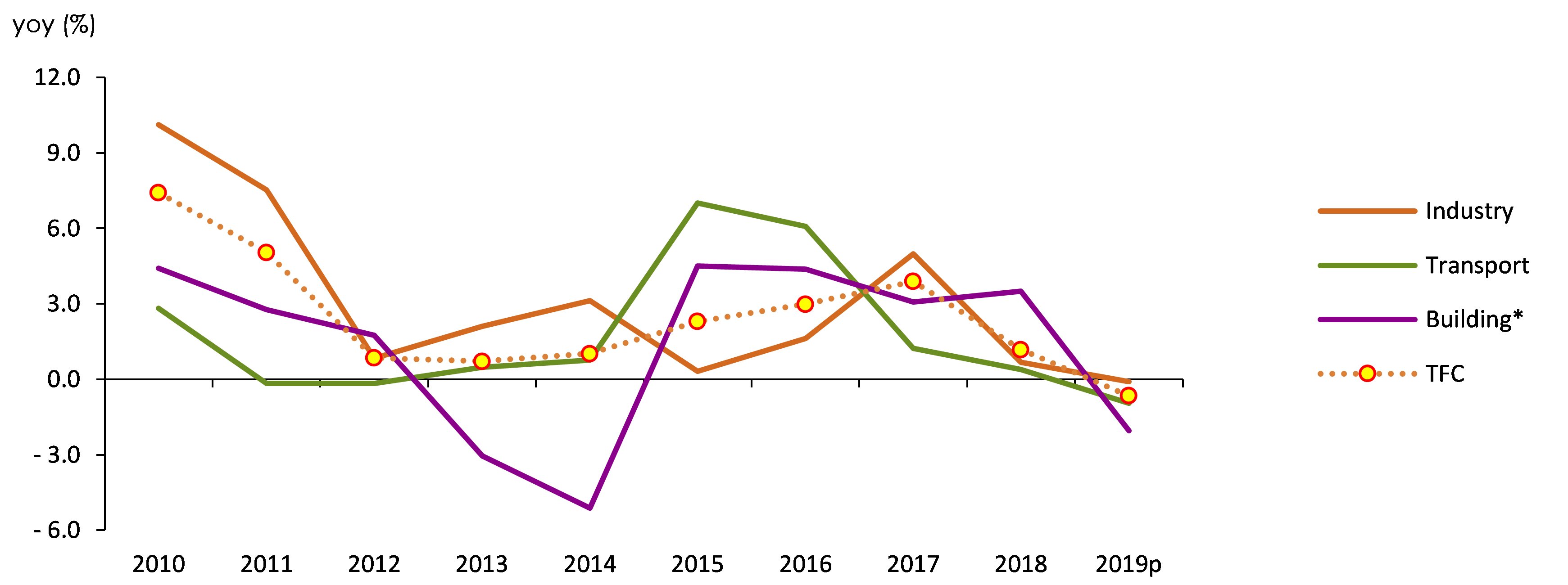

Final energy consumption in 2023 is down 2.3% y/y, with declines in the industrial, transportation and buildings sectors.

Industrial sector energy consumption continues to decline, falling 1.7% y/y, with a slight increase in consumption in steel and machinery, but a significant decline in petrochemicals, amid a slowing economy.

Transportation sector energy consumption decreased by 2.8% year-on-year, with declines in road, domestic aviation, domestic navigation, and rail, reflecting lower freight volumes due to the slowdown, despite lower petroleum product prices and higher travel demand.

The growth rates of TFC by end-use sector

Note: The Building sector includes residential, commercial and public-etc usage.

Energy consumption in the buildings sector decreased 3.2% year-over-year, with a decline in the residential sector and only a slight increase in the commercial sector due to higher energy prices, temperature effects, and slower service production.

Energy Demand Outlook

TPED is forecast to reach 301.4 million toe in 2024, an increase of 1.3% year-on-year.

TPED, which has been declining since 2021 due to the slowdown in economic growth, is expected to turn to growth in 2024 as economic growth picks up somewhat.

As the economy is expected to grow by 2.5% in 2024, up from 1.4% in 2023 (BOK 2024.5), energy demand is expected to rebound from the previous year's decline, but the growth will not be fast due to the slow recovery of major energy-intensive industries.

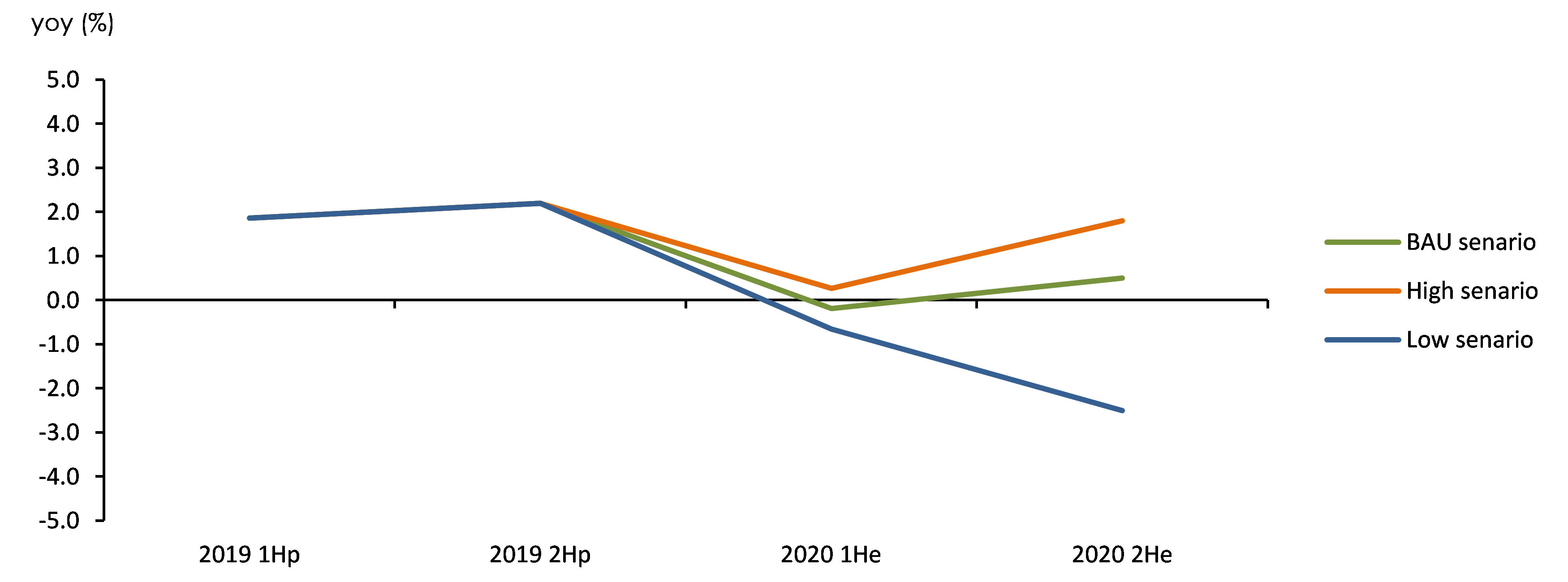

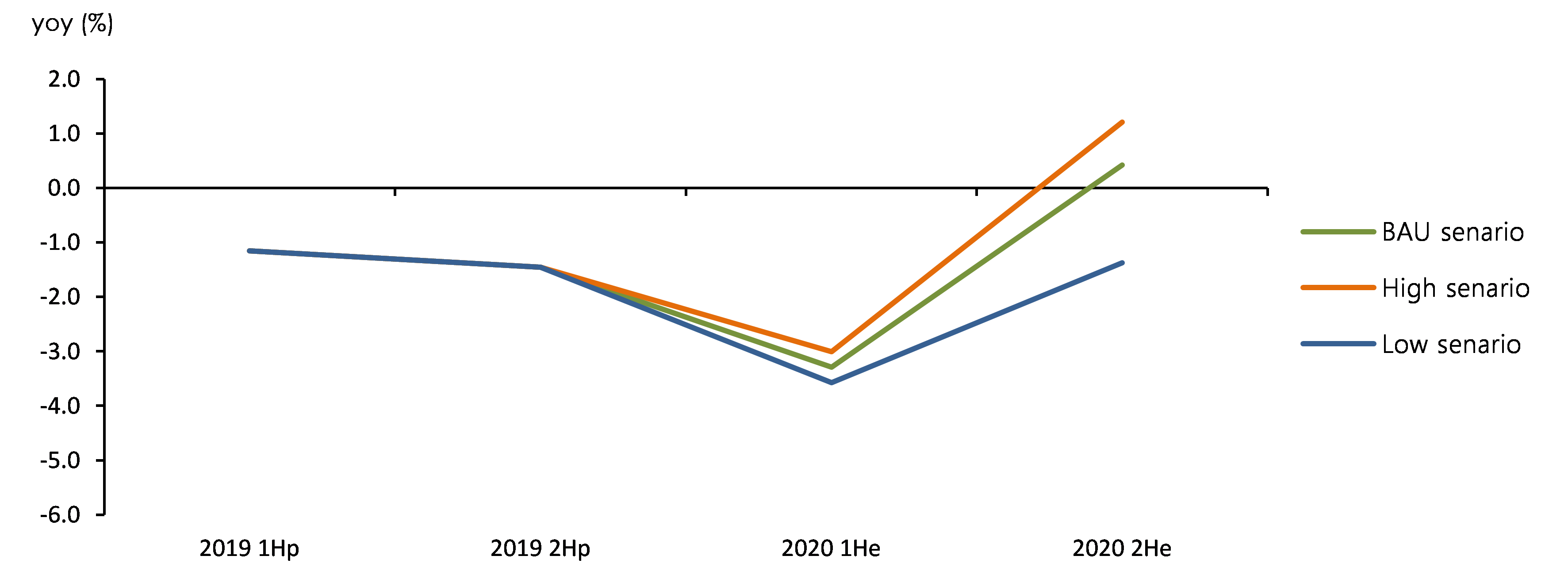

The growth rates of GDP, TPED and TFC, trend and outlook

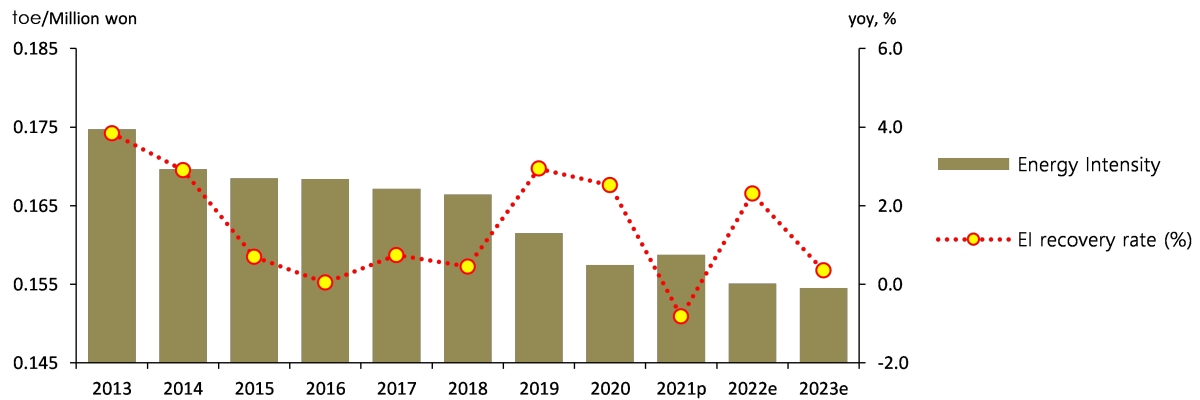

Energy intensity (TOE/million) is expected to continue to improve in 2024, decreasing 1.2% year-over-year.

Energy Intensity and EI Recovery Trends

Note: Energy Intensity is calculated as the value of 'TPED/GDP', expressed in toe/million won, EI recovery rate multiplies EI increase rate by '-1'.

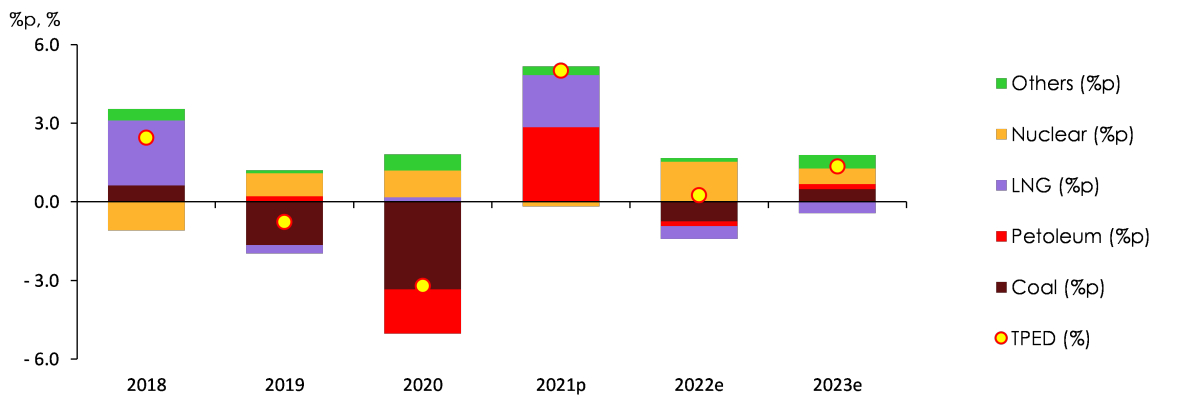

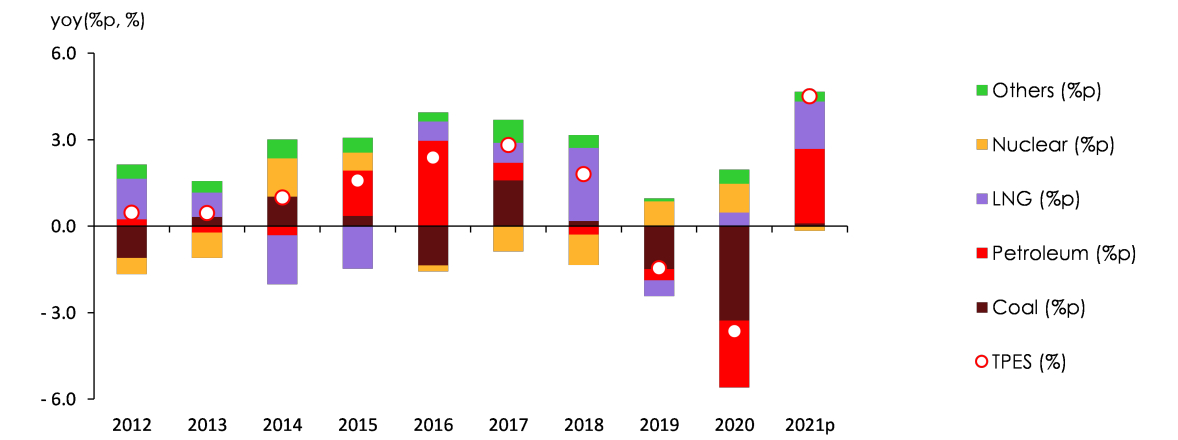

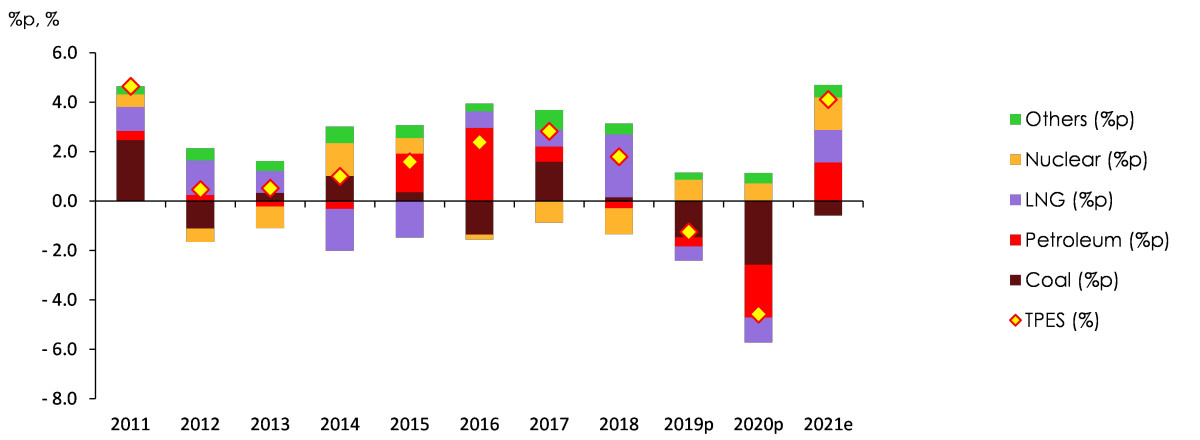

Coal continues to decline, oil and gas rebound from two consecutive years of decline, nuclear and renewables continue to grow.

Coal demand is forecast to decline by 3.4% y/y, with industrial rebounding, but power generation continuing to decline.

Oil demand is forecast to increase 0.7% y/y, led by feedstock use, with a slight improvement in petrochemicals.

Gas (natural + city) demand is expected to increase by 3.7% YoY, with both power generation and final consumption rebounding.

Nuclear power generation is expected to increase by 5.3% year-on-year due to the entry of Shin-Hanul Unit 2 and Saeul Unit 3. Renewable energy is also expected to increase by 9.3% due to continued expansion of power generation facilities.

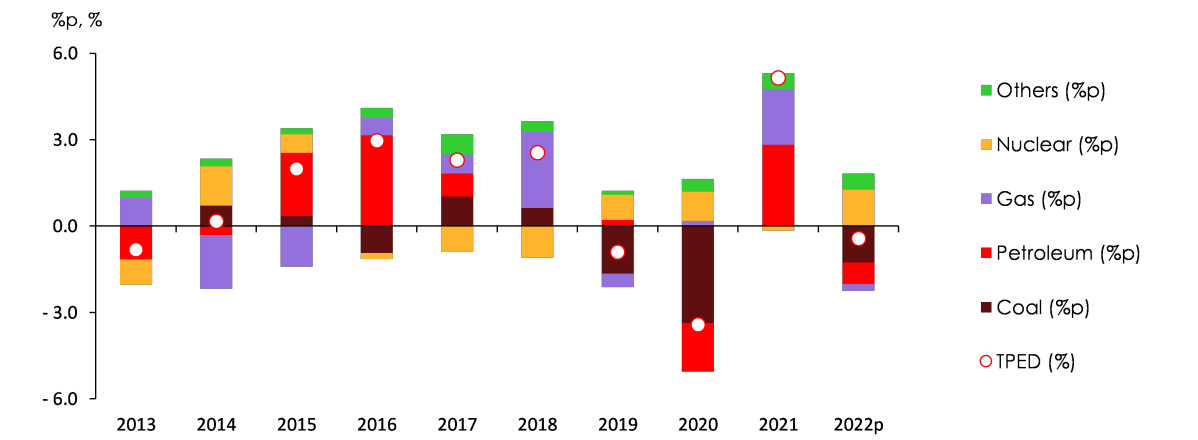

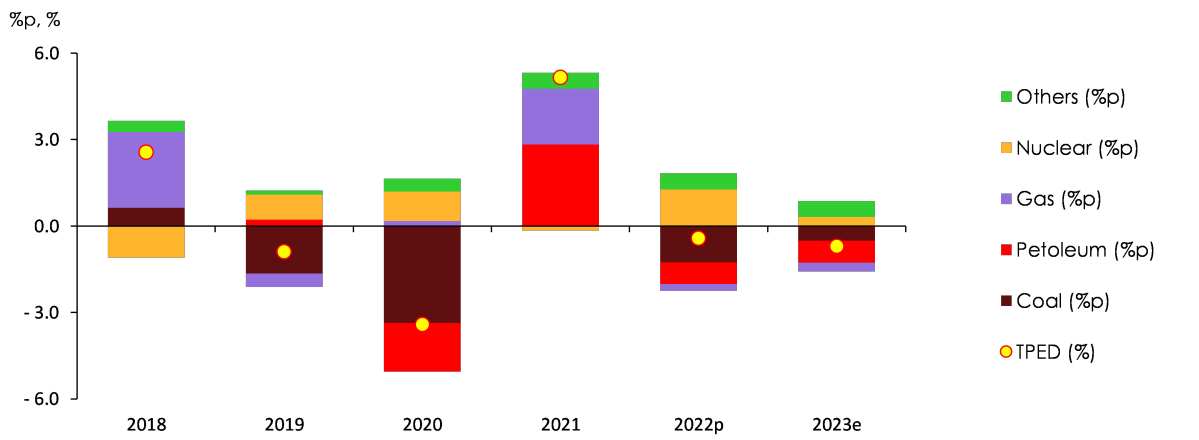

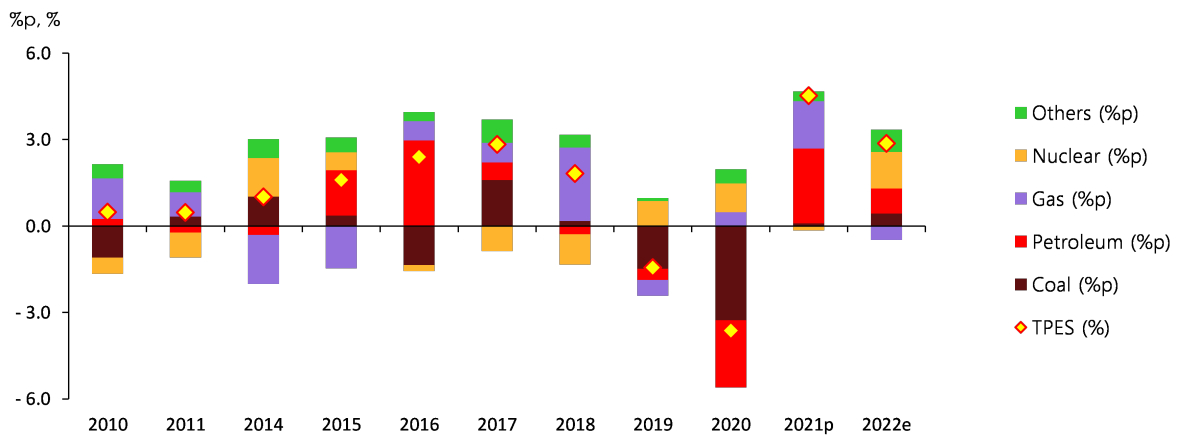

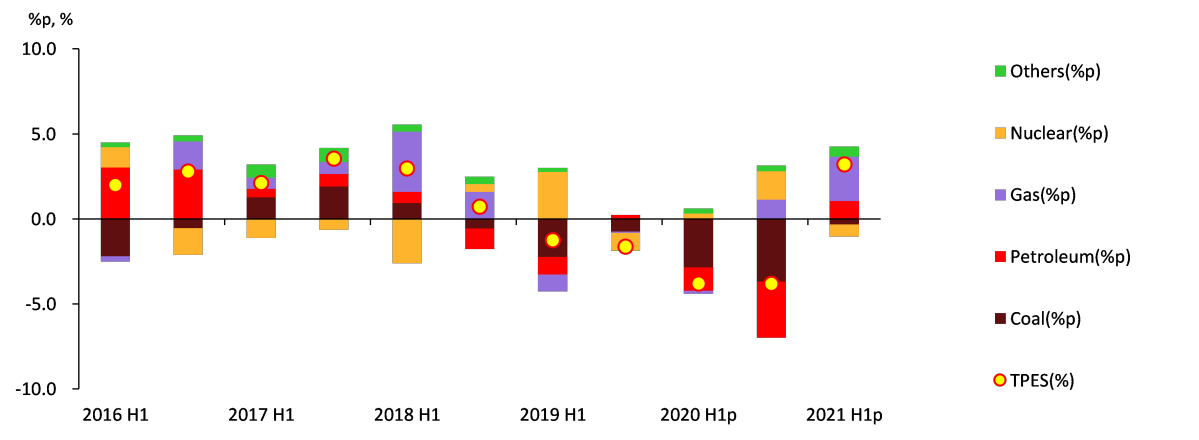

The growth rate of TPED & contributions by source

Note: TPED growth rate(%) is the sum of contributions (%p) by energy source.

Electricity demand is forecast to increase 0.8% year-over-year, with growth in industrial, residential, and commercial use.

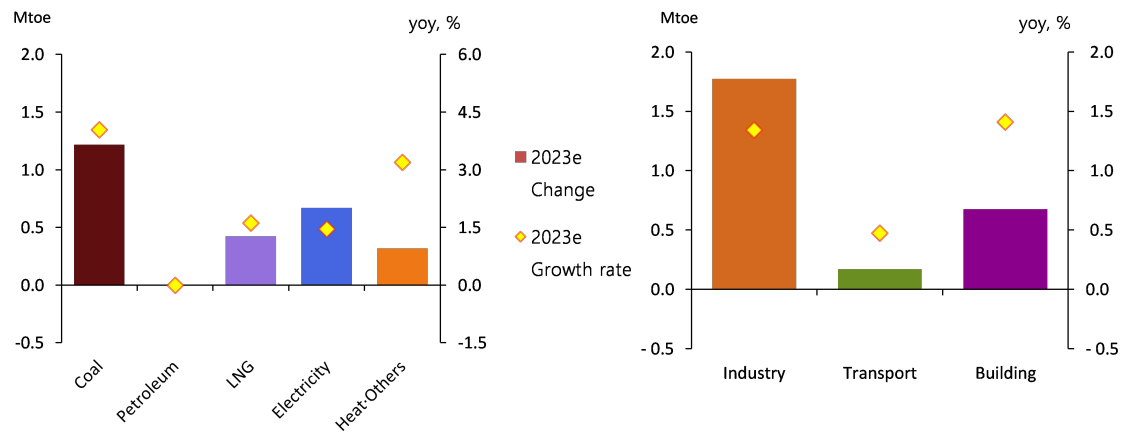

Final energy consumption is expected to increase by 0.8% y/y, with all sectors reversing the previous year's decline to increase.

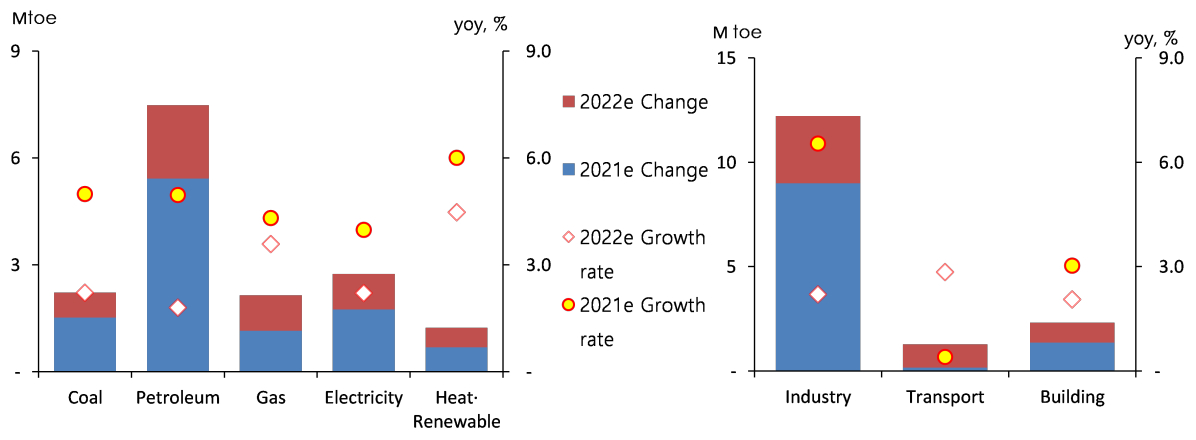

In the industrial sector, energy demand is forecast to increase by 0.7% y/y, driven by a slow recovery in petrochemicals and steel, but rebounding in feedstock due to the base effect of the previous year's decline.

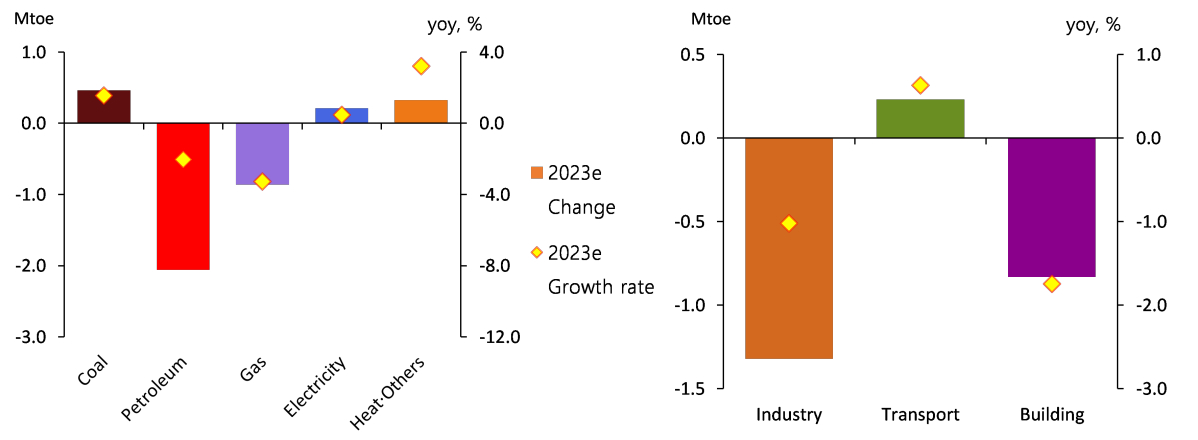

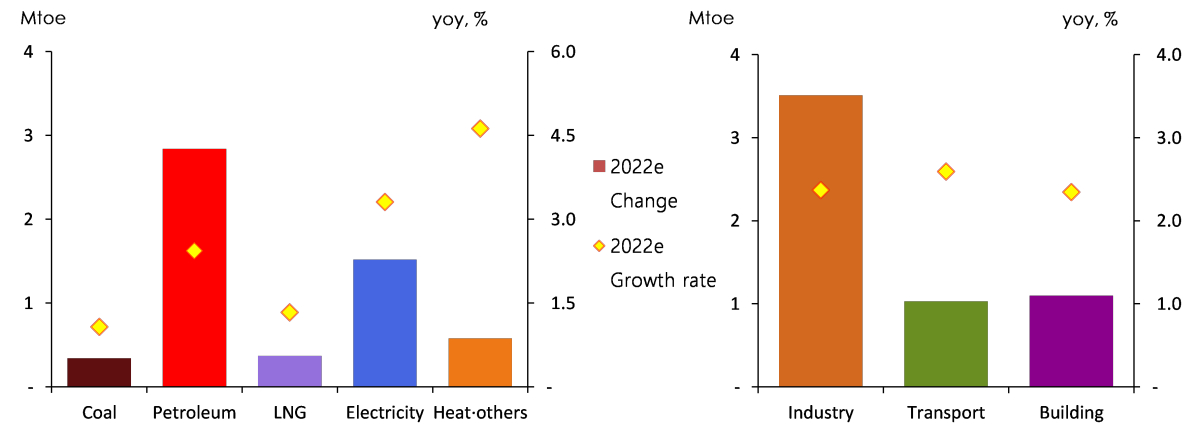

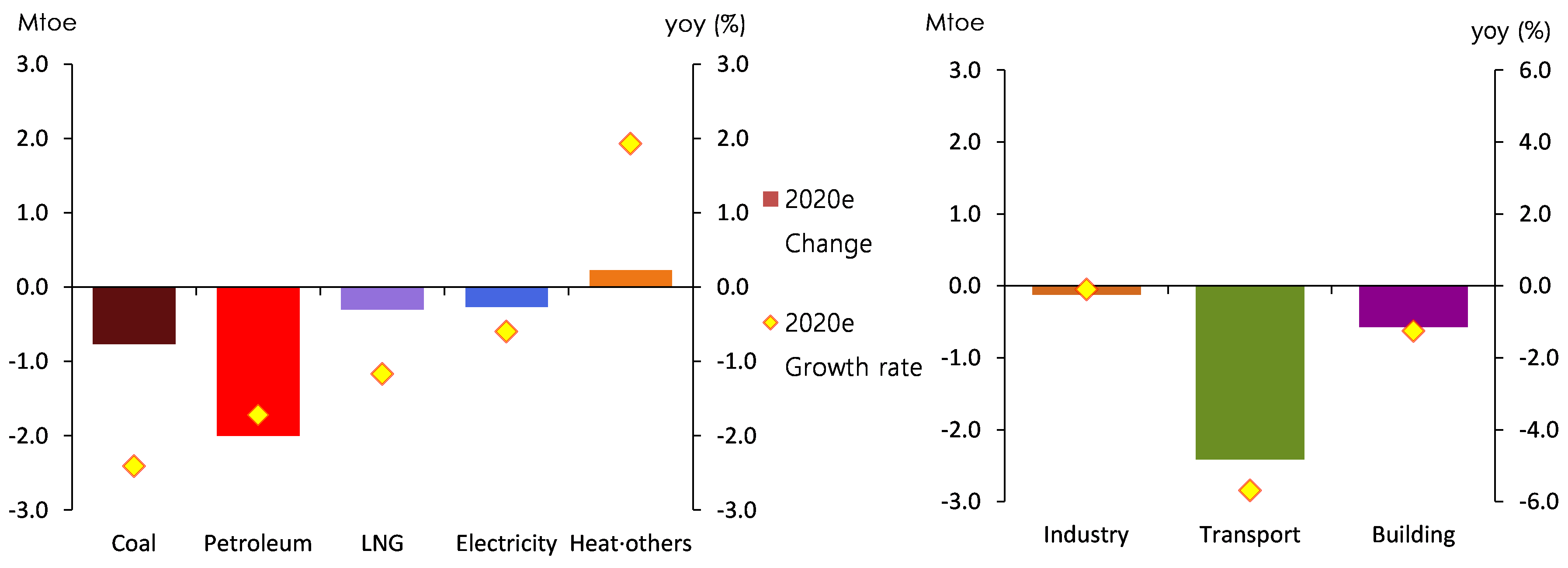

The change and growth rate of TFC by energy source and end-use sector

Transportation sector energy demand is forecast to increase 1.3% year-over-year, with gasoline growth sustained by higher passenger travel demand, and diesel demand rebounding as freight volumes recover partially.

Energy demand in the buildings sector is forecast to increase slightly (0.6%) year-over-year, despite a decline in heating and cooling degree-days, due to a base effect from the previous year's rapid decline (-3.2%).

Key Features and Implications

The impact of China's petrochemical industry self-sufficiency improvement

The petrochemical industry is showing signs of improvement, led by exports, amid weak domestic demand, but the outlook is negative.

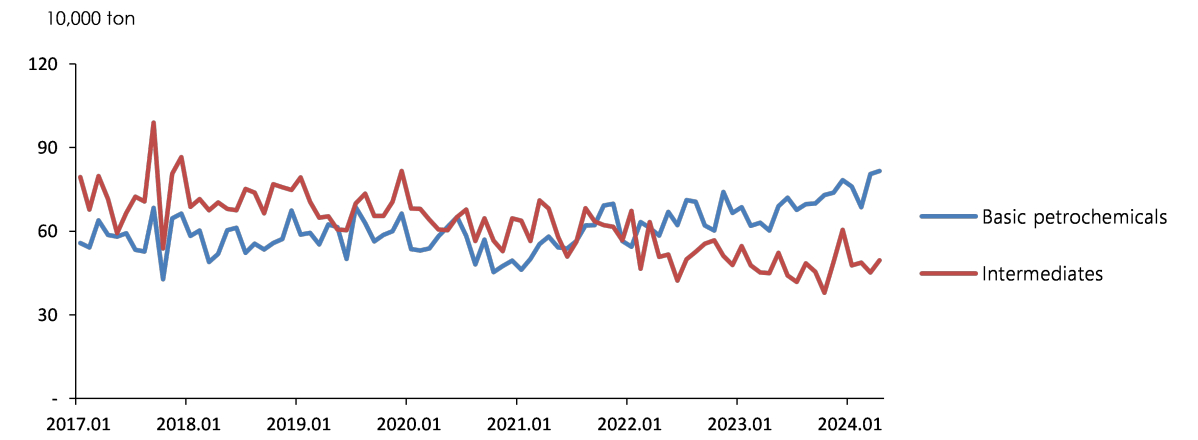

In 2023, basic petrochemicals production decreased by 5.2% y-o-y, due to the downturn in the petrochemical industry that started in the second half of 2022, but increased by 5.5% y-o-y in the first quarter of 2024. Intermediate product output is still on a declining trend.

Monthly exports of basic petrochemicals & intermediates

Source: Korea Petrochemical Industry Association

Korea's petrochemical exports are likely to continue to decline due to China's policy of increasing self-sufficiency in the petrochemical industry.

The Chinese government has significantly increased petrochemical capacity investment since 2019 to increase the self-sufficiency rate of the petrochemical industry, and the self-sufficiency rate of most basic petrochemicals and intermediates is expected to exceed 100% by 2025.

Exports to China, South Korea's largest importer of petrochemicals, are expected to continue to decline, resulting in only modest growth or stagnation in demand for naphtha and LPG, which are feedstocks for the petrochemical industry.

Residential electricity demand and electricity bill burden in summer 2024 due to heat wave

Estimated that even a spike in electricity use for cooling in the worst heat wave would only increase electricity bills by about KRW 30,000.

To analyze changes in residential electricity consumption for summer temperature scenarios, we split residential electricity consumption into cooling and non-cooling consumption, using consumption in months when little cooling or heating occurs.

Summer(June-September) residential electricity consumption breakdown & Proportion of cooling load

.jpg)

Note: Estimated using methodology from Kim and Kang (2017); 2024 is a projection based on 10-year average cooling degree days.

Assuming average heat over the past decade, summer (June-September) residential electricity consumption in 2024 is estimated to increase by 1.8% year-on-year, with midsummer (July-August) electricity bills rising by KRW 9,000 per month for a two-person household.

Assuming a record-breaking heat wave, residential electricity consumption for the entire summer season (June-September) in 2024 is estimated to increase by 11.2% year-on-year, with midsummer electricity bills rising by KRW 26,000 per month year-on-year for a household of two.

Considering that electricity for cooling accounts for less than 25 percent of total summer electricity consumption, it is unlikely that a spike in electricity consumption for cooling during a heatwave would lead to a bill bubble.

Electric steelmaking industry and electricity demand

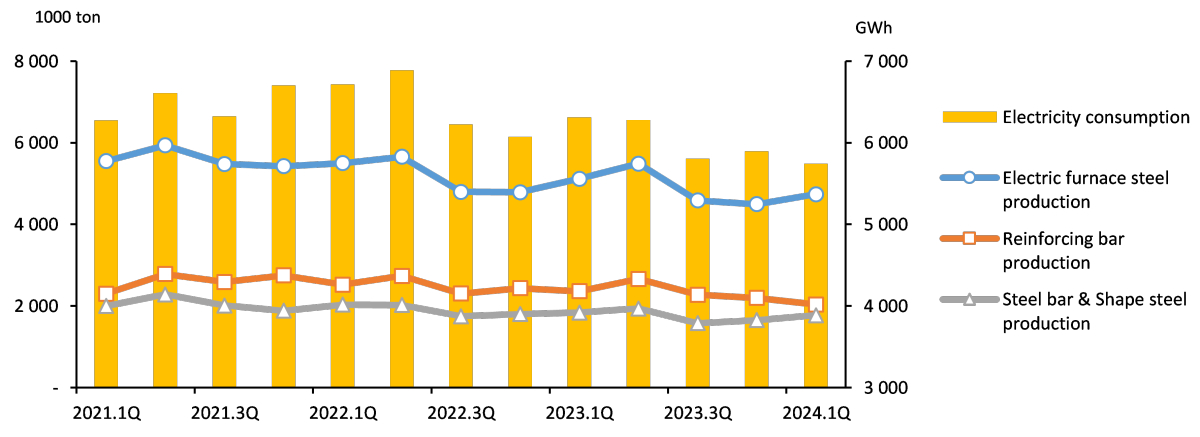

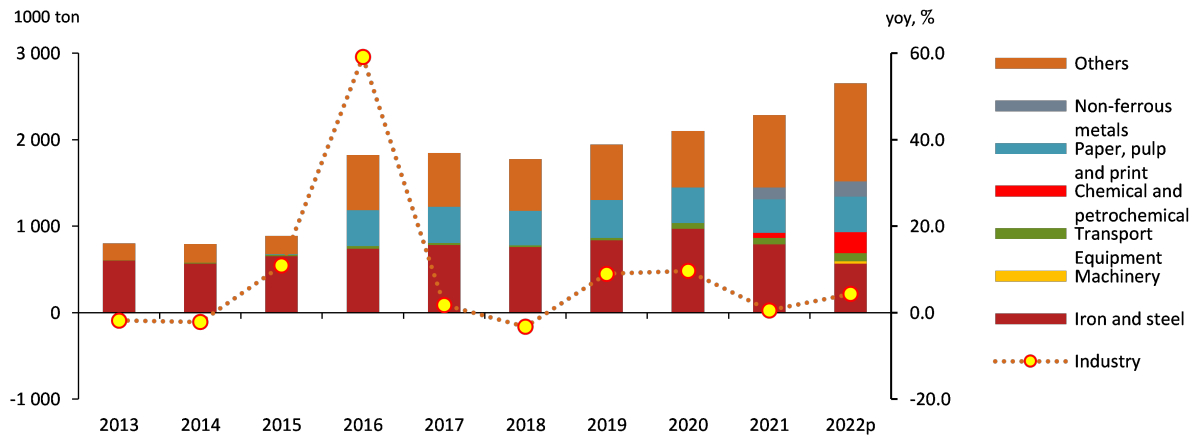

Production of electric furnace steel and construction steel products has been on a downward trend since 2022, reducing steel industry electricity consumption.

Production of electric furnace steel in the steel industry fell 5.1% y/y in 2023 to 19.68 million tons, the second consecutive year of decline after 2022 (-7.4%) and the first time it fell below 20 million tons since 2010, when the relevant statistics began to be compiled. Production in the first quarter of 2024 continued to decline, down 7.4% y/y.

Production of major steel products in electric furnaces & Steel industry electricity consumption trends

Source: Korea Iron & Steel Association

The decrease in production of electric furnace steel and steel products for construction was attributed to the excess supply of key steel products due to the slowdown in Korea's construction industry and China's economic slowdown.

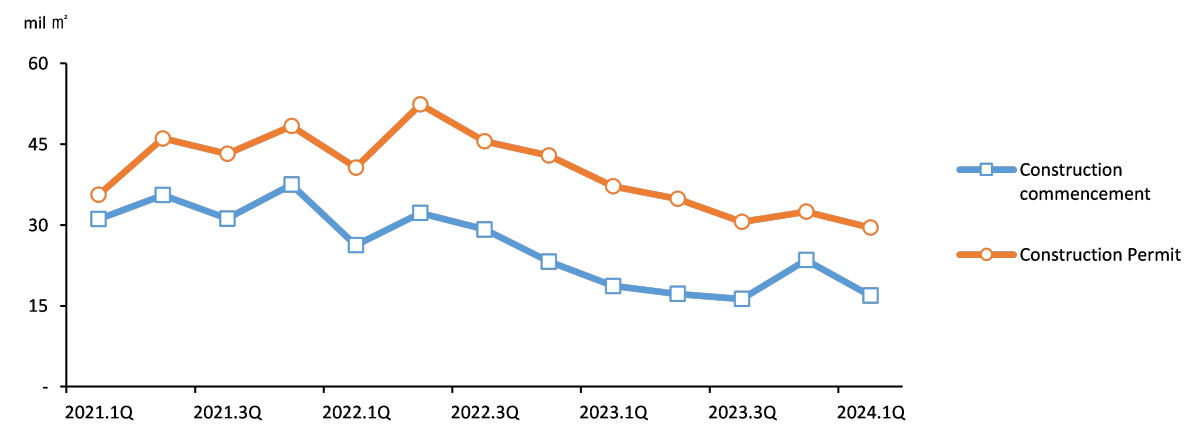

Construction commencement and construction permit trends

Source: Ministry of Land, Infrastructure, and Transport

Electricity consumption in the steel industry is expected to continue to decline in 2024 due to the contraction of electric furnace steel production due to the construction slowdown.

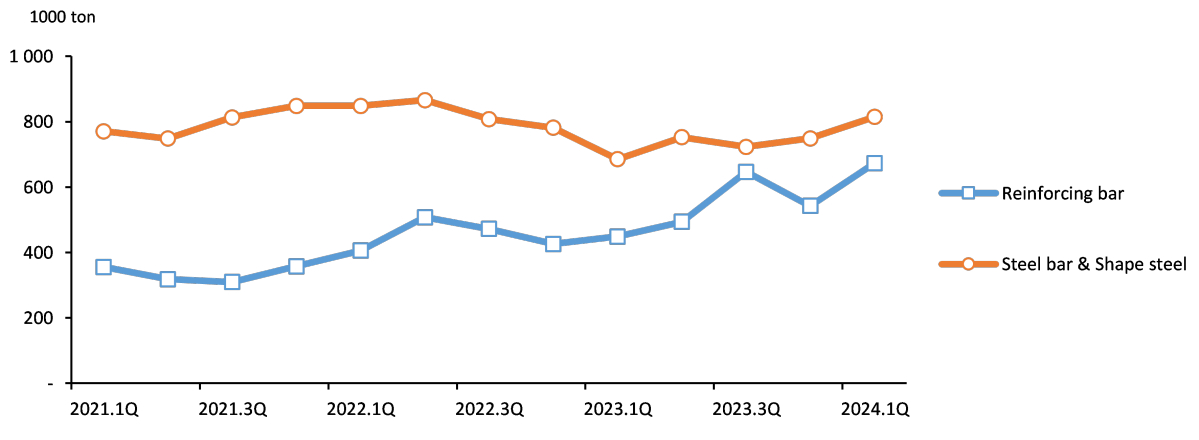

Inventories of rebar, a representative steel product, increased by 19.1% and 27.2% in 2022 and 2023, respectively, and surged by 49.9% year-on-year in the first quarter of 2024 (18.9% for steel bar and shape steel) due to sluggish demand for construction steel products and excess supply due to the construction slowdown.[1]

Rebar and steel bar & shape steel inventory trends

Source: Korea Iron & Steel Association

Major electric blast furnace steel producers such as Hyundai Steel and Dongkuk Steel are planning to cut production in 2024 to counter rising inventories.

Electricity consumption in the steel and non-ferrous metals industry is expected to decline by nearly 4 percent in 2024 as the downturn in the construction industry continues, leading to a decline in demand for steel products produced from electric furnace steel, such as rebar, steel bar & shape steel, and rising inventories, leading to production cuts in electric furnace steel.

[1] The distribution price of rebar reportedly fell from KRW 100.2 million per ton in December 2023 to KRW 70.5 million per ton in May 2024 due to an increase in rebar inventories (The Korea Economic Daily 2024.6.12.)

Attachments-

2024_단기(상)_표지.jpg

Download

2024_단기(상)_표지.jpg

Download

-

Korea_Energy_Outlook_2024H1.pdf

Download

View Details

Korea_Energy_Outlook_2024H1.pdf

Download

View Details

-

2024 Energy Demand Outlook (2023, Second Half)

- Date2024/01/10

- Author Department of Energy Outlook Research

- Number of downloads 29

-

Download multiple files Download the entire file

Total Primary Energy Demand and Total Final Consumption

Total Primary Energy Demand (TPED) fell by 4.0% year-on-year in 1H 2023 due to weak manufacturing activity amid the economic slowdown.

The domestic and global economic downturns that started since 2H 2022 and a consequent drop in industrial production were exacerbated in 1H 2023, and accordingly, the downward trend in energy consumption was accelerated.

Growth rate of GDP and TPED, production index

Petroleum, coal, and natural gas use fell sharply, while the use of nuclear energy remained flat, and renewable & other energy use slightly increased.

Petroleum use dropped by 5.2% year-on-year, as its industrial use plunged due to a sharp drop in petrochemical production, although it slightly increased in the transport sector.

Coal use went down by 6.3% year-on-year, as it dropped fast in the power generation sector due to transmission constraints, and it also declined in the industrial sector owing to the decreased production.

Growth rate of TPED & contributions by sources

Natural gas use fell by 6.8% year-on-year, as it declined in the power generation and end-use sectors.

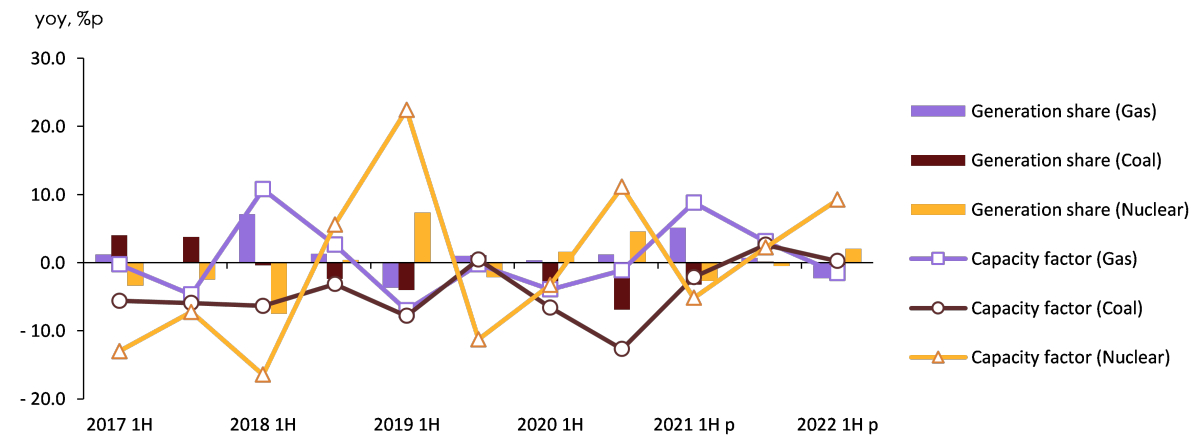

Nuclear power generation was flat on a year-on-year basis, even though the installed capacity was up 6.0% with the commissioning of a new large-scale reactor, as its capacity factor dropped by almost 5%p.

Renewable & other energy use increased (3.8%), mostly in the power generation sector, although the growth was much slower.

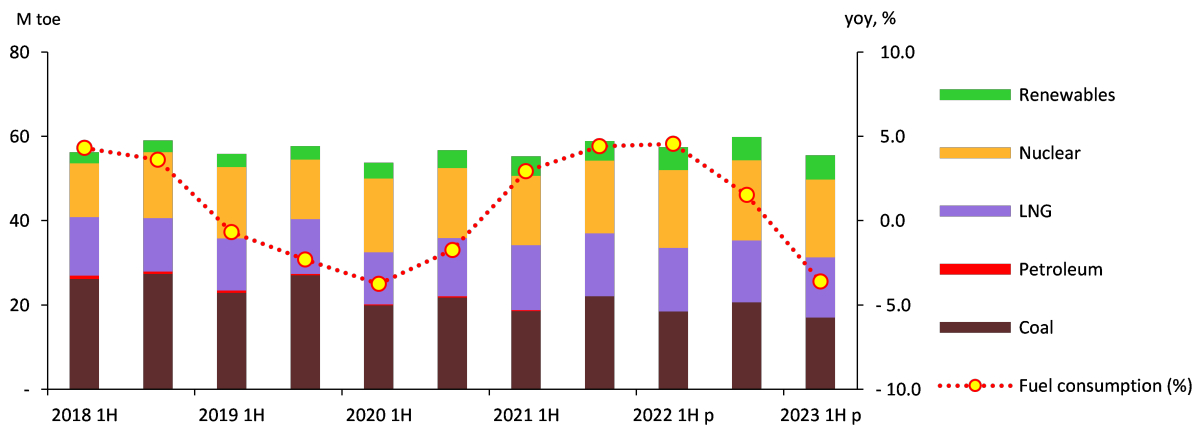

Growth rate of fuel consumption at power plants & fuel consumption trend by sources

Note: Capacity factor is the ratio of actual power generation to power generation when the facility is operated at full capacity

The final use of electricity was down 0.6% year-on-year, as its industrial use declined owing to the sluggish manufacturing activity, increased captive generation and decreased number of heating degree days, and as it grew more slowly in the building sector.

Total Final Consumption (TFC) fell by 4.6% year-on-year, as energy use plunged in the industrial and building sectors, although it increased in the transport sector.

Industrial energy use fell by 6.1% year-on-year, as it dropped rapidly in the petrochemical sector that accounts for a large share of the total industrial energy use amid an overall slowdown in manufacturing activity.

Transport energy use went up by 1.0% year-on-year, despite the overall economic slowdown, partly because domestic fuel prices declined including gasoline and diesel amid a downward trend in global oil prices.

Growth rate of TFC & contribution by sectors

Note: Building sector includes residential, commercial, public-etc usage.

In the building sector, energy use decreased by 4.3% year-on-year, as the number of heating degree days decreased, and the heating cost crisis emerged as a social issue following the city gas rate increase at the beginning of the year.

TPED & TFC Outlook

TPED is expected to drop by 2.2% in 2023, and then grow by 2.0% in 2024, reaching 305.4 Mtoe.

While TPED is expected to drop in 2023, mostly in the industrial sector due to sluggish manufacturing activity, a rebound is expected in 2024, despite weak domestic demand, as production activity picks up amid growing exports.

Growth rate of GDP, TPED and TFC, trend and outlook

In 2023, the energy intensity will rapidly improve (decline), despite the economic growth (1.4%), as energy consumption declines. In 2024, however, it is expected to improve at much slower pace, as the manufacturing sector that is highly energy intensive leads the economic recovery.

Energy intensity and EI recovery trends

Note: Energy Intensity is calculated as the value of 'TPED/GDP', expressed in toe/million won, EI recovery rate multiplies EI increase rate by '-1'.

In 2023, coal, petroleum, and gas are expected to lead the downward trend in energy use. In 2024, the use of all energy sources is forecast to increase except coal.

Petroleum demand is forecast to drop by 3.6% in 2023, especially for industrial feedstock use, while it is expected to grow by 1.7% in 2024, as overall manufacturing activity picks up, and the petrochemical industry recovers to some extent.

Coal demand is forecast to drop by 4.8% in 2023, with the industrial and power generation sectors leading the downward trend. In 2024, it is expected to fall by 2.3%, although it continues to decline in the power generation sector, as industrial coal demand rebounds due to the base effect of the recent downward slide.

Nuclear generation is expected to grow by 2.7% in 2023 and 5.4% in 2024, affected by the deployment of large-scale reactors.

Natural gas demand is forecast to drop by 3.8% in 2023, as it declines in the power generation and end-use sectors all together, and then grow by 5.4% in 2024, with the demand bouncing back in each sector.

Growth rate of TPED & contributions by sources

Electricity demand in the end-use sectors is expected to be flat in 2023 compared to the previous year. In 2024, it is likely to grow by 1.7% due to a recovery in the manufacturing sector.

Energy demand in the end-use sectors is forecast to decrease by 3.0% in 2023, and then increase by 1.9% in 2024.

In the industrial sector, energy demand is expected to decline by 3.4% in 2023 due to the slump in the petrochemical industry, which accounts for a large share of the total industrial energy use, while the demand is forecast to increase by 2.3% in 2024, owing to base effect and a recovery in production activity amid growing exports.

Change and growth rate of TFC by energy sources and end-use sectors

In the transport sector, energy demand is forecast to decrease by 1.8% in 2023, driven by lower energy demand for cargo transport, but the demand growth of 0.5% is expected in 2024, as the economy recovers to some degree.

In the building sector, energy demand is projected to drop by 2.6% in 2023 due to the decreased number of heating degree days and higher energy prices, while it is forecast to increase by 1.8% in 2024 partly due to base effect and the increased number of heating degree days.

Key Features and Implications

Outlook of petrochemical industry

Demand for petroleum products that are used as petrochemical feedstock decreased owing to the petrochemical industry's deepening slump, which started in 2H 2022, and weak production.

Since 2H 2022, domestic production of petrochemical products declined, which was affected by the global economic slowdown and China's enhanced self-reliance in producing petrochemical products.

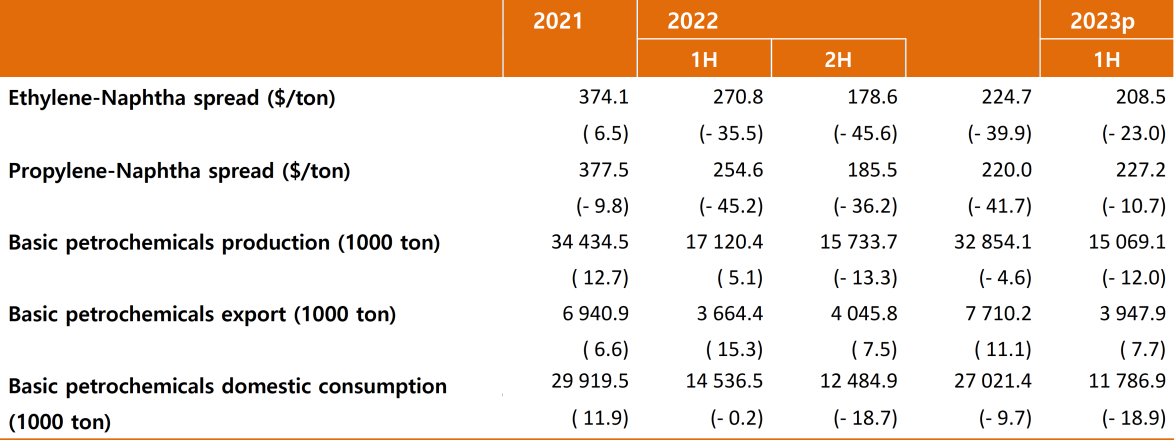

Key petrochemical indicators

Note: The numbers in parentheses indicate the rate of change compared to the previous year

Source: Korea Petrochemical Industry Association

Although the recovery of the petrochemical industry has been delayed, the industry is widely expected to pick up by the second half of 2024.

Until 1H 2023, the prevailing expectation was that the petrochemical industry would recover in the second half of the year. However, the recovery has been continuously delayed, as the oversupply issue of petrochemical products continued in the international market.

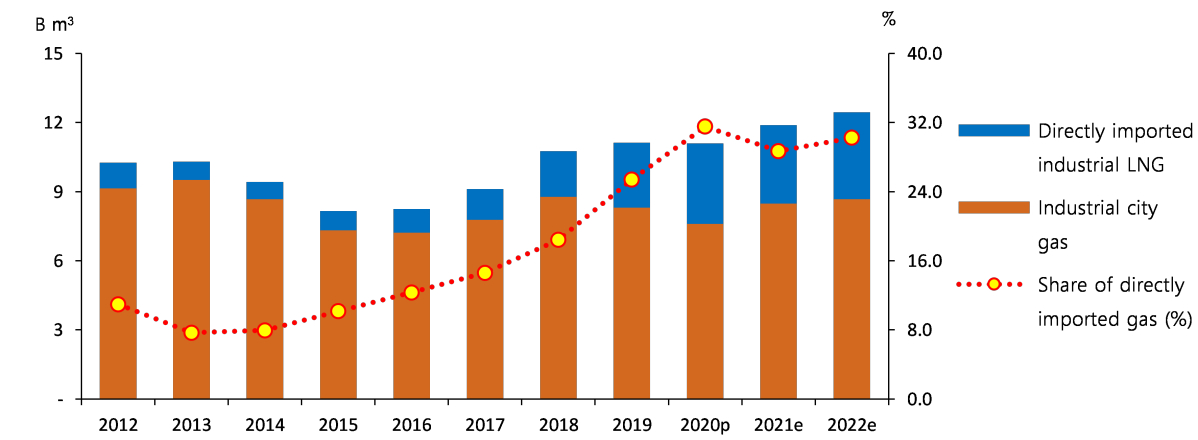

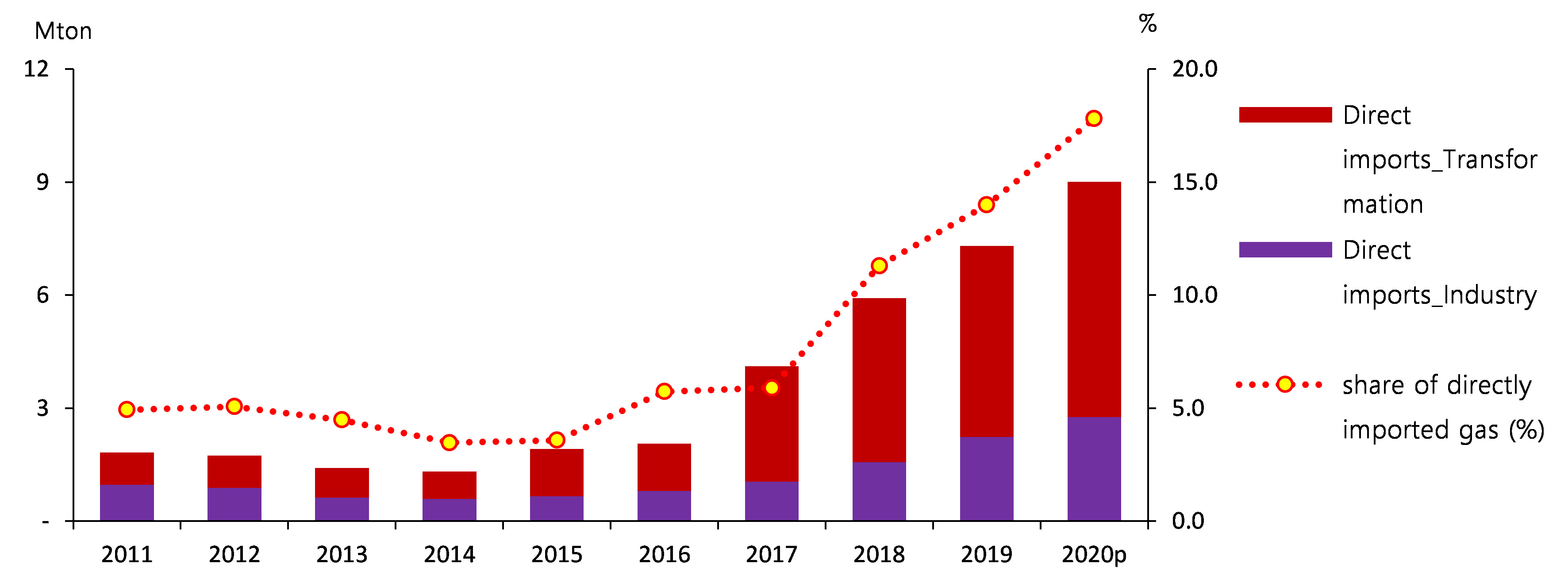

Industrial natural gas demand

Natural gas consumption by industrial sectors & consumption growth trend

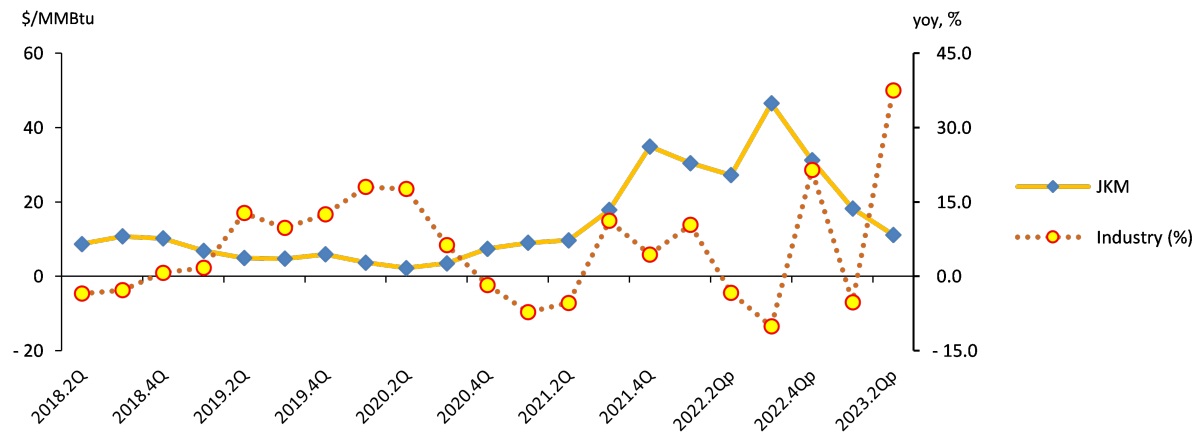

Industrial natural gas use that has been stagnant due to soaring global natural gas prices is expected to grow rapidly again during the outlook period.

Industrial natural gas use had rapidly increased for the past few years, as growing number of sectors used more natural gas for captive power generation, which uses directly imported natural gas, and for combined heat and power generation in industrial sites.

Global natural gas prices & growth rates in industrial natural gas use

Industrial natural gas demand is expected to grow fast during the outlook period. Still, global prices could possibly cause a large change in natural gas demand.

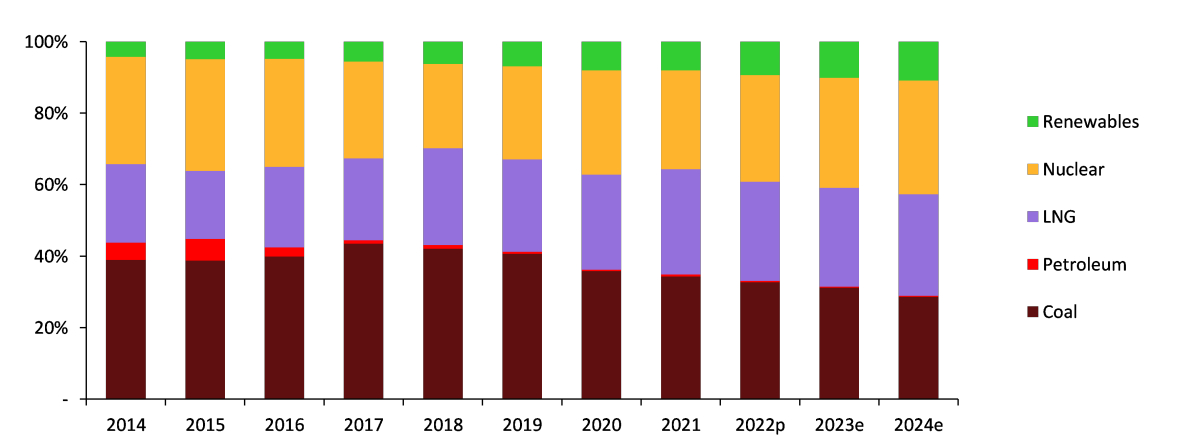

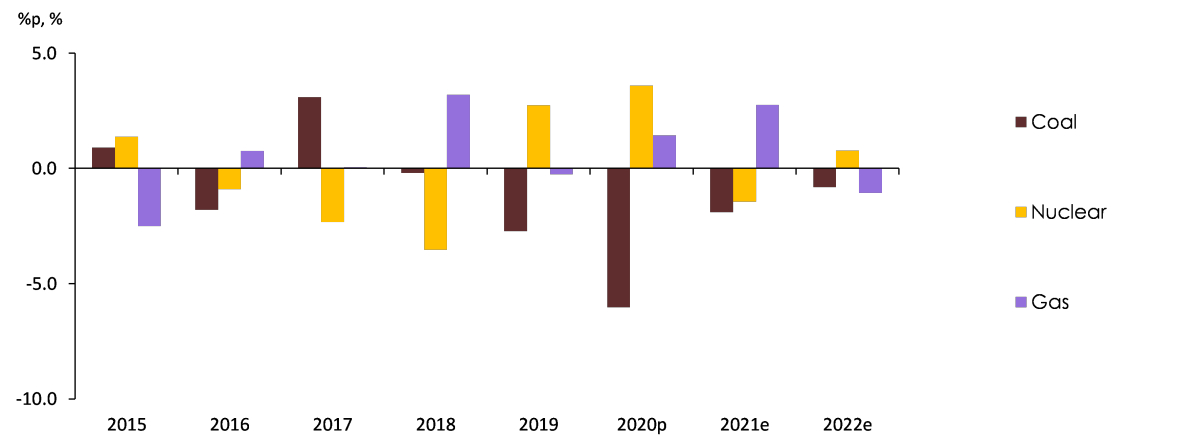

Changes in the energy mix

In 2024, nuclear generation is expected to regain the dominant position in the energy mix, as nuclear generation's share surpasses that of coal-fired generation for the first time since 2007.

The share of nuclear, renewable & other, and gas-fired generation is expected to increase, while that of coal-fired generation is expected to drop fast.

Changes in the energy mix by energy sources

Nuclear generation's share of the energy mix will rapidly increase during the outlook period, and the increased installed capacity will be the main contributing factor.

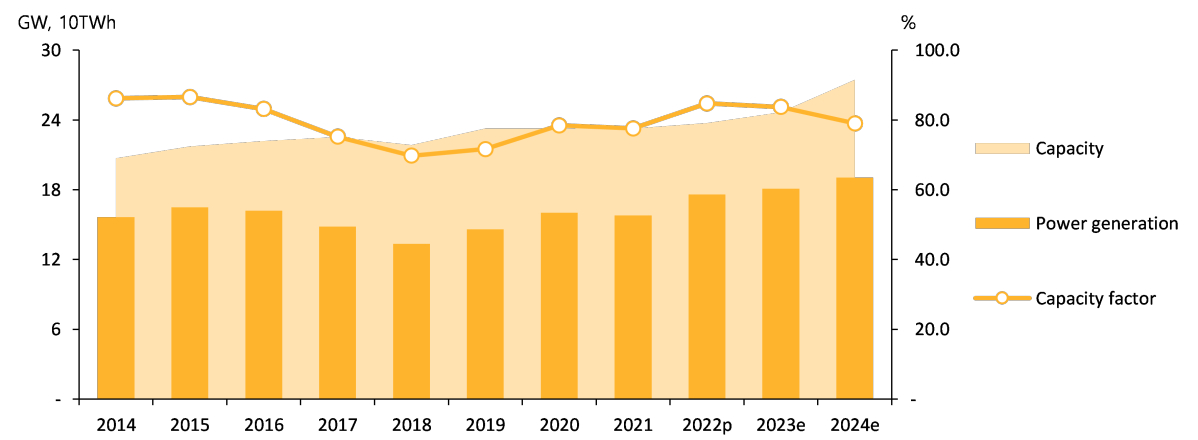

Nuclear installed capacity, capacity factor & power generation trends

Previously, the drop in coal-fired generation's share was largely attributed to the government's fine dust and greenhouse gas emissions reduction policy. Since 2022, however, the transmission constraint issue is considered to have a larger impact.

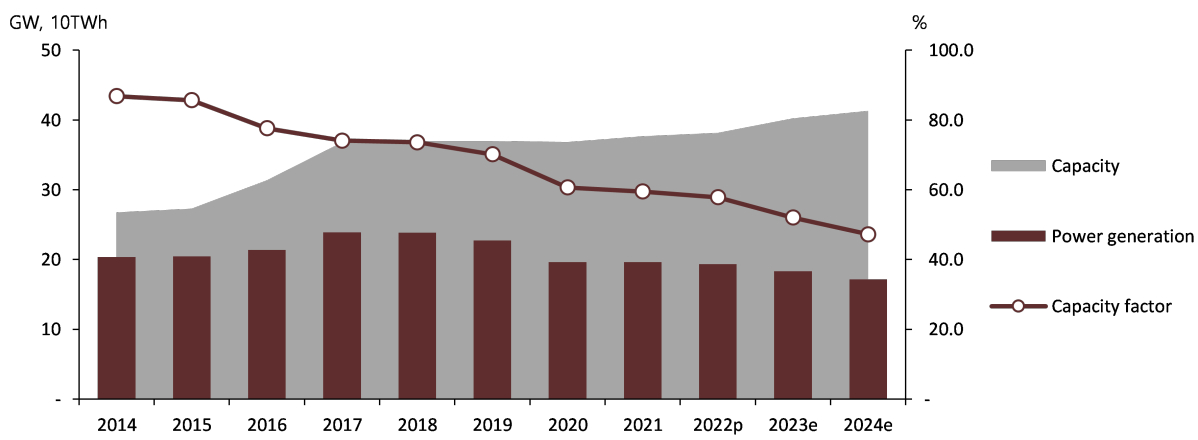

Coal installed capacity, capacity factor & power generation trends

Attachments

Attachments-

단기(하)_표지.jpg

Download

단기(하)_표지.jpg

Download

-

KoreaEnergyOutlook_2023H2_SecondHalf.pdf

Download

View Details

KoreaEnergyOutlook_2023H2_SecondHalf.pdf

Download

View Details

-

2023 Energy Demand Outlook (2023, First Half)

- Date2023/07/07

- Author Department of Energy Outlook Research

- Number of downloads 19

-

Download multiple files Download the entire file

Total Primary Energy Demand and Total Final Consumption

In 2022, Total Primary Energy Demand (TPED) dropped by 0.4% year-on-year to 302.0 Mtoe due to a slowdown in manufacturing production.

In the first half of 2022, energy use increased, driven by enhanced production activities in the mining & manufacturing sector. In the second half, however, energy use decreased as a result of sluggish production in the mining & manufacturing sector with the slowdown in global growth.

By energy sources, the use of nuclear energy and renewable & other energy grew by 11.4% and 11.2% year-on-year, while the use of fossil fuels such as coal, petroleum and gas fell by 5.3%, 1.9% and 1.2% respectively, and accordingly, greenhouse gas emissions are estimated to have declined than the previous year.[1]

The growth rates of GDP and TPED, production index

Note: Production indexes show year-on-year differences.

Gross Domestic Product (GDP) grew by 2.6% owing to a decent growth in production activities in the service industry that accounts for a large share of the total added values, while TPED decreased. As a result, energy intensity (toe/million won) improved(declined) by 2.9%.

In 2022, nuclear and renewable & other energy use increased, while the use of coal, petroleum and gas declined than the previous year.

Coal use fell by 5.0% year-on-year, as it declined in the power generation sector, affected by constraints on transmission lines, and its industrial use plunged, especially coking coal, due to a production loss in the iron & steel sector in the aftermath of a typhoon.

Petroleum use dropped by 1.9% year-on-year, as its use as feedstocks declined in the petrochemical sector, which takes up a large share of the total industrial petroleum use, and as it also declined in the transport sector amid falling demand for diesel in the road transport sector.

The growth rates of TPED & contributions by sources

Natural gas use slid by 1.1% year-on-year, with the power generation sector leading the downward trend, although its final use increased, especially in the building sector.

The total nuclear generation posted a year-on-year growth of 11.4% as a result of the growth in capacity factor and installed capacity. Renewable & other energy use was up 11.2%, led by the power generation sector.

The growth rates of energy use by major energy sources

Note: Capacity factor is the ratio of the electrical energy produced to the electrical energy that could have been produced at continuous full power operation.

Meanwhile, electricity use grew by 2.7% year-on-year, as it continued to grow rapidly in the building sector, although electricity use in the industry grew at slower pace mostly in the 2nd half of the year.

In 2022, Total Final Consumption (TFC) dropped by 1.1% year-on-year, as it declined in the industrial sector, which accounts for a large share of TFC, although the building sector consumed more energy.

Industrial energy use went down by 2.7% year-on-year due to weak production activities in the midst of the global economic downturn and lower iron & steel production, which was hit by a typhoon.

In the transport sector, energy use fell by 0.6%, mostly in the road transport sector, affected by high petroleum product prices, even though mobility demand increased following the termination of social distancing restrictions since April.

The growth rates of TFC by end-use sectors

Note: The Building sector includes residential, commercial and public-etc usage.

Energy use in buildings went up by 3.3%, with the commercial sector leading the growth by much stronger service production, and it was also affected by the increased number of cooling & heating degree days.

TPED & TFC Outlook

In 2023, TPED is expected to drop by 0.7% year-on-year to 299.8Mtoe.

TPED rapidly recovered from Covid-19 lows and peaked at 303.3 Mtoe in 2021. However, it is expected to decline for the second consecutive year partly due to a slowdown in economic growth.

The growth rates of GDP, TPED and TFC, trend and outlook

The total energy demand is likely to decline, led by fossil fuels including coal, petroleum and gas, while demand for zero emissions sources such as nuclear and renewable energy increases. As a result, national greenhouse gas emissions are expected to decline.

The energy intensity (toe/million won) is forecast to improve(decline) rapidly for the 2nd consecutive year in 2023, as GDP grows by 1.4%, while TPED decreases.

Energy Intensity and EI Recovery Trends

Note: Energy Intensity is calculated as the value of 'TPED/GDP', expressed in toe/million won, EI recovery rate multiplies EI increase rate by '-1'.

While the demand for nuclear and renewable energy is expected to increase, fossil fuels such as coal, petroleum and gas are likely to lead the downward slide in energy demand.

Coal demand is projected to drop by 2.5% year-on-year, as it declines in the power generation sector due to power grid constraints, although its industrial demand is expected to grow compared to the previous year with the iron & steel production returning to normal operations.

Petroleum demand is forecast to decrease by 1.8% year-on-year despite slightly increasing demand in the transport sector, as its industrial demand decreases, especially for use as petrochemical feedstocks.

Natural gas demand is expected to drop by 0.8% year-on-year, although it slightly increases in the power generation sector, as city gas demand decreases, mostly in the building sector.

The growth rate of TPED & contributions by sources

Nuclear generation is expected to grow by 2.6% as a result of the commissioning of a new reactor and increased capacity factors. Renewable & other energy generation is also forecast to grow by 10.3% due to a steady increase in installations.

Electricity demand is likely to grow by mere 0.5% year-on-year in the end-use sectors, as the demand remains flat in the industrial sector, while it declines in the residential sector, although it grows by more than 1% in the commercial sector.

TFC is projected to drop by 0.9% year-on-year (in 2023), with the industrial and building sectors leading the downward slide, though transport energy use is expected to increase.

Industrial energy demand is expected to drop by 1.0% amid the overall slowdown in production activities, as especially demand for LPG and naphtha-petrochemical feedstocks that takes up a large share of the industrial energy demand-is expected to rapidly decline.

The change and growth rate of TFC by energy sources and end-use sectors

Transport energy demand is expected to grow by 0.6% year-on-year, affected by stable fuel prices and growing mobility demand.

Energy demand in buildings is projected to decline by 1.7% year-on-year, as consumer sentiment slides due to higher energy rates, and the number of cooling & heating degree days decreases.

Key Features and Implications

In 2023, energy use is predicted to decline, largely driven by a drop in energy use as petrochemical feedstocks as well as lower energy demand in the building sector.

In 2023, the industrial sector is expected to make the largest contribution to the decline in energy use, and by the types of industries, it will be affected most by lower feedstock energy use in the petrochemical sector, which accounts for a large share of the total industrial energy use.

In the building sector, energy use is expected to plunge due to weak consumer sentiment that was hit by the heating cost crisis at the beginning of the year and price & temperature effect, which will be the main factor of a decline in the total energy demand.

In the power generation sector, the total generation will decrease to the pre-2010 level, as coal-fired power generation steadily declines due to transmission constraints, while the power generation from nuclear and renewable energy increases.

This section explains key features of the outlook, listed above.

Demand for petroleum products used as petrochemical feedstocks

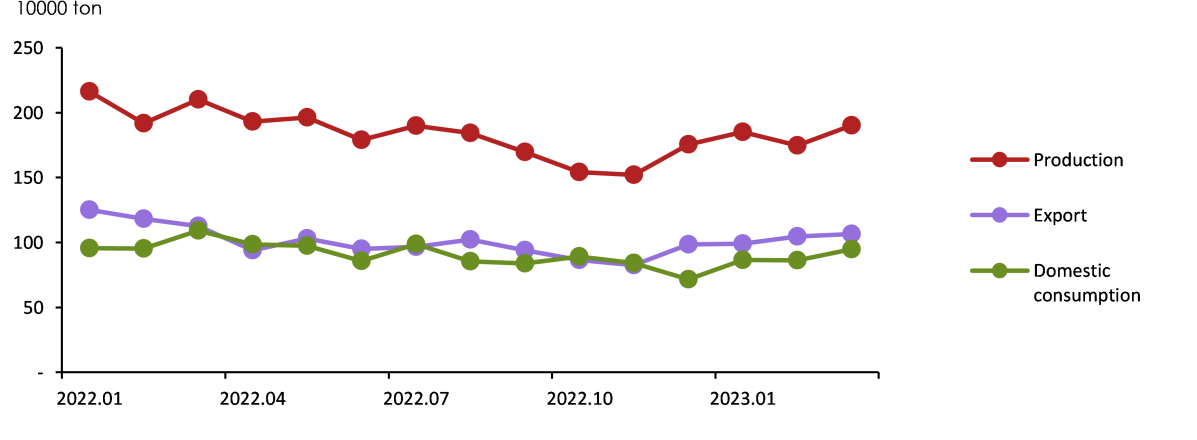

Since the 2nd half of 2022, petrochemical production declined, as its exports and domestic demand decreased amid the global economic slowdown.

During the covid-19 pandemic (2021-1st half of 2022), domestic production of petrochemical products was solid in line with growing demand. Since the 2nd half of 2022, however, production declined amid the global economic downturn and weak demand from China.

Production, export and domestic consumption of three major petrochemical products

Note: The three major petrochemical products are synthetic resin, synthetic fiber raw materials and synthetic rubber.

Source: Korea Petrochemical Industry Association, Statistics on production & sales (2023.6.19)

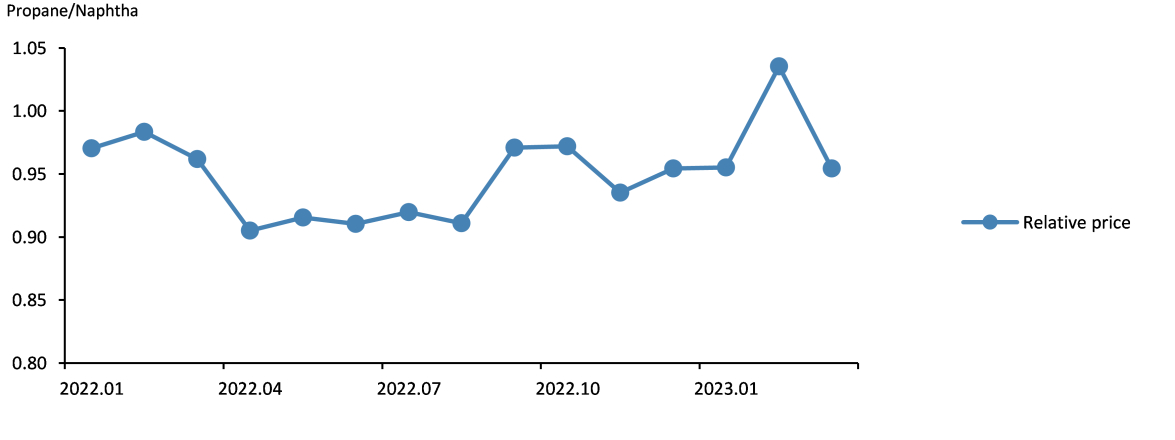

In the petrochemical sector, demand for petroleum products used as feedstocks such as naphtha and LPG dropped fast due to weak production.

The use of naphtha and LPG, which are petrochemical feedstocks, decreased by 7.6% year-on-year in the first quarter of 2023.

Relative price of propane in terms of naphtha (major petrochemical feedstocks)

Note: It is the price of propane when naphtha price is assumed to be 1 (based on weight).

Source: Korea International Trade Association, data on volume and value of import (2023.6.19)

While demand for petroleum products used as petrochemical feedstocks declined amid a drop in petrochemical production, LPG demand dropped faster compared to naphtha due to a surge in LPG Contract Price (CP), which is the global price benchmark.

Heating cost crisis and buildings' energy demand

Heat Wave Scenario

The heating cost crisis, which occurred early this year, raised consumers' sensitivity to energy costs in the building sector, contributing to the decline in energy demand.

Domestic energy prices increased amid the global energy price hikes last winter, and the number of heating degree days drastically increased in December. Consequently, a steep rise in heating costs emerged as a social issue.

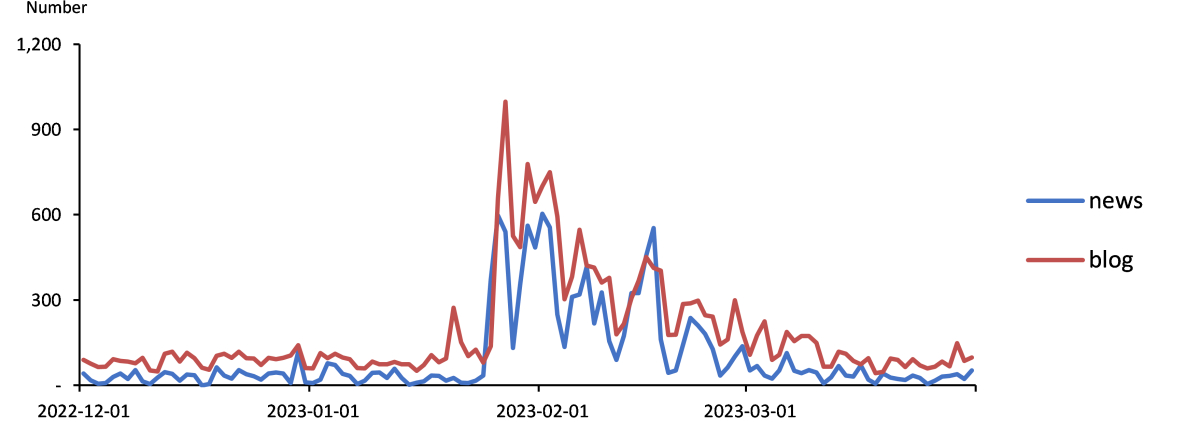

The number of times "heating cost" appeared on the internet news sites and blogs, 2022.12.1-2023.3.31

Source: The graph was drawn by the author of this report using the data derived from keywords trend analysis of big data platform, owned by National Research Council for Economics, Humanities and Social Sciences (https://www.nrcdata.re.kr/nrc/usr/main.do).

As heating cost crisis emerges as a social issue, general households and small business owners' sentiment for energy use fell sharply, and most of the energy rates including electricity, city gas and heat energy increased from the previous year, which will lead to a decline in buildings' energy demand.

In addition to higher energy rates, the number of cooling & heating degree days, which is the most important factor of the growth and decline in buildings' energy use, drastically decreased, and these factors are expected to accelerate the decline in buildings' energy demand.

In this outlook, energy use in buildings is projected to drop by 1.7% in 2023, contributing (-0.4%p) to the downward trend in TFC (-0.9%).

Transmission constraints and power generation mix

Coal-fired power generation is predicted to drop fast due to transmission constraints amid growing renewable and nuclear power generation.

Recently, new generation facilities have been rapidly increasing, while the construction of transmission infrastructure is being delayed partly due to a lack of consensus in local communities, exacerbating constraints on transmission lines connecting the east coast & Honam areas and the metropolitan area.

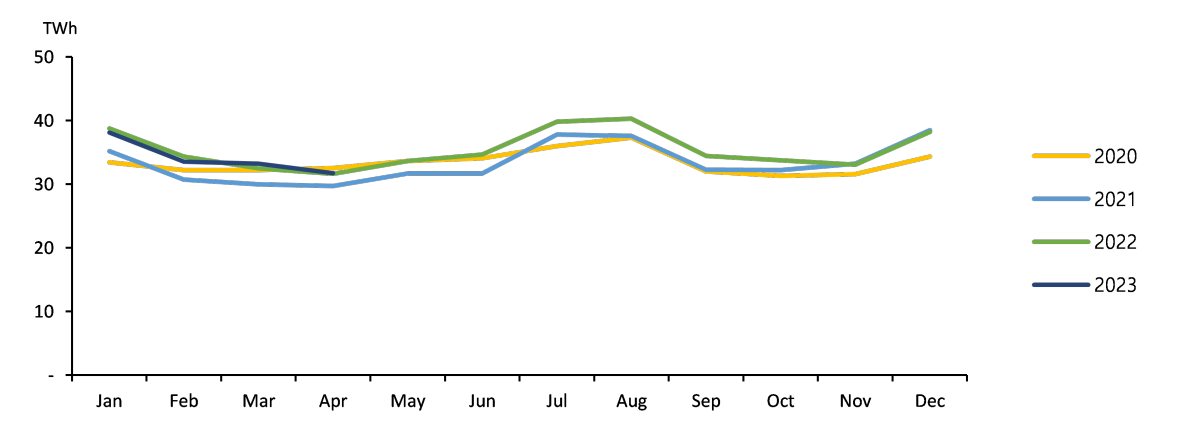

Monthly baseload generation trend since 2020 (including renewable energy)

Amid growing renewable and nuclear power generation, such transmission constraints are causing a drop in coal-fired power generation that is given a lower priority than renewable and nuclear energy when generating electrical power.

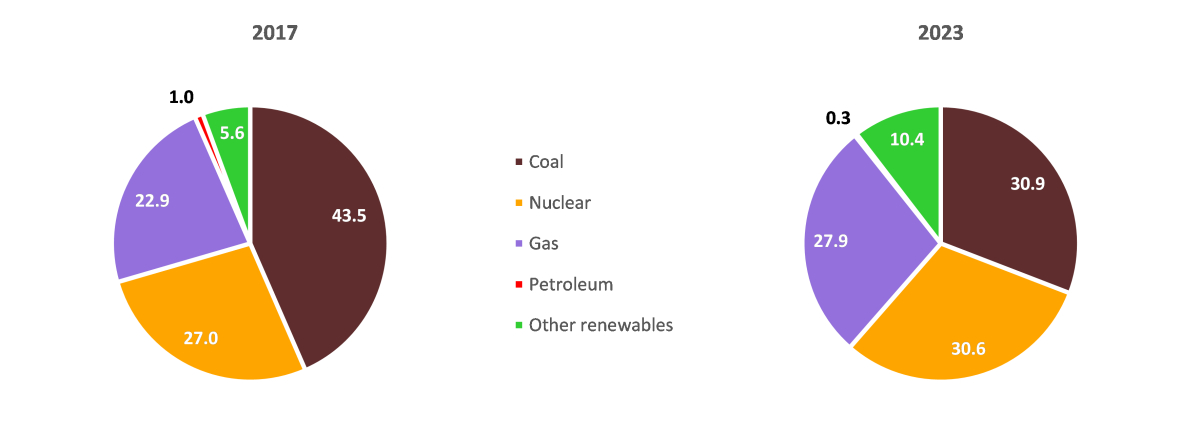

Comparison of power generation mix, 2017 vs 2023

Note: 2023's power generation mix by energy sources was compared with that of 2017 when coal accounted for the largest share of the total power generation during the past decade.

This outlook predicted power generation by energy sources, considering the fact that transmission infrastructure is the same as the previous year in 2023, and assuming this year's baseload generation (including nuclear energy) is at a level similar to 2022.

[1] The statistics on greenhouse gas emissions are published biennially, and the data of 2021 is the latest available statistics as of April 2023.

Attachments-

단기(상)_표지.jpg

Download

단기(상)_표지.jpg

Download

-

KoreaEnergyOutlook_2023H1_FirstHalf.pdf

Download

View Details

KoreaEnergyOutlook_2023H1_FirstHalf.pdf

Download

View Details

-

2023 Energy Demand Outlook (2022, Second Half)

- Date2023/01/31

- Author Energy Outlook Research Team

- Number of downloads 21

-

Download multiple files Download the entire file

Total Primary Energy Demand and Total Final Consumption

Total Primary Energy Demand (TPED) went up by 1.3% year-on-year in 1H 2022, as production activities continued to recover from COVID-19 disruptions to some extent.

Energy consumption grew, as production activities continued an uptrend in the manufacturing and service sectors following last year's recovery, though the pace of growth was limited by higher energy prices amid the Russia-Ukraine conflict.

Growth rate of GDP and TPED, production index

The use of nuclear energy surged, and that of petroleum and gas slightly increased, while coal and renewable & other energy use declined a bit.

Petroleum use grew by 1.2% year-on-year, led by the industrial sector, which accounts for a major portion of the total petroleum use, following the construction of additional petrochemical facilities, although it declined in the transport and building sectors due to higher prices.

Coal use fell by 1.4% year-on-year, as its industrial use declined, especially in the steelmaking sector, although it slightly increased in the power generation sector.

Growth rate of TPED & contributions by sources

Natural gas use rose by 0.3% year-on-year, as it grew decently in the city gas production sector, though it declined in the power generation sector owing to a surge in nuclear generation and soaring global natural gas prices.

The total nuclear generation was up 12.3% year-on-year, as the capacity factor went up by over 9%p compared to the same period last year, though the total installed capacity remained the same.

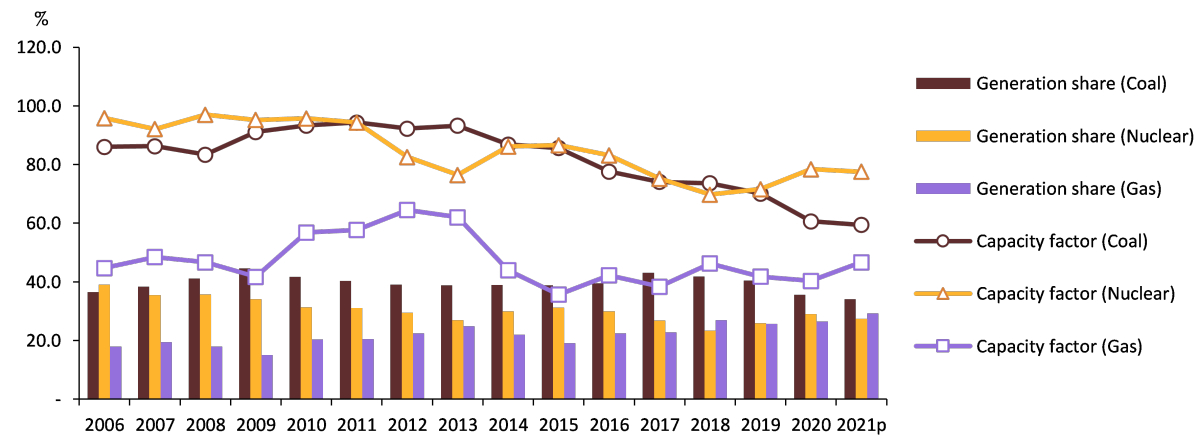

Capacity factor and Generation share of major sources<4 >

Note: Capacity factor is the ratio of actual power generation to power generation when the facility is operated 100%.

Meanwhile, the final electricity use posted a year-on-year growth of 3.9%, as production activities rapidly increased in the manufacturing and service sectors, and the number of heating degree days rose sharply, especially in the 1st quarter.

Total Final Consumption (TFC) increased by 1.2% year-on-year in 1H 2022, with the industrial and building sectors driving the growth, although it declined in the transport sector.

Industrial energy use grew by 1.7% year-on-year, as production activities grew quite strongly in the overall manufacturing sector in addition to a sharp increase in the use of petrochemical feedstock, which takes up a large part of the total industrial energy use.

Transport energy use dropped by 3.2% year-on-year, despite the termination of social distancing measures of COVID-19, because fuel prices increased such as gasoline and diesel.

Growth Rate of TFC & Contribution by Sector<4 >

Note: The building sector includes residential, commercial, public-etc usage.

Energy use in buildings posted a year-on-year growth of 3.2%, as it grew in both of the residential and commercial sectors amid the increased number of heating degree days and stronger service production as a result of the termination of all the social distancing rules.

TPED & TFC Outlook

TPED is expected to grow by 0.3% in 2022 and 1.3% in 2023, reaching 309.0 Mtoe.

In 2022, TPED is likely to grow much slowly compared to the economic growth rate due to disruptions to steel manufacturing in the aftermath of a typhoon, lower utilization rates at petrochemical facilities and a surge in energy prices. In 2023, however, TPED is expected to grow faster, as the contributing factors to the slower TPED growth in 2022 have less effect in 2023.

Growth rate of GDP, TPED and TFC, trend and outlook

The energy intensity (toe/million won) is expected to improve (drop) rapidly in 2022. In 2023, however, the rate of improvement will be much slower.

Energy Intensity and EI Recovery Trends

Note: Energy Intensity is calculated as the value of 'TPED/GDP', expressed in toe/million won, and EI recovery rate multiplies EI increase rate by '-1'.

In 2022 and 2023, nuclear and renewable & other energy are forecast to lead the growth in energy demand, while gas and petroleum demand steadily declines.

Petroleum demand is forecast to slightly decrease in 2022 and 2023, as petrochemical facilities operate at much lower utilization rates, although it is likely to increase until 1H 2022, led by the industrial sector.

Coal demand is projected to fall by 3.0% in 2022, mostly in the industrial sector, while it is expected to increase by around 2% in 2023.

Nuclear generation is forecast to grow by 14% in 2022 and 5% in 2023, the capacity factor and the total installed capacity increases.

The growth rate of TPED & contributions by sources

Natural gas demand is expected to fall for two consecutive years of the outlook period, as it declines in the power generation sector due to global natural gas price hikes and the construction of additional baseload power plants, driving natural gas demand down, and as city gas demand grows at slower pace.

The final electricity use is likely to grow fast until 2022, continuing the recovery from COVID-19 disruptions. Meanwhile, it is projected to grow in the mid 1% range in 2023, as production activities in industry slow down amid the domestic and global economic slump.

In the final consumption sector, energy demand is forecast to grow by 0.3% in 2022 and 1.2% in 2023.

In 2022, industrial energy demand is forecast to drop by 0.4% due to production delays in the iron & steel sector as a result of a typhoon and lower utilization rates at petrochemical facilities. In 2023, however, it is expected to rebound by low 1%, as production activities recover, especially in the second half of the year.

Change and Growth rate of TFC by energy sources and end-use sectors

Transport energy demand is projected to fall by 1.3% in 2022 partly due to higher petroleum products prices, while it is expected to bounce back a little in 2023, as prices decline, and mobility demand slowly recovers from COVID-19.

Energy demand in buildings is forecast to grow by 3.3% in 2022, affected by temperature conditions and the recovery of the service industry. In 2023, however, the demand growth is expected to slow down to the low 1% range partly due to a drop in the number of cooling & heating degree days.

Key Features and Implications

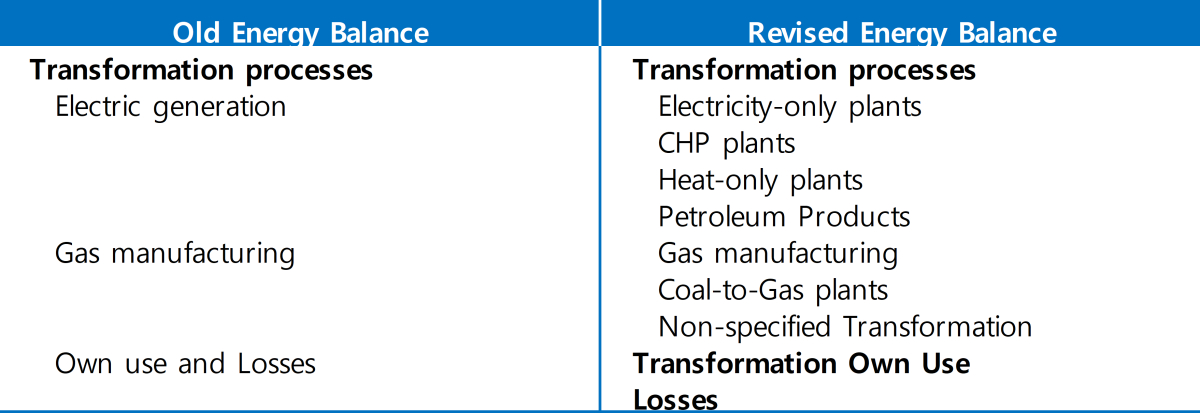

This is the first outlook report that was written based on the data from the revised Energy Balance.

The old Energy Balance had been in place since the 1980s, but it had its limitations in fully reflecting the current structure of energy consumption and supply. Accordingly, it went through years of updating process, and the revised Energy Balance was designated as the nationally authorized statistics in October 2022, replacing the old version.

This is the first outlook report that was produced based on the revised Energy Balance. This section briefly explains the difference between the old and revised Energy Balance and the noteworthy points in analyzing figures in this outlook report.

Transformation Processes

The transformation process refers to the production of secondary energy products (electricity, heat, city gas etc.) from the primary energy products (coal, natural gas, petroleum etc.). The structure of revised Energy Balance was modified as shown in the table below (Table 3.1).

Comparison of the Transformation processes in the old and revised Energy Balance

"Electric generation" and "district heating" in the old Energy Balance, which are related to electricity and heat producton, were subdivided into the categories of "Electricity-only plants", "CHP plants[1]" and "Heat-only plants" in the revised Energy Balance.

Since Pumped-storage hydroelectricity generation was excluded in the revised Energy Balance, the total electric generation figures suggested in the revised Energy Balance are different from those of Korea Electric Power Corporation(KEPCO).

The revised Energy Balance added "petroleum products manufacturing" as a new category within the transformation processes.

"Gas manufacturing" refers to the transformation process of gasifying LNG into city gas, which was the same as in the old Energy Balance.

In addition, the Integrated Gasification Combined Cycle(IGCC)'s gas and hydrogen manufacturing were subdivided into "coal-to-gas manufacturing" and "non-specified transformation".[2]

"Own use and Losses" in the old Energy Balance was further divided into the two categories of "Transformation own use" and "Losses" in the revised Energy Balance. "Transformation own use" includes some of the industrial energy use in the old Energy Balance.

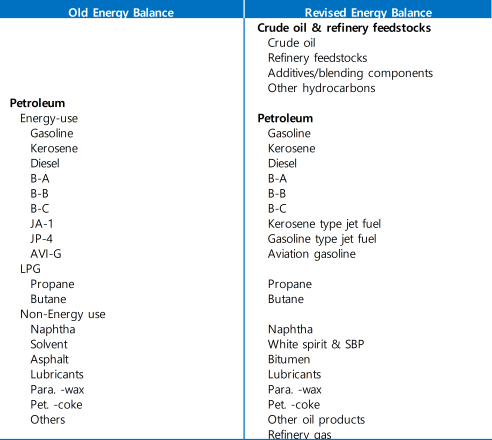

Comparison of Petroleum in the old and revised Energy Balance

Petroleum

In the revised Energy Balance, as petroleum products manufacturing was included into the transformation processes, energy products were placed in a different structure as in the table above, including the new category of "Crude oil & refinery feedstock".

Among all energy sources, the biggest statistical change was seen in the petroleum category of the revised Energy Balance, as petroleum products manufacturing was included into the transformation processes, and the statistical standards for international bunkering were changed.

The revised Energy Balance compiled the data on crude oil & refinery feedstock inputs, petroleum products output and energy consumption and losses during the transformation process including oil refining, as petroleum products manufacturing was included into the transformation processes.

Transportation sector changed to not include International Bunkering. It includes only consumption of Rail, Road, Domestic Navigation and Domestic Aviation.

This report does not provide an outlook of primary energy consumption by petroleum products to avoid any confusion that could be caused when such consumption is negative. Instead, it only provides the outlook result on the final use of petroleum products.

Gas

In revised Energy Balance, the most distinct feature regarding gas is that the oil refining sector's natural gas and city gas use was excluded from the final energy use and classified as the transformation sector's own use, as the "Transformation own use" category was newly added.

In the old Energy Balance, the final use of natural gas (LNG) represented the use of directly imported natural gas, but in addition to that, other categories were also added in the revised Energy Balance.

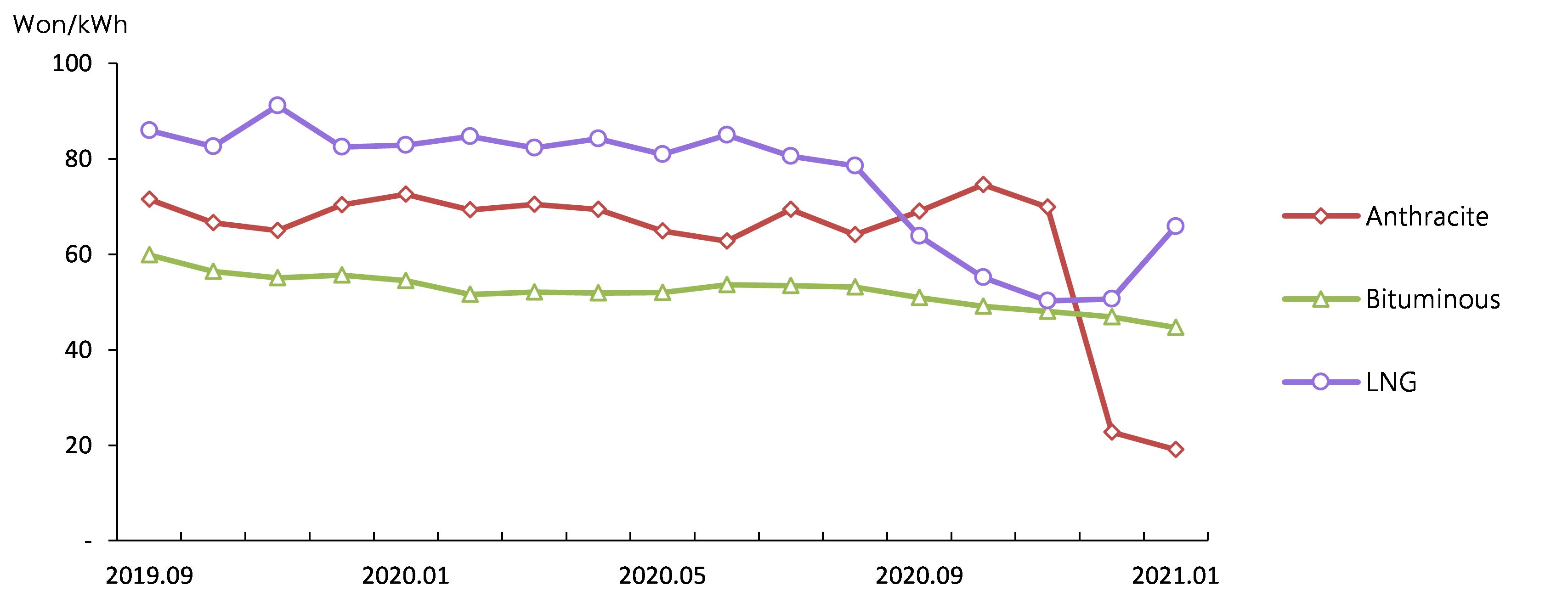

Coal

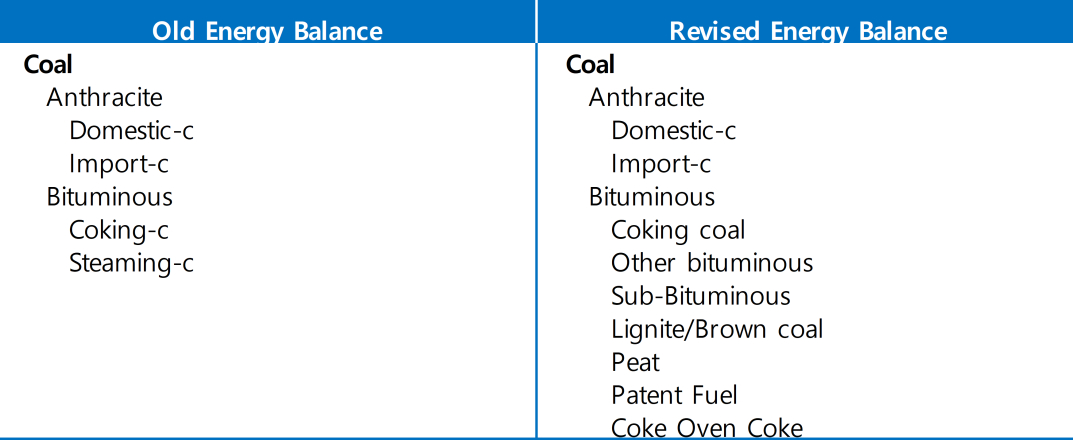

In the revised Energy Balance, the types of bituminous coal were subdivided into more categories and businesses that consume anthracite were more specific than the old Energy Balance. See the table below (Table 2.3) for the subdivided types of coal in the revised Energy Balance.

Comparison of Coal in the old and revised Energy Balance

The revised Energy Balance provides detailed coal products consumption data, suggesting more types of coal and the use of each coal product by subdivided sectors and businesses.

In the old Energy Balance, coal consumption in the iron & steel sector, which is a large coal consumer, only represented coking coal consumption. In the revised Energy Balance, the data is complied across three categories, i.e., coking coal, other bituminous coal and imported anthracite.

[1] CHP plants are used for integrated energy industries, which is divided into 1) district heating, 2) industrial complex and 3) district heating-industrial complex combined. In the revised Energy Balance, CHP only includes the data on district heating, while fuel input for industrial complex and the combined category are regarded as final consumption by each type of business in the industrial sector.

[2] These two categories were created in preparation for the further expansion of the relevant flieds and more clarified statistics, because they involve some limitations for now, as the amount of coal input cannot be estimated in the "coal-to-gas manufacturing" category, and the output exceeds the input in "non-specified transformation" category.

Attachments-

단기(하)_표지.jpg

Download

단기(하)_표지.jpg

Download

-

KoreaEnergyOutlook_2022H2_SecondHalf.pdf

Download

View Details

KoreaEnergyOutlook_2022H2_SecondHalf.pdf

Download

View Details

-

Energy Demand Outlook (2022, First Half)

- Date2022/06/30

- Author Energy Demand and Supply Research Team

- Number of downloads 20

-

Download multiple files Download the entire file

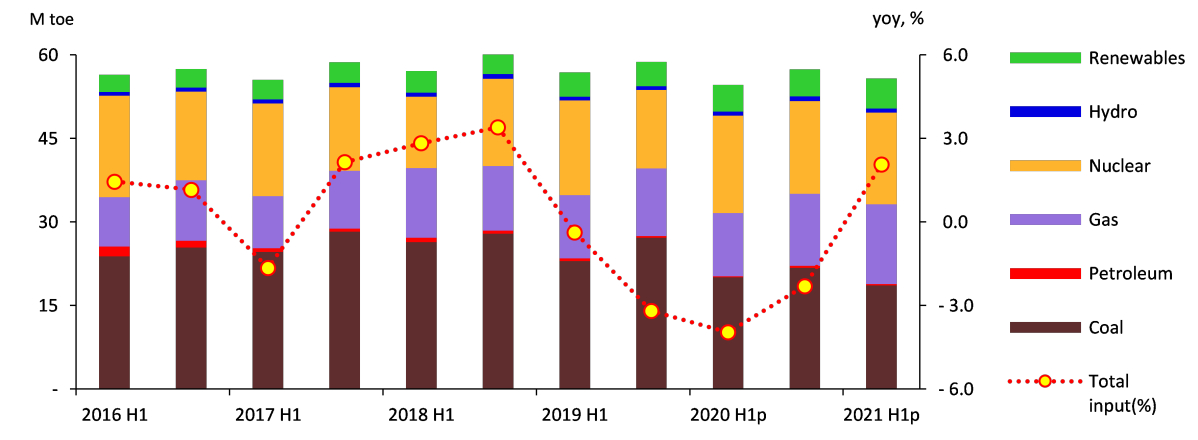

Total Primary Energy Supply and Total Final Consumption

The Total Primary Energy Supply("TPES") increased by 4.5% year-on-year to 305.3 Mtoe in 2021 with the recovery of economic activities.

TPES grew at the fastest rate since 2011 (4.9%), as exports and domestic demand increased amid the rapid economic recovery at home and abroad, which led to the growth in production activities of the manufacturing and service sectors.

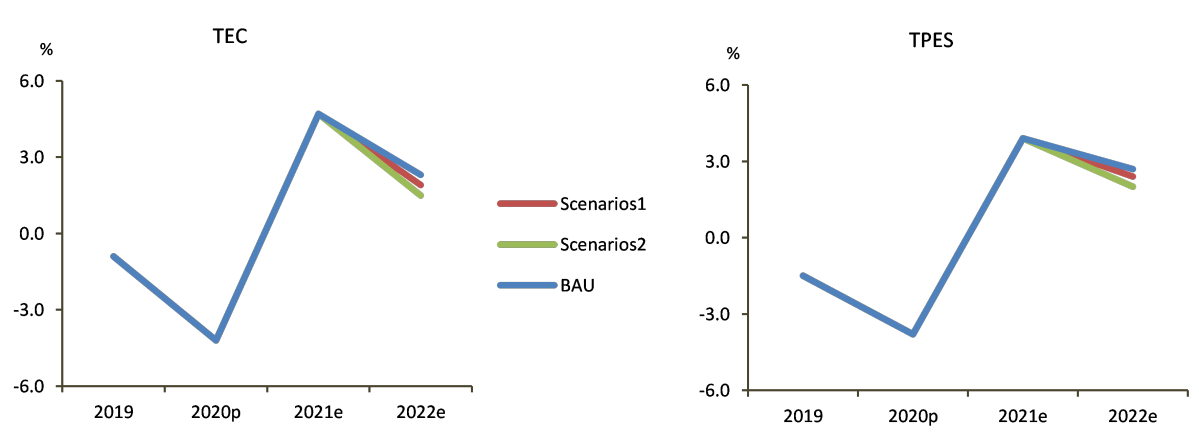

The growth rates of GDP and TPES, production index

Note: Production indexes show year-on-year differences.

The use of almost all energy sources increased except nuclear energy, and the increase was mostly led by petroleum and gas.

Petroleum use rose by 6.9%, which was driven by growing industrial energy use, especially those used as feedstock, owing to the economic recovery and the construction of additional petrochemical facilities, although the growth in transport energy use was stagnant due to the impact of COVID-19.

Coal use remained flat at the previous year's level, despite the decent growth in industrial coal use, as it declined in the power generation sector.

The growth rate of TPES & contribution by sources

Natural gas use went up by 8.7% year-on-year, as it surged in the power generation sector due to the increased electricity demand and decreased base load generation, and as it also grew decently in the city gas production sector.

Nuclear generation fell by 1.4% without any change in its installed capacity, as nuclear capacity factor slightly decreased.

Renewable and other energy use increased by 5.8%, partly due to the government policies that encourage the deployment of renewable installations.

Capacity factors by energy sources and power generation mix

Note: Capacity factor is the ratio of the electrical energy produced to the electrical energy that could have been produced at continuous full power operation.

Electricity use rose by 4.7% year-on-year, led by the industrial and building sectors; industrial electricity use grew rapidly with stronger production activities; buidlings' electricity use increased due to the cold spell at the beginning of the year, increased cooling demand during the summer and the recovery of the service sector.

The Total Final Consumption("TFC") grew by 5.4% year-on-year in 2021, led by a surge in the industrial sector, which accounts for a large share of TFC, although transport energy use remained stagnant.

Industrial energy use jumped 7.3%, as domestic demand and exports rose fast amid the economic recovery at home and abroad, which led to the increased production in the manufacturing sector, especially large-energy consuming businesses.

Transport energy use only slightly increased by 0.9%, despite the 1.4% growth in the road transport sector, as it declined in other transport sub-sectors.

The growth rate of TFC by end-use sectors

Note: The building sector includes residential, commercial, public-etc usage

Energy use in buildings posted a year-on-year growth of 3.8%, as it increased in both of the residential and commercial sectors due to the cold spell at the beginning of the year, increased cooling demand during the summer and the stronger service production.

TPES & TFC Outlook

TPES is expected to grow by 2.9% year-on-year in 2022 to reach 314.0 Mtoe.

Since the onset of the COVID-19 pandemic, TPES has been recovering rapidly, posting two consecutive years of growth, and in 2022, it is likely to exceed the previous peak seen in 2018.

The growth rates of GDP, TPES and TFC, trend and outlook

The rate of TPES growth is expected to be similar to that of the economic growth, and accordingly, energy intensity (toe/ KRW 1 million) will remain at the previous year's level.

Energy Intensity and EI Recovery Trends

Note: Energy Intensity is calculated as the value of 'TPES/GDP', expressed in KRW 1 million, EI recovery rate multiplies EI increase rate by '-1'.

Nuclear energy, petroleum and renewable energy will contribute the most to the growth in TPES this year, while gas use is expected to decline especially in the power generation sector.

Petroleum demand is forecast to grow by around 3%, despite the recent oil price hike, partly because the amount of petroleum used as feedstock increases amid the economic recovery from COVID-19 shocks and following the construction of additional petrochemical facilities.

Coal demand is set to rebound, despite the stagnant growth in industrial coal use, which was hit by the supply chain crisis, as its demand increases in the power generation sector as a result of the slightly eased restriction on coal-fired generation amid the recent natural gas price hike.

Nuclear generation is projected to increase by over 10%, leading the growth in TPES, along with the increased capacity factors than last year and following the commissioning of new reactors.

Natural gas demand is expected to drop in the mid-2% range, as it decreases in the power generation sector due to the unprecedentedly high global natural gas price, and as it remains flat in the city gas production sector at the previous year's level.

Final electricity demand is expected to reach 550TWh, marking the second consecutive year of fast recovery, after it declined from 2019 to 2020 due to temperature effect and the COVID-19 outbreak.

The growth rate of TPES & contribution by sources

Final energy demand by end-users is expected to grow by 2.4% year-on-year to 240.3 Mtoe in 2022.

Industrial energy demand is forecast to grow by mid-2% amid a strong economic growth, though there are some factors that could increase uncertainties in this outlook, such as the global economic slowdown triggered by the supply chain crisis.

The change and growth rate of TFC by energy sources and end-use sectors

Domestic and global travel demand is showing signs of recovery as the COVID-19 pandemic is subsiding. The growth in energy demand, however, is expected to be limited, affected by soaring gasoline and diesel prices amid the Russian-Ukraine War.

Buildings' energy demand is expected to grow at the rate of the early 2% on a year-on-year basis due to temperature effect and the recovery of the service sector from the COVID-19 crisis.

Key Features and Implications

Energy Supply Chain Crisis

Global energy prices are expected to remain high during the outlook period amid the energy supply chain crisis.

Global oil price had shown a strong upward move in 2H 2021, as the global economy started to recover from the COVID-19 pandemic. Since then, however, uncertainties surrounding the future oil prices have increased due to a potential global economic recession triggered by the Russian invasion of Ukraine in February 2022.

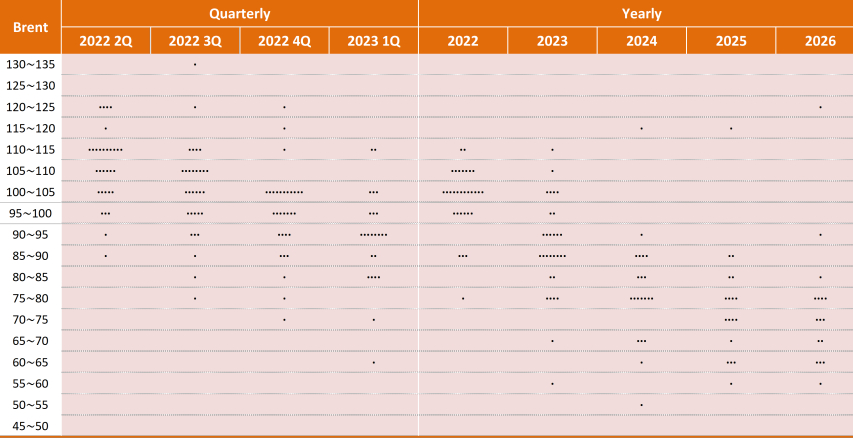

International Oil Price Forecast Dot Plot (US$/bbl)

Source: Refinitiv Eikon, "Reuters Commodity Polls"(2022.4.29)

A group of experts reached a consensus on an expectation that oil prices will remain high until 2023 and then stabilize at low level.

In a shor-term, global oil prices will be largely affected by the Russian-Ukraine war, sanctions on Russia and the pace of the global economic recovery. In the mid- & long-term, the progress in energy transition will be a major factor that determines the oil price trend. For instance, if demand for and supply of fossile fuels decline at the same time throughout the energy transition process, it will have a limited impact on oil prices, while in the case of a demand-supply imbalance, oil price could fluctuate more significantly.

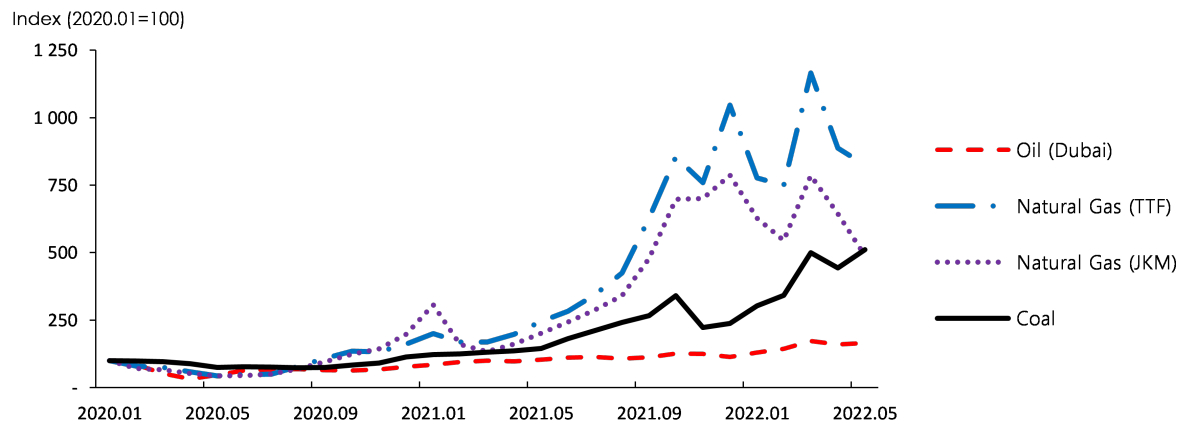

International nternational Energy Price Trend

Global natural gas and coal prices surged after Russia invaded Ukraine(2022.2.24) and then showed some downward trends, but the prices are expected to remain high compared to the previous year due to growing uncertainties amid the prolonged Russia-Ukraine crisis.

The drop in TFC is likely to be limited, despite the sharp increase in global energy prices.

Domestic energy prices could face an upward pressure due to soaring global energy prices. However, the price increase will be limited thanks to the government policies aimed at stabilizing prices and reducing the burden on people, and consequently, general consumers' energy use is not expected to rapidly decline.

As mentioned above, soaring global energy prices will have only limited impact on domestic energy use. However, if inflation continues to rise worldwide, and austerity measures, that are taken as a response, lead to the economic recession, the production may slow down especially in the industrial sector, which could possibly decrease energy demand.

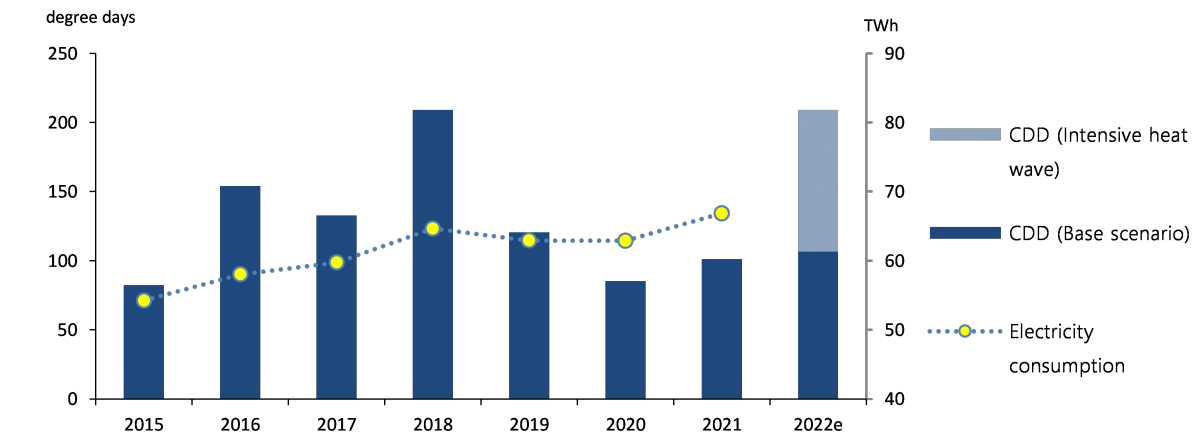

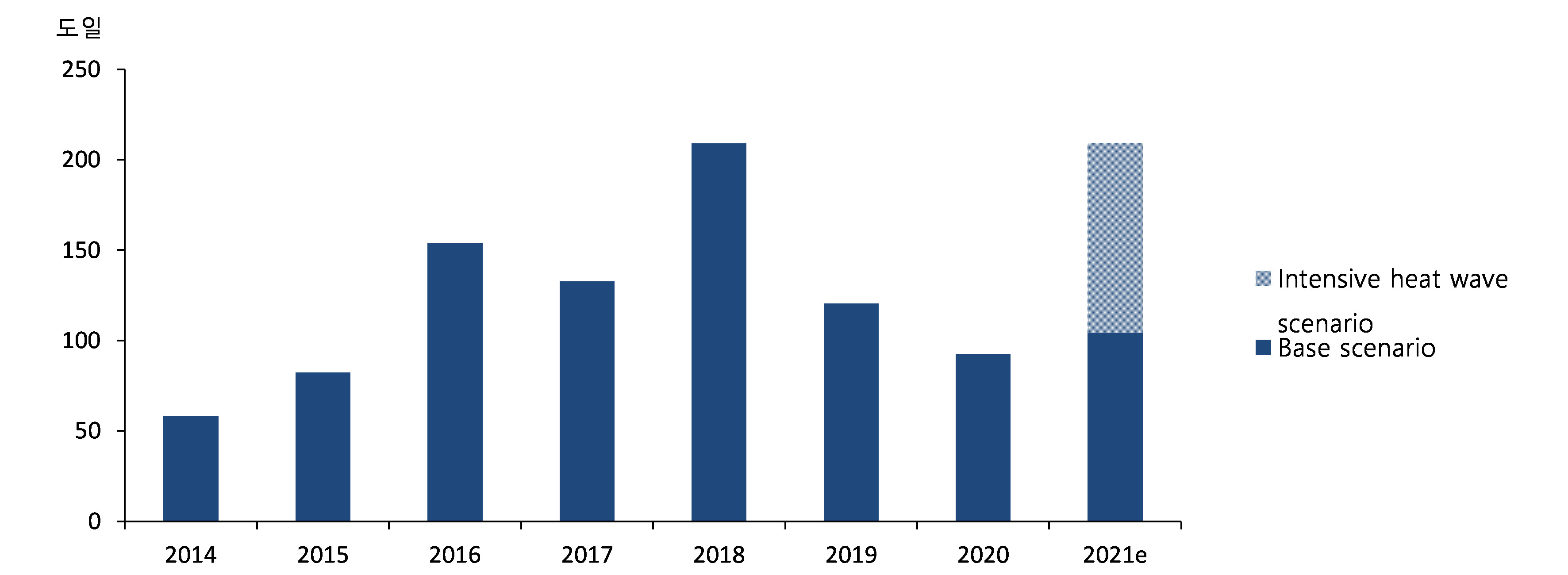

Heat Wave Scenario

Electricity demand and supply emerged as a major energy issue for this summer, as a hotter than usual summer is expected.

Since the extremely hot summer in 2016 and 2018, concerns intensify over scorching heat every summer, and how to respond to growing power demand for cooling is discussed as a major issue of energy demand and supply.

Electricity consumption trend in the building sector in summer (Jul-Sep) and cooling degree days

Note: The bottom of the cooling degree day bar of 2021 represents the number of possible cooling degree days assuming the average temperature of last ten years for this summer ('Base scenario') while the whole bar graph shows the value assuming that this summer will have the same number of cooling degree days as in 2018 ('Intensive heat wave scenario')

Korea Meteorological Administration("KMA") predicted a high possibility of hotter than usual summer(KMA, June 2022) for this year, and therefore, changes in electricity demand needs to be analyzed under the heat wave scenario.

If the number of cooling degree days of 2022 is the same as in 2018, the growth rate of electricity demand will be 0.6%p higher compared to the base scenario.

In the base scenario, the number of cooling degree days is expected to grow by 5.2% year-on-year in 2022, while it is expected to surge by 106.3% in the heat wave scenario, which assumed the same number of cooling degree days (209) recorded in 2018 when the weather was the hottest on record.

In the heat wave scenario, the residential electricity demand, which is affected the most by heat waves, is forecasted to increase by 5.0% year-on-year in 2022 and by 12.5% in 3Q which includes the summer season.

In the heat wave scenario, the commercial sector's electricity demand (including the public sector) is estimated to grow by 3.6% year-on-year in 2022 and by 5.5% in 3Q, which is 0.5%p and 2.0%p higher than the rates in the base scenario.

The industrial sector is expected to show the smallest change in electricity demand due to temperature change, with its annual electricity demand increasing by just 0.2%p in the heat wave scenario compared to the base scenario.

If heat waves strike in the midst of the energy supply chain crisis, it is crucial to secure power generation fuels to guarantee energy security.

If heat waves strike not only Korea but also the entire world this summer[1], the demand for power generation fuels such as coal and natural gas is highly likely to surge, which could exacerbate the current energy supply chain crisis.

In our base scenario, the total gas-fired generation is to be 36.0 TWh in 3Q. In the heat wave scenario, if the growth rate of electricity demand goes up 0.6%p, the gas-fired generation is expected to grow by 9.8% to 39.5 TWh.

Securing power generation fuels is far more significant in the energy security aspect, inspite of inflationary conditions caused by soaring fossil fuel prices.

Attachments-

단기(상)_표지.jpg

Download

단기(상)_표지.jpg

Download

-

KoreaEnergyOutlook_2022H1_FirstHalf.pdf

Download

View Details

KoreaEnergyOutlook_2022H1_FirstHalf.pdf

Download

View Details

-

Energy Demand Outlook (2021, Second Half)

- Date2022/01/10

- Author Energy Demand and Supply Research Team

- Number of downloads 22

-

Download multiple files Download the entire file

Total Primary Energy Supply and Total Final Consumption /h1>

Total Primary Energy Supply ("TPES") for the first half in 2021 posted a year-on-year increase of 3.2% driven by an overall recovery of economic activities

As the global economy enjoyed a recovery, the total export value in Korea jumped up and as a result, the production activity in the mining and manufacturing industries became activated. The production activity in the service sector also showed signs of recovery. Against this backdrop, the energy consumption grew at a fast speed of more than 3%

Growth Rate of GDP and TPES, Production Index

* Production indexes show year-on-year differences

Despite of a drop in nuclear and coal use, Total Energy Consumption ("TEC") climbed up rapidly as petroleum, gas and renewable energy consumption increased

Coal use declined by 1.8% due to a fall in the power generation sector, although in the final use sector, coal consumption rose mainly for industrial use

While the growth in petroleum use in the transport sector became stagnant in a backwash of COVID-19 pandemic, the industrial use increased thanks to a business recovery and expansion of petroleum facility. Consequently, the total petroleum consumption posted a year-on-year growth of 2.6%

Growth Rate of TPES & Contribution by Source

Natural gas use rose by 13.7% year-on-year as the consumption in the power consumption went up rapidly due to increased electricity consumption and a drop in base-load generation and the amount of gas used for producing city gas showed a decent growth

Nuclear power generation declined by 5.9% as the facility capacity stayed the same and the operation rate of nuclear power plants slightly went down. On the other side, renewable & other energy use rose by 8.8% on the back of the government policies aiming for widely deploying renewable power generation facilities

Meanwhile, electricity use posted a year-on-year increase of 3.6% as the industrial sector witnessed a rapid growth in its power consumption with increased production activities. Also, the consumption in the building sector went up decently as the demand for heating jumped up due to cold snaps at the beginning of the year and the service industry enjoyed a business recovery

Generation Input and Total Generation Input Growth by Energy Source<4 >

While the energy use in the transport sector became stagnant, the total final energy consumption for the first half in 2021 increased by 4.0% with a rapid growth in the industrial and building sectors

Industrial energy use stepped up by 4.8% year-on-year as the economy recovered from the impact of COVID-19 pandemic to boost production activities in the mining and manufacturing industries, mainly driven by energy-intensive businesses

Although the road transport sector, which has the largest share in energy consumption, posted a 2.3% growth, the total energy use in the transport sector stayed almost at the same (0.6%) on the year-on-year basis with the 13.2%, 3.3% and 8.4% decreases in the air, marine and railroad transport sectors

Growth Rate of TFC & Contribution by Source<4 >

* Include residential, commercial, public·etc usage

As for the building sector, the residential, commercial and public sectors jumped up by 4.0%, 2.3% and 8.4% respectively on the year-on-year basis due to a business recovery in the service industry and cold snaps at the beginning of the year

TPES & TFC Outlook

Total Primary Energy Supply ("TPES") is expected to increase by 3.9% and 2.7% in 2021 and 2022 respectively to reach 311.3 million toe

Thanks to a base effect resulting from a decline trend for last two consecutive years and a rapid recovery in production activities, TPES is anticipated to increase by nearly 4% in 2021. Similarly, energy consumption in 2022 is likely to rise as the negative impact of COVID 19 pandemic is expected to abate

Growth Rate of GDP, TPES and TFC, Trend and Outlook

Recently, Energy Intensity (toe/million KRW) recovered fast with a decline in energy use. As this recovery acts as a base effect, Energy Intensity is expected to stay at the 2020 level from 2021 to 2022

Energy Intensity and EI Recovery Trend

Note: Energy Intensity is calculated as the value of 'TPES/GDP', expressed in toe/million. EI recovery rate multiplies EI increase rate by '-1'

While petroleum and gas will lead the increase in the energy demand in 2021, petroleum, nuclear and renewable energy sources are expected to take the lead in 2022

The demand for petroleum is likely to grow fast in 2021 in the industrial sector, especially for petroleum used as a raw material in the petrochemical industry. Similarly, in 2022, the petroleum demand is expected to rise in the transport sector mainly for road and air transportation

The demand for coal in the final consumption sector will go up at a decent rate driven by the iron making industry. However, as the demand in the power generation sector is likely to decline or become stagnant, the growth rate in the demand for coal is anticipated to stay at a 1-2% level

In 2021, nuclear power will experience a slight drop as its capacity factor declines a bit. However, nuclear generation is expected to rise by more than 5% in 2022 with one new large-capacity unit coming online

As for natural gas, the demand is likely to step up rapidly with a surge in gas consumption from the power generation sector. However, the growth in the total gas demand is forecast to slow down dramatically as the gas used for generation witnesses a slight decrease

Electricity demand fell for two years in a row since it reached the peak of 526.1 TWh in 2018. The demand for electricity, however, is expected to surpass the 2018 high in 2021 and approach a 540 TWh level in 2022

Growth Rate of TPES & Contribution by Source

Energy demand in the final consumption sector is expected to grow by 4.7% in 2021 and 2.3% in 2022

Energy demand in the industrial sector will rise by more than 6% in 2021 thanks to a recovery in production activities across industries as well as facility expansion and increased facility utilization rate of energy-intensive industries. On the same note, the industrial energy demand is anticipated to increase by more than 2% on the back of a decent economic growth rate of 3% in 2022

Change and Growth Rate of TFC by Energy Sources & End-use Sector, 2021 and 2022

In the transport sector, the energy demand continues to be stagnant in 2021 due to the impact of COVID-19 pandemic. However, it is expected to recover fast mainly in the second half of 2022 as the energy demand in road and air transport sectors starts to improve

Energy demand in the building sector is anticipated to keep rising at a 2-3% level driven by several factors including a base effect and a temperature effect

Key Features and Implications

Surge in Global Energy Prices

As natural gas prices are taking sudden changes, the uncertainty of outlook for gas and the role of nuclear power are expected to grow

Due to a mix-up between the supply and demand of natural gas in the global market, LNG price almost trebled compared to the price in June. However, a possibility of an LNG price collapse is emerging as well, giving a boost to uncertainties around gas prices

In 2022, natural gas price is expected to be higher than average. Consequently, the pressure to increase the domestic city gas price is likely to increase while the growth in direct LNG imports, which have surged over the last few years, will significantly slow down

Trend and Outlook of Industrial City Gas & Directly Imported Industrial LNG

Influenced by increased price of natural gas, the share of gas in the generation mix in 2022 will decline. On the other side, the proportion of nuclear power is likely to grow as it is to step in for the reduction of gas-fired generation

Share in Generation Input Mix by Energy Source

The surge in oil price, triggered by the imbalance between supply and demand of global crude oil, is expected to be short-lived and limited in influencing the domestic market

The oil demand jumped up thanks to the global economic recovery from the impact of COVID-19 pandemic. However, the production increase from oil-producing countries did not keep up with the recovery, which strongly drove up the global oil price. Nevertheless, the monthly average of Middle East Dubai crude oil kept being sluggish after it hit $82.2/barrel in August

Petroleum products in the domestic market also witnessed large price jumps. Since last November, the retail prices of all petroleum products soared

As the global crude oil price goes up, the prices of petroleum products in the domestic market are anticipated to rise for the time being. However, the impact of increased global oil price on the supply and demand of petroleum in the transport and industrial sectors is likely to be limited

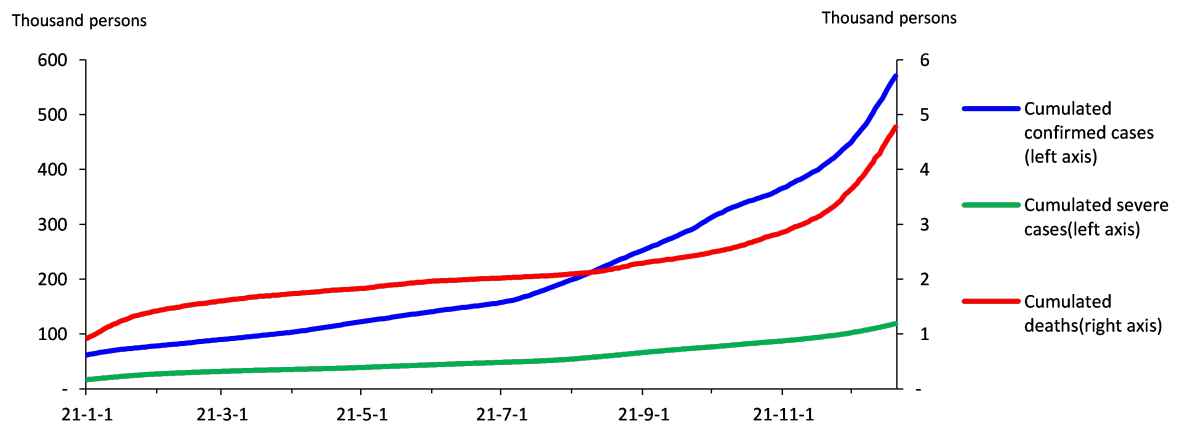

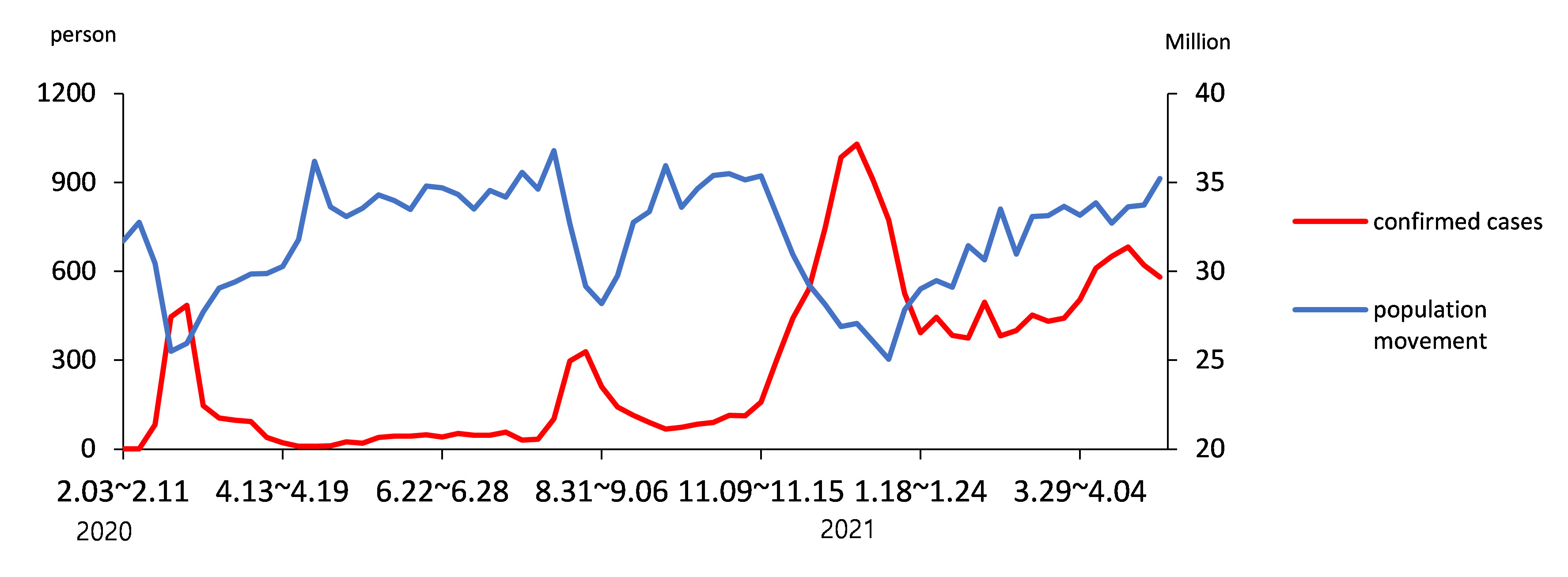

Increased Uncertainty Amidst Spread of COVID-19 Virus

The uncertainties related to COVID-19 pandemic rise as the number of confirmed cases soared after November 1 and a new variant of Coronavirus has surfaced

Korea had adhered to enhanced Social Distancing restrictions, including a cap of five people per social gathering. However, the Moon administration decided to switch to Gradual Return to Normal phase on the back of more than 80% of First Dose vaccination rate and over 75% of Second Dose vaccination rate

Unfortunately, since November 1 commencing Phase 1 of Gradual Return to Normal, the number of confirmed cases began rising rapidly

The spread of Omicron, first detected in South Africa, marched rapidly onto all corners of the world, and the variant is becoming the dominant variant over Delta variant in some major countries. In this situation, the waves of Coronavirus can gain speed once again

Cumulated Confirmed Cases, Severe Cases & Deaths of COVID-19

In case that COVID-19 pandemic stays longer than expected, the recovery of energy demand is likely to slow down driven by the transport sector